Employee fraud often starts small, with a fake receipt here, and a little misuse of company funds there. But left unchecked, it can spiral into serious financial loss and broken trust across your team. The damage doesn’t stop at money; it chips away at morale and reputation. In this blog, we’ll dive into the most common types of employee fraud and the simple ways you can prevent them to protect your business.

What is Employee Fraud?

Employee fraud refers to deceptive actions committed by an employee with the intent of personal gain, resulting in financial or reputational harm to the organization. It can take various forms, from falsifying expense reports and misusing company assets to manipulating financial records or stealing confidential information.

While often perceived as rare, employee fraud is a common challenge faced by businesses of every dimension and industry. It usually arises from a mix of opportunity, pressure, and rationalization, called the fraud triangle. In other words, when an employee sees a chance, feels compelled by personal circumstances, and justifies their behaviour, fraud becomes a risk.

Exploring the issue of employee fraud is critical not only for the company’s financial well-being, but also because of the potential impact on its trust, culture, and ethics. By acknowledging that fraud exists and training both employees and management to spot warning signs, organizations can be proactive about preventing fraud and addressing it directly.

20 Types of Employee Frauds That Can Harm Your Business

There are many ways employees can perpetrate fraud against your business. It is therefore essential to understand these risks for prevention. Below are common types of employee fraud that can impact your organization. unproductive applications used.

1. Expense Reimbursement Fraud

Expense reimbursement fraud occurs when employees submit false or exaggerated claims to receive financial compensation for non-business-related expenses. This may include arbitrarily inflating costs associated with meals and travel, submitting duplicate receipts, and even creating fabricating expenses that were never incurred.

Although a single fraudulent claim may not seem significant, it adds up quickly if claims are filed repeatedly, costing thousands of dollars per year. Such fraud requires organizations to have strict expense policies as well as auditing procedures in place.

2. Payroll Fraud

Payroll fraud is one of the most common forms of employee fraud, impacting companies that do not keep a close eye on payroll processes. Employees might falsify timesheets by logging hours they didn’t work, punching in for those who weren’t there (buddy punching) , or changing records to get the overtime pay they didn’t earn. In more serious cases, dishonest employees or payroll administrators create fictitious employees, often called “ghost employees,” who receive pay checks that are collected by the fraudster. Payroll fraud can cause companies to lose money in the long run if left unchecked

3. Asset Misappropriation

Asset misappropriation is the theft of company property, which can include theft of company inventory, office supplies, tools, or equipment. Employees may take valuable assets for personal use or resale, leading to rising operational costs and stock shortages. Such fraud is particularly prevalent in sectors that handle high-value equipment or easily resold items. The risk can be avoided by enforcing strict inventory tracking and conducting internal audits.

4. Financial Statement Fraud

Financial statement fraud happens when employees or executives act and change financial records to give an incorrect image of the companies performance. This might include overstating revenues, concealing expenses, or manipulating profit margins to deceive investors, stakeholders, or regulatory agencies. Often, financial statement fraud is perpetrated by senior employees who feel pressured to achieve financial targets. Companies can combat this through strict accounting. practices, external audits, and strong ethical leadership.

Ensure Accuracy, Eliminate Fraud!

Time Champ provides clear, error-free billing with real-time tracking. Keep your financial records transparent and secure. Try it today!

Signup for FreeBook Demo5. Cash Theft

Of all the forms of fraud, one of the most basic, yet also most damaging, aspects is stealing cash directly from a business. This offers ample opportunity for financial discrepancies as employees who have access to cash registers, petty cash or company deposits could also take money for personal gain. This type of fraud is particularly common in retail and service industries. Regular cash reconciliations, security cameras, and accountability measures can help reduce the risk of cash theft.

6. Check Tampering

This can include altering the payee's name on a company check, inflating the amount of the check, or writing checks to fake vendors. Because businesses typically put their finance teams in charge of handling checks, internal fraud can remain undetected for months.Preventing check tampering through dual approvals and regular bank reconciliations

7. Procurement Fraud

Procurement fraud occurs when the employees involved in purchasing pervert the relationship with the vendors to their benefit. A company may also collude with suppliers to inflate contract prices, manufacture fake purchase orders, and accept kickbacks if they are awarded contracts. In addition to financial losses, such fraud causes deterioration of the quality of goods and services. Businesses should enforce competitive bidding policies and conduct routine vendor audits to identify irregularities.

8. Data Theft

Employees with access to sensitive company data, such as client information, trade secrets, or financial records, may steal or sell this data for personal gain. In case the data stolen is leaked or even sold to the competitor, it can cause huge reputational and financial damage. To prevent breaches , businesses must toughen the data access controls, monitor employee activities , and provide the staff with data security training.

Stop data theft before it starts!

With Time Champ, monitor access, track file movements, and keep your confidential information safe. Get started today!

Signup for FreeBook Demo9. Ghost Employees

A "ghost employee" is a fake worker added to the payroll system by a fraudulent employee, allowing them to collect salaries for non-existent personnel. Fraud of this kind is most likely seen in large companies where payroll oversight is lacking. Fraudsters may create fake employee profiles, reactivate terminated employees, or list relatives as employees to funnel money into their accounts. Ghost employee schemes can be spotted by conducting regular payroll audits and cross-verifications with HR records.

10. Misuse of Company Credit Cards

The intention of company credit cards is to be used only for business expenses, but some employees abuse it using it on a personal basis. The fraud that this could encompass is unauthorized purchases, too much travel expense, or using the company card to pay for personal subscriptions or entertainment. Implementing strict spending policies, requiring receipts, and monitoring statements can help businesses detect and prevent credit card misuse.

11. False Billing

False billing fraud is when an employee bills for services or products that were never delivered. In some cases, fraudsters collude with vendors to overcharge the company in exchange for personal kickbacks. This fraud can go unnoticed for long periods if financial records are not closely monitored. Conducting regular invoice reviews and verifying supplier legitimacy can help identify suspicious transactions.

12. Skimming

Skimming involves stealing cash before it is officially recorded in a company’s accounting system. This kind of fraud is prevalent in businesses dealing with cash transactions like retail stores or restaurants. Cash payments may be pocketed by employees before being entered into the register and thus be difficult to detect. Systematically using point-of-sale systems and reconciling transactions can limit the skimming.

13. Unauthorized Discounts or Refunds

Some employees abuse their access to sales systems by issuing unauthorized discounts or refunds to friends, family, or accomplices. In this way, revenue can be lost, and inventory can differ from the stock records. Setting approval processes for large discounts and regularly reviewing transaction logs can help businesses curb this type of fraud.

14. Loan Fraud

Employees with access to company finances may take unauthorized loans or cash advances in their name or under fake employee profiles. If undetected, such fraud can lead to serious financial instability for the company. Enforcing strict approval processes and maintaining transparent financial records can minimize loan fraud risks.

15. Inventory Theft

Employees who have access to inventory storage may steal items for personal use or resale. This is especially common in industries dealing with electronics, pharmaceuticals, and retail goods. Conducting regular inventory audits and using tracking systems can help businesses detect missing stock.

16. Insurance Fraud

Employees may file workers’ compensation claims or property damage reports that are fraudulent in order to receive insurance payouts. Some may even exaggerate minor injuries to take extended paid leave. Businesses should investigate all claims thoroughly and require medical documentation before approving payouts.

17. Bribery and Corruption

Bribes can be accepted by employees in decision making roles in exchange for providing contracts, approvals, and preferable treatment. This causes compromise to the integrity of business operations and may result in legal implications . Companies should establish clear anti-bribery policies and conduct ethics training to prevent corruption.

18. Forgery

Employees can forge documents, signatures, and financial records to access funds, transact, deceive, or even falsify management. Forgery will lead to legal complications and great financial loss. Multi-level authentication processes, and digital verification methods should be implemented by businesses to prevent document fraud.

19. Kickbacks

Kickbacks are payments or favors accepted by employees in return for business contracts, discounts, or preferential treatment. Distorting fair business practices, and inflated costs are the result of this type of fraud. Policies for whistleblowers and strict vendor management are useful in uncovering kickback schemes.

20. Embezzlement

Embezzlement involves the diversion of company funds by employees entrusted with the same for personal use. This can involve transferring company money to personal accounts, inflating expenses, or diverting payments. Embezzlement tends to begin small but build up if not stopped. Regular audits, segregation of duties, and financial oversight can help detect and prevent embezzlement.

Optimize Productivity, Eliminate Risks!

With Time Champ, track work, prevent fraud, and ensure seamless operations. Start today!

Signup for FreeBook DemoHow to Detect Employee Frauds: Key Indicators & Red Flags

Employee fraud is a threat to businesses that don’t get a second thought until companies have already experienced significant damage. Identifying and detecting fraud early involves keeping a watchful eye on user behavior , financial patterns, and activity in the workplace . Here are some key warning signs that may indicate fraudulent activities.

1. Unusual Financial Patterns

One of the biggest red flags in employee fraud is irregularities in financial records. Watch for:

- Overcharges in invoices, payroll, or expenses.

- Unclear or duplicate payments.

- Payments to unfamiliar vendors or quick supplier changes.

- Unfiled reports or slow record updates.

2. Unexplained Lifestyle Changes

Employees living beyond their means without a clear explanation may be involved in fraudulent activities. Warning signs include:

- Expensive purchases, vacations, or luxury items that don’t match their salary.

- Regular betting or overspending.

- Financial ease without salary changes.

3. Controlling or Secretive Behavior

Fraudsters often try to manipulate systems to avoid detection. Pay attention to:

- Workers unwilling to share roles or pass on tasks.

- Avoidance of audits or financial checks.

- Unauthorized entry into secure data or records.

- Too much overtime without clear reasons.

4. Behavioral and Work Performance Red Flags

Changes in an employee’s behavior or work habits may indicate fraudulent activities, such as:

- Avoiding vacations or time off to prevent others from accessing their work.

- Becoming unusually defensive when questioned about tasks or finances.

- Falling productivity, constant mistakes, or work delays.

- Strange interest in financial work or records.

5. Frequent Complaints or Ethical Concerns

Sometimes, colleagues notice suspicious behavior before management does. Take concerns seriously when:

- Team members question an employee’s integrity or work habits.

- There is an increase in internal complaints or reports of unethical behavior.

- Employees suddenly leave the company without explanation, especially in financial roles.

Don’t Let Data Breaches Cost You Millions!

Time Champ helps you detect, monitor, track, and secure critical information effortlessly. Get started now!

Signup for FreeBook DemoHow to Prevent Employee Frauds: Best Strategies & Solutions

Employee theft costs are rising at a rate of 15% per year, highlighting the need for strong fraud prevention measures. Here are the best strategies to minimize the risk of fraud in your organization.

1. Implement Strong Internal Controls

Establishing checks and balances is crucial to preventing fraud. Ensure:

- Segregation of duties – No single employee should control an entire financial process.

- Regular audits – Conduct periodic financial together with operational audits to notice any inconsistencies.

- Transaction approvals – Put in place double checks before any financial transaction goes through.

2. Monitor Financial Transactions Closely

Fraud often occurs through manipulated financial records. You can Prevent this by:

- Checking expenses, payroll, and vendor payments often to notice anything irregular.

- Monitoring in real-time through accounting software with built-in alerts for detecting unexpected activities.

- Making sure every reimbursement and claim comes with proper proof and receipts.

3. Conduct Background Checks & Regular Evaluations

Hiring and monitoring employees with due diligence can prevent fraud:

- Check candidates’ backgrounds carefully before hiring them for financial responsibilities.

- Frequently assess both employee work quality and financial handling.

- Keep reviewing security clearances and access to financial data on a routine basis.

4. Implement a Whistleblower Policy

Employees are often the first to notice fraudulent activities. Reassure them to come forward with concerns by:

- Setting up anonymous reporting channels.

- Protecting whistleblowers from retaliation.

- Following up on every report promptly and making the right decisions.

5. Encourage a Transparent & Ethical Workplace

A strong ethical culture reduces fraud risks. Businesses should:

- Define detailed code of conduct for both fraud policies and their corresponding disciplinary actions.

- Set up regular training programs and leadership actions to foster ethical conduct.

- Establish an open dialogue system that gives employees full freedom to report any suspicious incidents.

To prevent employee fraud, there must be a balance between policy, technology, and an ethical work environment. By staying proactive and vigilant, businesses can safeguard their financial health and build a trustworthy workplace.

Don’t Let Data Breaches Cost You Millions!

Time Champ helps you detect, monitor, track, and secure critical information effortlessly. Get started now!

Signup for FreeBook DemoHow Time Champ Helps Businesses Detect and Prevent Employee Fraud

Many businesses fail to notice fraud until it’s too late. Hidden frauds can be indicated by such things as unexplained financial losses, productivity drops and data breaches . The key to prevention? A system that detects and stops suspicious activities before they escalate, ensuring transparency and security at every level.

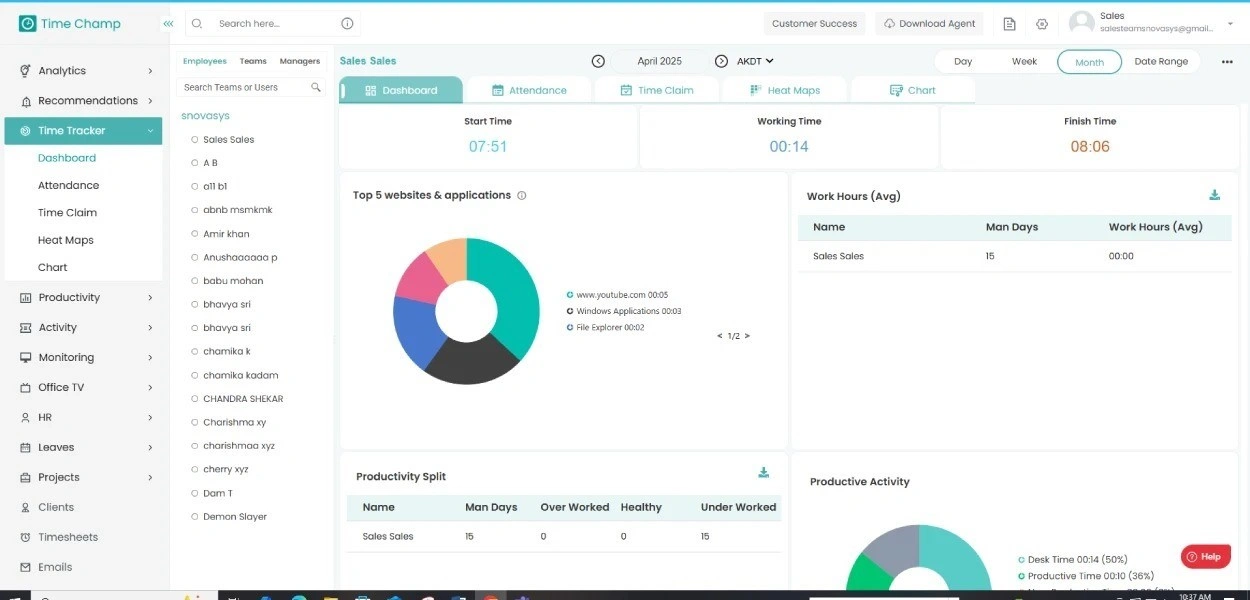

That’s where Time Champ comes in. With its advanced tracking and monitoring capabilities, Time Champ helps businesses identify irregular activities, restrict unauthorized access, and safeguard sensitive data, preventing fraud before it becomes a serious threat. Here’s how Time Champ helps in detecting and preventing fraud.

1.Real-Time Activity Monitoring

Time Champ continuously tracks employee activities to detect unusual behaviors that may indicate fraud. It finds excessive idle time , unproductive work hours of employees and irregular login patterns. Unauthorized access attempts and the use of unapproved applications or websites are also flagged, ensuring a secure and transparent work environment.

2. Strict Access Controls for Data Protection

Unauthorized access to sensitive data is a major fraud risk for the company. Time Champ strengthens security by limiting access to confidential files, in a manner that only authorized personnel can view or modify them. It also takes the precaution of restricting access to critical info and controls USB connections, allowing only approved devices to connect.

3. Automated File & Network Monitoring

Time Champ provides real-time file tracking to monitor data movements across the network , ensuring immediate detection of suspicious file transfers. It helps to protect from unauthorized data exports, thus helping a quick response to potential threats before causing any damage. Additionally, it keeps a detailed activity log, allowing the business to monitor file access history and identify security risks.

4. Role-Based Access Control (RBAC)

In order to reduce the risk of exposing sensitive data, Time Champ offers role-based access control. Employees can only access information necessary for their specific job roles, preventing unauthorized access to critical business data. It allows organizations to restrict incorrect data access in order to avoid data leaks, security breaches, and compliance issues and keep the confidential information safe.

Time Champ does more than just preventing fraud. It fosters a workplace built on transparency, accountability, and security. Through the integration of advanced monitoring and security features, businesses can achieve more growth while bringing their operations fraud-free.

Prevent Workplace Fraud Before It Starts!

Time Champ detects suspicious activities, safeguards sensitive data, and keeps your business secure. Start Your Free Trial Today!

Signup for FreeBook DemoConclusion

For a workplace to be trustworthy and secure, it is essential to detect and prevent employee fraud. A proactive approach not only safeguards company resources but also reinforces a culture of integrity. Smart technology combined with strong oversight helps businesses to foresee and tackle any potential risks and maintain a stable and transparent work environment.

Smarter Work, Stronger Security!

Optimize efficiency and prevent risks with Time Champ’s advanced tracking and monitoring. Start Your Secure Journey Today!

Signup for FreeBook DemoFrequently Asked Questions (FAQs)

The most recurring type of employee fraud is the asset misappropriation or the employees stealing or misusing company resources. These range from fraudulent expense claims to payroll fraud, cash and inventory theft, and fraud with regard to the use of company credit cards.

Staff members committing employee fraud can be theft, time fraud, or data manipulation for personal gain. In contrast, management fraud is perpetrated by executives or higher-level employees who modify financial statements, misrepresent the operations of the company or commit corruption in order to achieve financial or professional benefits.

Occupational fraud is a broader term that includes any misuse of a job position for personal gain, such as embezzlement, bribery, or financial statement fraud. Employee theft is a specific type of occupational fraud that involves stealing physical or monetary assets from the employer.

While it may be difficult to eliminate employee fraud entirely, it can be significantly reduced through strict access controls, real-time monitoring, strong internal policies, and a culture of accountability. Fraud detection systems and audits can also be implemented to alleviate such risks.