Table of Contents

What is Project Accounting?

Project accounting is a part of project management in keeping track of costs for specific projects a company does. They record all the costs and watch how well each project is doing financially. This helps the company stick to its budgets, see which projects make money, and decide how to manage them better.

Project accounting helps companies stay on track with their project budgets, make sure projects are making money, and decide on the best ways to manage them well.

To hit the mark, a plan of financial accounting is a must. This plan is the one that is developed at some point in the project initiation phase and captures all expenses. It will describe the way of accounting for these expenses during the project, such as the cost of the project team, system purchase, and others.

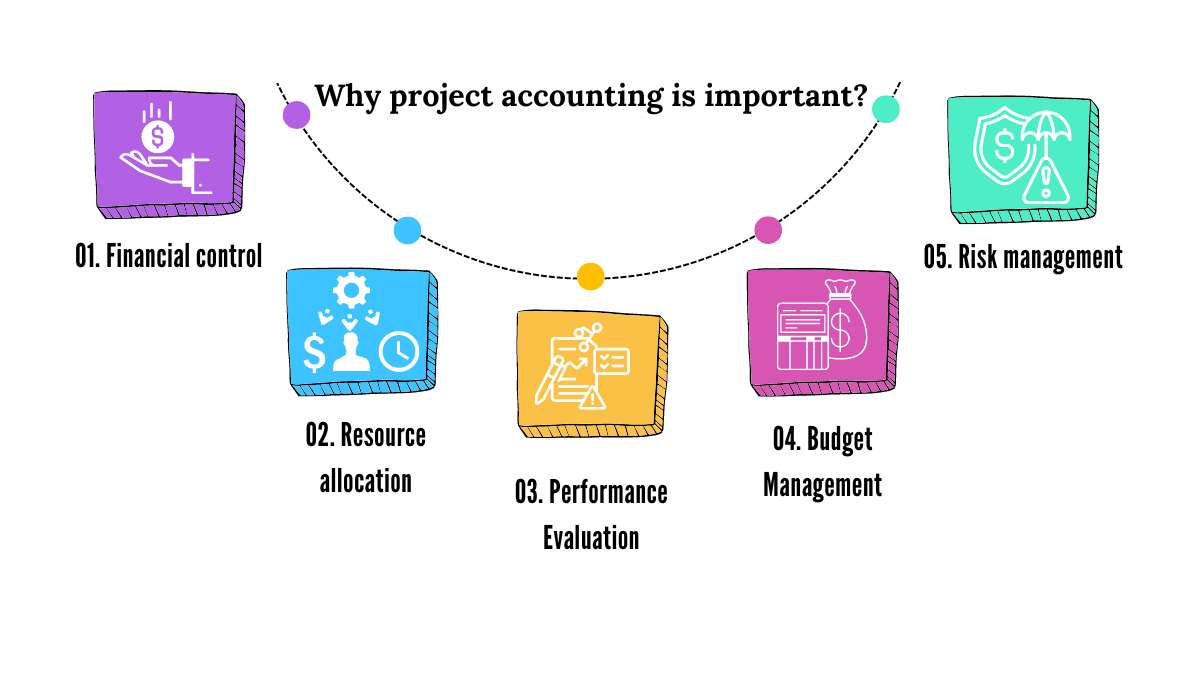

Why is Project Accounting a Crucial Factor?

The project accounting system is one of the most important tools in the financial management of companies. . It provides a clear picture of a project’s financial standing, enabling informed decisions about resource allocation and future strategies. The monitoring of expenses and revenue is the most evident and accountable financial operation required for compliance and meeting the expectations of shareholders. It is not only an indicator of the future economy and risks but also serves as a preventive measure against financial difficulties. In addition, project accounting may be a tool to help you achieve better project results and plays a critical role in a company’s long-term growth.

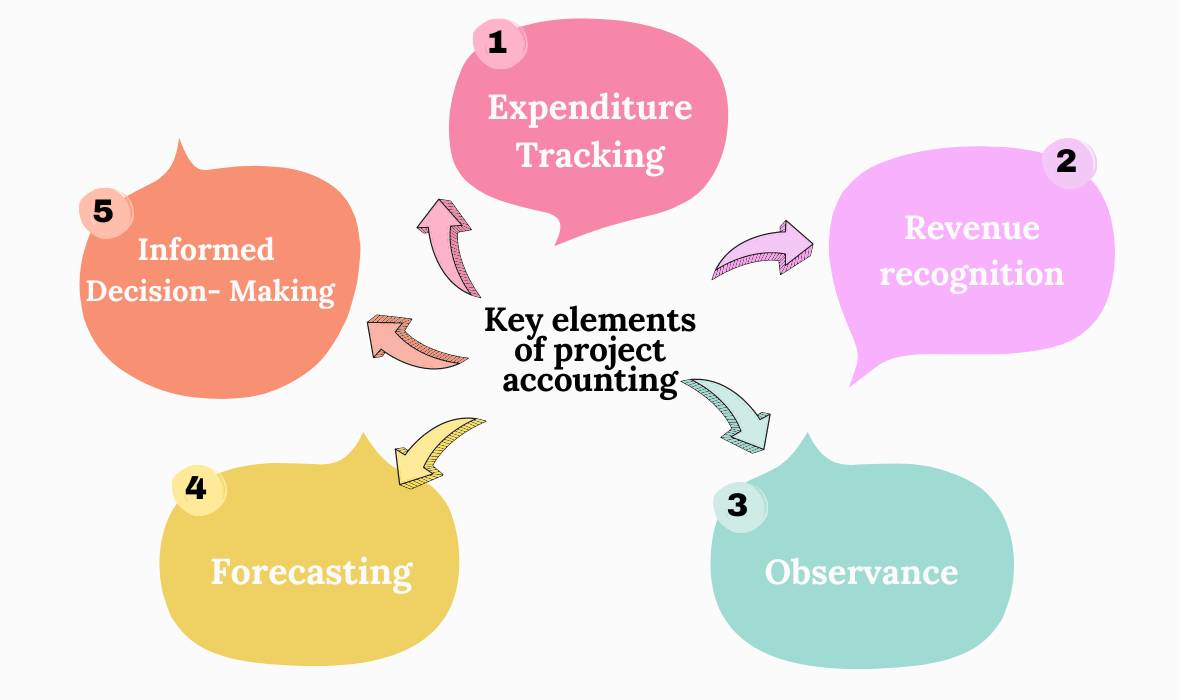

What are the Main Components of Project Accounting?

The main components of project accounting are made up of different aspects that are essential in managing the finances of the project in an orderly manner.

1. Expenditure Tracking:

Tracking the project budget is important and involves constantly tracking the amount of funds spent on a project all the time. These expenses include staff salaries, material purchases, getting equipment, and managing overhead costs. This is the way to show that all the costs are entered into the proper categories and recorded properly. This is the role of a financial manager, who has a clear view of how the resources are used, which is important for budget management and maintaining the correctness of financial statements and decisions throughout the project.

2. Revenue recognition:

Revenue recognition is a key component in project accounting because it shows the real income from project activities. This specifies the financial performance of the project and its effect on the whole company. Proper revenue recognition allows project accountants to monitor profitability and make intelligent resource allocation and budgeting decisions.

3. Observance:

Firstly, project execution must stick to accounting rules, laws, and company policies at every stage. This means consistently following regulations and principles set by accounting authorities, the government, and the organization itself. Verifying compliance helps maintain accurate and transparent financial records, aligned with legal regulations. Taking these steps prevents financial reporting issues and displays ethical project implementation.

4. Forecasting:

Forecasting is the key element of project accounting because it enables the budgeting process to be more accurate. Future costs and revenues are predicted using past and current data trends.

5. Informed Decision-Making:

In project accounting, making good decisions is crucial. It enables project managers to use resources wisely through the understanding of the financial outcome of their actions. Through careful consideration of risks, they can remove the risks. Besides, it is necessary to keep stakeholders well-informed to ensure clarity. Good decision-making is a crucial factor in project accounting, it allows managers to maximize resource utilization, minimize risks, and effectively manage the budget.

What Steps are Needed to Establish Project Accounting Systems and Procedures?

Setting up project accounting systems and processes involves several things:

Defining Objectives: The project accounting system will require the defining of project objectives and the strategy on how to spend, generate revenue, and make profitability. It also fits the organizational objectives, and the decision-making is done in the light of the informed process.

Select the Right Software: While selecting accounting software, there are several factors to be considered, namely the scale of the project, the budget, the needed features, and the compatibility with the other systems. Hence it is a confirmation that there is good fiscal management and smooth systems.

Adjust settings: Draw up a customized chart of accounts specific to the project with categories for expense, revenue, and resources. This makes the method detailed and suitable to the project’s specific needs as the financial transactions and reports are always in line with the project’s unique needs.

Set up procedures: Create a recording process that is consistent across all the projects and includes expense tracking, timekeeping, and invoicing. This methodology makes it possible to certify that all financial transactions are recorded accurately and consistently. This results in improvements in terms of data accuracy and report preparation speed. This technique is going to help you automate the operations and reduce the errors that will ultimately lead to the improvement of the project performance.

Deliver Coaching: Train all the project team members to be experts in the accounting system and familiar with the set of standard procedures. Furthermore, offer ongoing guidance and solutions to any questions or problems arising, to make the process of learning and doing their jobs easier.

What are the Best Practices for Project Accounting that Work?

The best practices in project accounting are highly important as they make it possible to maintain financial control, use resources efficiently, and increase profits. These practices enable companies to shorten their processes, eliminate mistakes, and have clear financial reporting. This type of behaviour will result in more successful projects and the company’s success.

Work on Managing costs: Working on managing costs is a critical element in effective project accounting since it is the basis of financial success. When organizations are in control of costs, they can maintain budgets, use resources wisely, and increase profits. This focus brings financial stability and competitiveness to the projects. Cost management helps to minimize financial risks, make the right decisions, and maintain the trust of the stakeholders. Cost management should be given priority as it leads to the success of the project and benefits the entire organization.

Time Tracking: Without daily time tracking from your team, it’s hard to know if the project is progressing and to determine the real-time costs. Project managers must be able to see how much time employees spend on tasks so that they can assess the project’s progress and achieve their goals. The use of advanced time management tools enables you to instantly track data as it occurs. Consequently, timesheets are essential in reporting project finances and identifying resource-heavy tasks. With your team members logging hours, you can then track the project progress and closely monitor the costs.

Control Administrative Work: Non-billable work can include any tasks that do not move the project forward, but still use up resources and budget. These can be anything from meetings, internal activities, and even fill-in spreadsheets. If non-billable work is more than a particular limit, it may affect project costs and it may also affect how we use the resources without showing real progress.

Implement change management: When working with project accounting, accountants may detect changes in the project only after they have occurred. Most of the time these are not planned earlier. However, when the accountants are involved, they can see changes and manage them. They use numbers to demonstrate to the managers which activities or changes have a similar cost so that they can decide.

Optimize Project Timelines and Budgets with Time Champ

Signup for FreeBook DemoWrap Up

Project accounting is vital so that the project money is not lost. It shows how much is spent, and how much is earned, and makes sure all the money goes according to the economic policies. For that purpose, we need to set clear objectives and the proper software. The best way to pull it off is by managing the prices well, timing it rightly, and taking care of the tasks that do not give money. At the end of the day, accounting helps us to manage our money well and enables us to stay on the right track for a long period.

Project accounting includes keeping records, monitoring, and reporting financial transactions and project indicators, that are related to the project or task undertaken by the company.

Project accounting is the key to staying within the allocated budgets, confirming project profitability, and making the best choices on the distribution of resources, project management methods, and many more.

The essential components include budget monitoring, revenue recognition, adherence to accounting principles and rules, forecasting, and informed decision-making.

The role of decision-making in project management cannot be overemphasized as it enables managers to make the most of the resources at their disposal, minimize risks, and properly manage the budget by being aware of the financial outcomes and keeping the stakeholders well informed.

Establishing accounting systems and procedures for a project involves several steps. First, define the project’s specifications and objectives. Next, select appropriate software to support project accounting needs. Customize settings to align with project requirements. Develop uniform recording procedures for financial transactions. Lastly, provide training and ongoing guidance to team members to ensure proper implementation and use of the system.

Non-billable work in project accounting is the work that does not contribute to the project but still uses resources and budget. For instance, these activities may include internal meetings, administrative tasks, and training sessions. Non-billable work causes the project budget to be spent on overhead costs and if the project is not done on time, this can result in budget overruns.

The project accounting system helps to identify and manage financial risks that are involved in projects by giving real-time data about the project budgets, expenses, and revenue streams. Through the monitoring of financial indicators as well as performance metrics, project accountants can be proactive and detect potential risks, which allows them to take correct actions that would reduce the risks and maintain project financial health and stability.

Project accounting may increase client satisfaction and trust by supplying detailed and accurate reports on the project’s finances, showing accountability for budget management and resource allocation, as well as delivering projects within the agreed time and budget. Clear communication and pro-activeness in managing client expectations are also part of the process that builds trust and helps create positive client relationships.

For a common project accounting tool, QuickBooks, Asana, Toggl, Expensify, and Resource Guru, can do actions like accounting, project management, time tracking, expense management, and resource allocation.

Project accounting improves efficiency and profitability by controlling costs, optimizing resources, managing risks, making informed decisions, and satisfying clients. By tracking project finances in real time, organizations can identify issues, allocate resources wisely, mitigate risks, and deliver successful projects. This proactive approach minimizes waste, enhances efficiency, and ensures client satisfaction, ultimately boosting profitability.