Imagine if every moment you spent working could be billed. Sounds ideal, right? But reality works differently. Some hours generate revenue through client work, while others are dedicated to the vital tasks that support business growth and operations yet cannot be tied to a single project. The tricky part is distinguishing between billable vs non-billable hours without guesswork. In this guide, we will unravel that complexity and show you how to manage your time more intelligently for maximum efficiency and profitability.

What is the Difference between Billable and Non-Billable Hours?

Not all working hours contribute directly to revenue. Some tasks can be charged to clients, while others are essential for business operations but cannot be billed. This creates a distinction between billable and non-billable hours.

Billable hours are the time spent on work that generates revenue and is invoiced to clients. In contrast, non-billable hours are necessary for running and growing a business but do not directly contribute to income.

This comparison outlines the main differences between the two subjects:

| Category | Billable Hours | Non-Billable Hours |

|---|---|---|

| Definition | Time spent on work that is directly invoiced to a client. | Time invested in tasks that support business operations but are not charged to clients. |

| Purpose | Contributes to revenue generation through client work. | Enhances internal processes, efficiency, and long-term business growth. |

| Billing Rate | Charged to clients based on an hourly rate, fixed fee, or contract term. | Considered an operational expense, absorbed by the company. |

| Business Impact | Directly increases revenue and profitability. | Improves internal workflows, skill development, and overall business sustainability. |

| Priority | High, as it affects revenue and client relationships. | Secondary but essential for maintaining efficiency and long-term success. |

A thriving business requires proper management of both billable and non-billable working hours. Profitability depends on billable hours, but non-billable hours maintain operational fluidity while establishing future business expansion. Finding the right balance between the two is key to maintaining productivity and financial stability.

What are Billable Hours?

Imagine working hard for multiple hours on the project, delivering results, but then realizing that you can’t really charge for half of your time. That’s why it’s essential to understand billable hours.

Billable hours are the time that you spend on tasks that directly work towards a client’s project and can be billed. If a client is paying for your time, that’s going to be billable. These hours are the lifeblood of income for freelancers , agencies, law firms , consultants, and any business that charges for services.

Examples of Billable Hours

Billable hours include any task that directly contributes to a client’s project and can be invoiced. Some common examples include:

- Client work: Completion of tasks per a contract, such as design, development, consulting, or legal services.

- Client meetings: Time spent communicating project details, updates, or strategy with a client.

- Project research: Conducting necessary research related to a client’s work.

- Revisions and edits: Making changes based on client feedback as part of the agreed scope.

- On-site work or travel: If stipulated in the contract, time spent at a client’s location or traveling for project-related purposes.

- Reporting and documentation: Writing a project report, slides, or other deliverables required by the client.

Make every billable hour count!

Time Champ eliminates manual tracking and ensures accurate invoicing. Start now!

Signup for FreeBook DemoWhat are Non-Billable Hours?

Not every hour spent at work equals revenue earned, however, they're necessary for running a successful business. Non-billable hours refer to the time spent on tasks that support business operations but cannot be charged to a client. These hours don’t directly make money, but they are integral to ensuring efficiency, growth, and long-term success.

Think of non-billable hours as the behind-the-scenes effort that keeps everything running smoothly. While billable hours bring in revenue, non-billable hours fuel innovation, strengthen internal processes, and pave the way for future opportunities. Though it may seem tempting to minimize non-billable time, ignoring these tasks can lead to disorganization, missed growth opportunities, and burnout . The key is to strike a balance: optimize non-billable hours without neglecting their importance, ensuring long-term efficiency and business success.

Examples of Non-Billable Hours

Non-billable hours include many activities necessary for the day-to-day operational success of a business, including:

- Administrative tasks: Managing emails, scheduling, invoicing, and other operational duties.

- Team Meetings: Team discussions, strategy sessions, and company updates.

- Training and professional development: Skills development, attending conferences, earning certifications.

- Marketing and business development: Content creation, networking, or prospecting for new clients.

- Recruitment and employee management: Activities related to hiring, onboarding, and team building.

- Non-client research: Conceptual research on the industry, trend research, or development of new service offerings.

Why is it Essential to Track Billable and Non-Billable Hours?

Time is money, but only if you know where it’s going. Most companies keep tabs on billable hours because that’s what they get invoiced on. However, overlooking non-billable hours can cause inefficiencies, lost revenue, and poor strategic decisions. Here’s why tracking both is non-negotiable.

1. Maximizing Revenue and Profitability

Every untracked billable hour is a lost opportunity. Failure to log billable time accurately often leads to errors in underquoting projects, miscalculating effort, and ultimately losing revenue. Without a clear record, clients can dispute invoices, payments may be delayed, and cash flow can take a hit. Tracking helps ensure that every minute of client work is recorded, billed accurately, and compensated fairly. It also assists in revenue forecasting, setting more accurate rates, and measuring the time that projects take. Without this information, companies are forced to guess, and guesses don’t pay the bills.

2. Identifying Time Drains and Boosting Efficiency

Not all hours are made equal. Some generate revenue, and others drain productivity away. Administrative work, unnecessary meetings, and excessive revisions can slowly eat into valuable time without being noticed. Tracking billable as well as non-billable hours empowers your businesses to identify inefficiencies, allowing the removal of time-wasting activities. It’s not that non-billable work should be stamped out completely, it can be optimized. Knowing where the time spent allows a company, to reorganize workflows, establish priorities, and gain overall efficiency without losing quality.

3. Smarter Resource Management and Project Planning

On paper, a project may look lucrative, however, if there are too many hours spent on non-billable work, the profit margins shrink fast. The lack of clarity about how time is divided creates the risks of overload on teams, misallocating resources, and underestimating the actual effort required for projects. Tracking both types of hours helps managers spread workloads fairly, avoid burnout, and use data to make informed decisions. It keeps teams from wasting too much time on things that won’t make them money while still allowing for essential business operations.

4. Strengthening Long-Term Business Growth

Non-billable hours might not generate income immediately, but they set the pace for future achievement. Business development push, employee training , and internal strategy sessions may not be billable, but they are vital for remaining competitive. Companies can learn about the return on investment for these efforts by tracking non-billable time. Are training sessions leading to better performance ? Is marketing generating valuable leads? Instead of treating non-billable time as a necessary expense, businesses that track it can turn it into a strategic asset.

Businesses that fail to track their time operate in the dark, making decisions based on assumptions rather than facts. Whether it’s ensuring accurate invoicing, improving efficiency , or planning for growth, tracking both billable and non-billable hours provides the clarity needed to build a stronger, more profitable business.

How to Calculate Billable Hours Accurately

Calculating billable hours isn’t just clocking time, it’s a metric you need to know about to understand how your team’s effort translates into revenue and ensure that no hour slips through the cracks. Whether you’re a solo professional or managing a large team, following a structured approach helps you price smart, work efficiently, and avoid burnout. Here’s how to get it right.

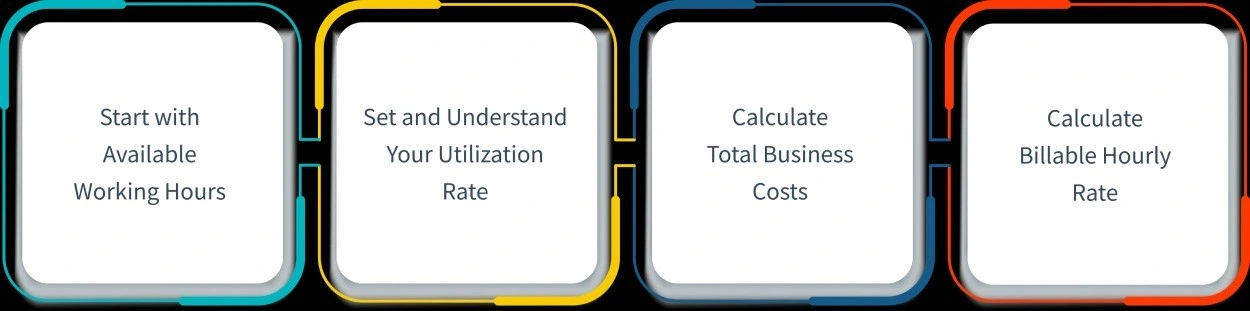

1. Start with Available Working Hours

Before you can talk numbers, you need to know how many hours your team members are actually available to work.

- Typically, a full-time employee works 40 hours per week, which adds up to 2,080 hours per year (40 hours × 52 weeks).

- But let’s not forget about the downtime: paid leave, sick days, and public holidays. If you account for about 30 days off (or 240 hours) per year, the real number of available working hours shrinks.

So, 2,080 hours – 240 hours = 1,840 available working hours per year.

This number is your baseline, the real-world capacity of one person before you consider how many of those hours can be billed to clients.

2. Set and Understand Your Utilization Rate

Now, here’s the key: determining how efficiently those available hours are used building for clients. And that’s where your utilization rate comes into play.

Utilization Rate = (Billable Hours ÷ Available Working Hours) × 100

A healthy utilization rate differs from one industry to another, but most experts agree that approximately 75% is ideal. This keeps your team busy being productive with most of their time spent on revenue-generating work as well as planning, learning, and other non-billable but critical tasks.

Let’s do the math:

1,840 available hours × 75% = 1,380 billable hours per year.

If your utilization rate gets too high, say, near 100%, it’s not something to celebrate. That usually means that your team is overworked, stressed out, and a little bit on the brink of burnout. Quality wanes, creativity withers, and turnover rates surge.

On the flip side, if the utilization rate is too low (below 60%), it’s a red flag that your team isn’t getting enough billable work, and valuable resources are being wasted. The trick is balance: An optimal utilization rate ensures your team is productive but not overworked and your business lucrative but not at the edge of a cliff.

3. Calculate Your Total Business Costs

Once you’ve figured out how many billable hours you can actually generate, it’s time to figure out what those hours need to pay for. Your business costs go beyond salaries, consider overheads, benefits, taxes, software subscriptions, rent, and more.

A common rule of thumb is, when calculating the cost of an additional employee, it is wise to multiply each employee’s annual salary by 3 to include these additional expenses. Why three? Because beyond salary you’re shouldering operating expenses, employee turnover costs, and trying to increase profits.

For instance, if an employee earns $65,000 annually, the total business cost becomes:

$65,000 × 3 = $195,000 per year.

This method keeps you from under-pricing your services and ensures that you’re not only breaking even but making room for growth and stability.

4. Calculate Your Billable Hourly Rate

Now comes the most important part, setting your billable hourly rate. You have your total business cost as well as your annual billable hours; dividing one by the other gives you the hourly rate you need to charge to cover costs and turn a profit.

Billable Hourly Rate = Total Business Cost ÷ Annual Billable Hours

Let’s plug in the numbers from our earlier examples:

$195,000 (business cost) ÷ 1,380 (billable hours) = approximately $141 per hour.

This rate ensures you’re not undervaluing your services or short-changing your business. It becomes the foundation for how you price projects, retain clients, and grow sustainably.

Calculating billable hours isn’t just a numbers game, it’s a strategic endeavor. By understanding your team’s capacity, setting realistic utilization rates, accounting for all business costs, and pricing accordingly, you’re setting your business up for both profit and longevity. It’s not guesswork, it’s careful and intentional planning that provides the most protection for your people and strengthens your bottom line.

Track smarter, bill better!

With Time Champ, calculating billable hours is effortless and precise. Try it today!

Signup for FreeBook DemoCommon Errors in Tracking Billable and Non-Billable Hours

Tracking billable and non-billable hours can derail even with the right tools and intentions. Such mistakes not only skew data but also undermine profitability , resource planning, and client trust. Here are some of the most common errors that can quietly sabotage your efforts and how to steer clear of them:

1. Guessing Instead of Logging in Real-Time

A lot of professionals make the error of recording hours at the end of the day or week, relying on their memory. The result? Missed hours, overestimated time, and inaccuracies that add up quickly. Tracking work in real-time or at least tracking the work immediately after completing a task helps keep data accurate and honest.

2. Blurring the Line between Billable and Non-Billable Work

A quick client chat, a brief internal discussion, or reviewing a document can feel billable but often drift into grey areas. Without crystal-clear definitions and team alignment , the lines get blurred, and mistakes happen. This not only affects billing but can also impact client trust if they question charges. Defining billable activities upfront and keeping everyone aligned ensures there’s no confusion or awkward conversations down the line.

3. Overlooking Small but Frequent Tasks

Five minutes now, ten minutes later. Minor tasks seem harmless, but they add up over weeks and months. Ignoring these tiny time pockets creates invisible gaps in billing. It also undervalues the effort put into client work. When businesses keep track of these tiny tasks and write them down, they get the full worth of their time and maintain profitability without overextending resources.

4. Failing to Track Non-Billable Time

Non-billable hours may not be client-facing, but they are powerful narratives about where time is actually going. Failing to log these hours means companies lose out on identifying inefficiencies such as unproductive meetings, extended admin tasks, or scattered attention. Tracking non-billable time gives you the chance to eliminate waste , optimize workflows, and make room for quality work. It’s not just about saving money, it’s about working smarter.

5. Using Outdated or Clunky Tracking Tools

This system of manually entering time into a spreadsheet or relying on outdated tools often leads to confusion, wasted effort, and missed entries. These systems are prone to human error and don’t provide the real-time insights that modern businesses need. Smart time-tracking tools not only automate the process but also provide analytics to help teams identify inefficiencies, allocate their team’s time more effectively, and bill with confidence. In a world where every second counts, the right tool isn’t just helpful; it’s essential.

How Does Time Champ Simplify Billable and Non-Billable Hour Tracking?

Manual methods or clunky spreadsheets become a time drain (not to mention susceptible to error) when tracking billable and non-billable hours. Enter Time Champ to be your effortless solution. Here’s how Time Champ absolutely turns what could be a tedious task into something smooth, smart, and hassle-free:

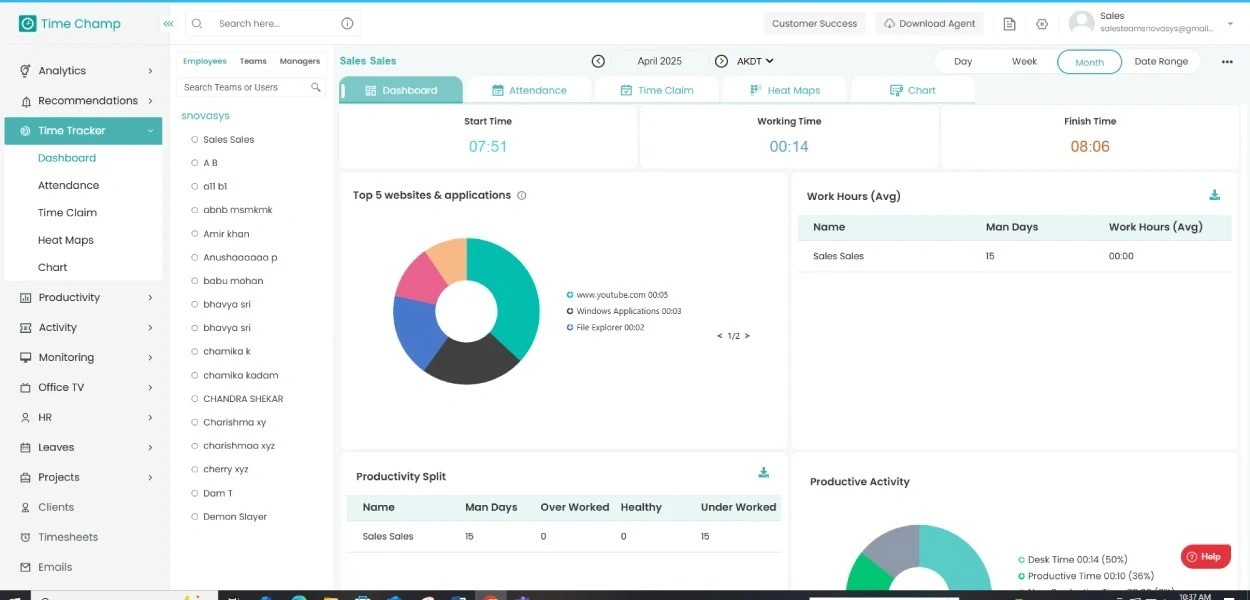

1. Automatic, Smart Time Tracking

No more manual entries or trying to remember your day at the end of the week. Time Champ operates silently in the background to record the time spent on different tasks as you work. It detects the patterns of your activity, monitors your apps and websites , and neatly organizes time without you lifting a finger. The result? Accurate records that reflect real work, not estimations, provide managers and teams with an honest, clear overview of where time is being spent.

2. Clear Differentiation between Billable and Non-Billable Time

Not all hours spent on work directly bring in revenue, but the hours still matter. Companies face challenges such as inaccurate invoices and loss of resources when there isn't a proper system for distinguishing billable from non-billable time. Time Champ solves this problem by automatically categorizing time spent across internal meetings, administrative tasks, client work, etc.

A clear breakdown allows businesses to:

- Bill the clients for true work performed.

- Know non-billable tasks that cost you a lot of time.

- Streamline the internal processes to ensure greater efficiency.

Equipped with this transparency, teams don’t need to second-guess how they spent their time, and managers can better decide how to distribute workloads .

3. Effortless Timesheet Management That Saves Hours

Manually entering data into spreadsheets is not only tedious but also prone to errors. Employees forget to enter time, managers find it hard to verify hours, and it’s a nightmare across the board. Time Champ automates timesheet management by generating accurate, real-time reports that require minimal effort.

- Employees don’t have to meticulously track every single minute, they just check in and submit.

- Quick timesheet approval for managers, no need to go through blocks of inconsistent logs.

- Reduced disputes and lower administrative work for payroll and invoicing.

A process that historically took hours can now take minutes, freeing teams to spend more time on meaningful work.

Struggling with manual timesheets?

Time Champ automates it all, saving time and eliminating errors. Start your free trial!

Signup for FreeBook DemoConclusion

Understanding the difference between billable and non-billable hours is more than just a business practice. It is the key to unlocking productivity, maintaining financial clarity, and driving long-term success. Knowing exactly where your time goes allows you to make smarter decisions, improve efficiency, and ensure every minute is spent moving toward progress.

Stop guessing, start growing!

With Time Champ, track every billable and non-billable hour seamlessly and take control of your time. Try it today!

Signup for FreeBook DemoStop guessing and start optimizing! With Time Champ, gain complete visibility into billable and non-billable hours, empowering your team for better efficiency and profitability. Try it today!

Frequently Asked Questions

Billable hours are the hours worked that can be charged to a client, while actual hours include both billable and non-billable time, such as administrative tasks, meetings, and training. Both tracking help improve efficiency and profit.

Cut out unnecessary meetings, automate repetitive tasks, set clear priorities, and track nonbillable time to see where you can work more efficiently. Streamlining these activities helps maximize productive work hours. Finally, encouraging more concentrated work blocks also curtails time wasted on constant task-switching.

Excessive non-billable work reduces overall revenue, strains resources, and lowers profitability. Managing it effectively ensures that more time is spent on revenue-generating activities while maintaining operational efficiency.

Automate administrative work, avoid unnecessary meetings, delegate effectively, and establish clear guidelines on billable work. Good planning will prevent valuable time from being lost, as non-billable work will not take over.