When you get an offer of employment, you are not given a figure but a salary break-up. It specifies how your salary is distributed to basic salary, allowance and statutory benefits respectively. Understanding that divide will enable you to compare offers on a level playing field and estimate how much take-home pay you would have in each offer.

A clear salary breakdown will also assist in planning taxes, claiming benefits you are entitled to, and asking the right questions in negotiations. This guide will define what a salary breakup is and provide every detail in depth.

What is a Salary Breakup?

A salary/CTC breakdown is how the salary is apportioned into fixed and allowances, variable, and statutory contributions. It shows your salary, deductions, and your remaining salary.

Your break-up is not just a wage but a design blueprint. It tells about how much is fixed pay and how much is variable pay, the allowances that you will get, and how much will be deducted to bring down the in-hand pay. It allows you to estimate taxes without a salary breakdown and budget monthly expenses.

It is important since two offers with the same CTC are likely to offer very different take-home figures. The salary breakup format allows you to maximise the constituents (HRA or LTA), make mandatory deductions, and negotiate the largest components.

What are the Key Components of a Salary Breakup?

Your salary is not a single figure; in fact, it consists of various components that influence your take-home pay, your retirement savings and general financial planning. Getting to know these aspects can make you aware of whether your compensation is designed in such a way and the way it affects your benefits.

1. Basic Salary

This is the main part of your pay and acts as the foundation for many other computations (PF, gratuity, HRA). Basic can be maintained at a fixed proportion of CTC, usually between 30-50%, so that companies can maintain compliance with the Pay Commission level but also maintain take-home pay. Higher basic increases retirement benefits and reduces the in-hand salary.

2. House Rent Allowance (HRA)

HRA will support your expenditure on hired housing. Its percentage is usually bound to be simple (40% in non-metro and 50% in metro policies). HRA can also save a lot of taxable income when you pay rent and can satisfy documentation requirements.

3. Conveyance/Transport Allowance

This is the travel money for commuting or within the area of work. It is a fixed monthly amount in some cases and through expense claims by employers in others. Tax treatment is dependent on region, and the provision of a modest transport allowance allows greater transparency in the structure of the salary breakup.

4. Medical/LTA/Special Allowance

Medical allowance, LTA (Leave Travel Allowance), is usually a part of earnings. LTA can be a claim-based journey on suitable travel. The remaining fixed pay is usually put on a special allowance, which offsets the CTC against the other elements and contributions.

5. Employer Provident Fund Contribution

Employers make an employer contribution of a percentage of your basic (commonly 12%) to the Provident Fund. Some of this is CTC, and some of this is not part of your in-hand salary. It creates long-term savings and can have an impact on how the remainder of the breakup is sized.

6. Gratuity/Insurance/Other Benefits

Gratuity (usually provided at an amount equivalent to ~ 4.81 per cent of basic) and insurance premiums that are group in nature may be included in CTC. These do not show up in your monthly take-home but are useful as security and tenure-based benefits.

7. Tax Benefits

Some fringe benefits like HRA, medical allowance and leave travelling allowance (LTA) are tax exemptions. These allowances cut down on your taxable income, improving your effective take-home pay.

What are the Factors Affecting Salary Breakup Structure?

Various internal and external factors come into play to determine a salary breakup, as a portion of your salary would be fixed, allowances, and benefits. Learning these factors will make you understand why pay varies among jobs, organisations, and industries.

1. Job Role & Seniority

Leadership and niche technical roles will feature higher-level, fixed job elements to provide stability, alongside performance-based components. There are entry roles that may offer allowances to maintain in-hand competitiveness while satisfying statutory requirements.

2. Company Compensation Philosophy

Some companies emphasise retirement riches (better base, better PF/gratuity). Others are more concerned with the take-home pay (worse basic pay and better allowances). The knowledge of that philosophy will help you see why two offers with the same CTC may differ greatly in your bank account.

3. Location and Cost of Living

Metro postings would normally have an increased HRA and transport allowance. Possible relocation or housing assistance in a remote or tier-II location is also possible. Even the local taxes (e.g., professional tax) can change your net result.

4. Legal/Statutory Compliance

PF, gratuity, minimum wage baselines, and local tax laws are also factors that influence component sizing. In order to prevent non-compliance and yet make the salary breakup more appealing to hiring and retention, HR designs the format of the salary breakup.

5. Performance & Variable Pay Mix

Sales and growth roles usually have incentive or bonus pay. High variable compensation has the capability to push CTC up higher and fixed down, a great thing when you deliver over and above, but it also increases income variability, which you must reckon with.

6. Benefits and Perquisites

WFH/Internet stipends or education assistance may be out-of-pocket but within CTC. These are extras to the package, but they do not boost the take-home pay.

How to Calculate Salary Breakup?

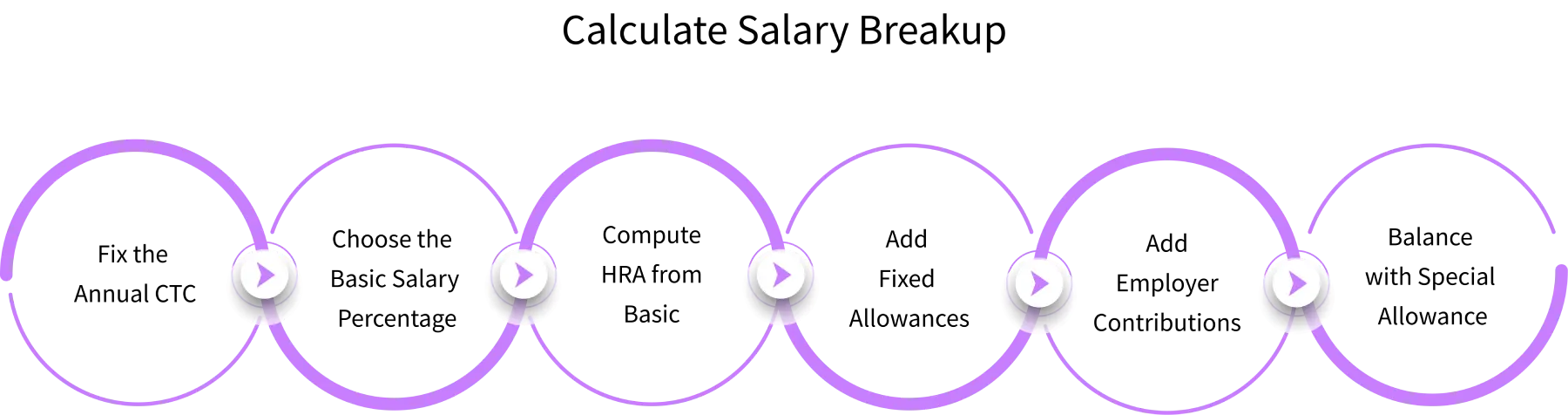

Calculating your salary break-up makes you realise what proportion of your salary reaches the fixed pay, allowance and deductions. With the elements broken down in steps, it is easy to identify your take-home pay in comparison with the amount spent by the company (CTC).

1. Fix the Annual CTC: Take the provided CTC (e.g., 12,00 000 per year). Calculate monthly (1,00,000) if you prefer. It is the inner envelope where you will put earnings, benefits, and employer contributions.

2. Choose the Basic Salary Percentage: Choose a moderate basic pay breakup, say 40% of CTC monthly (₹40,000). Do not forget, higher basic increases PF/gratuity but may lower take-home as the employee will be taxed more via PF deduction.

3. Compute HRA from Basic: Apply your company's HRA rule (e.g., 40% of basic in non-metro = 16000; 50% of basic in metro). The HRA component may be used to shrink taxable income (provided it is documented and subject to tax requirements), should you rent.

4. Add Fixed Allowances: Transport, medical, and LTA expenses (e.g., 3,000 + 1,250 + 4,000). They boost gross earnings and can be claimable (LTA) or fully taxed, depending on your jurisdiction.

5. Add Employer Contributions: Include employer PF (12% of basic = 4,800) and gratuity (4.81% of basic = 1,924) in CTC. They are not paid in-hand but are essential for long-term compliance.

6. Balance with Special Allowance: Assign the rest of the CTC to Special Allowance, and you should have a total of components equaling your CTC. This provides you with a fully auditable structure of salary breakup that you can compare across offers.

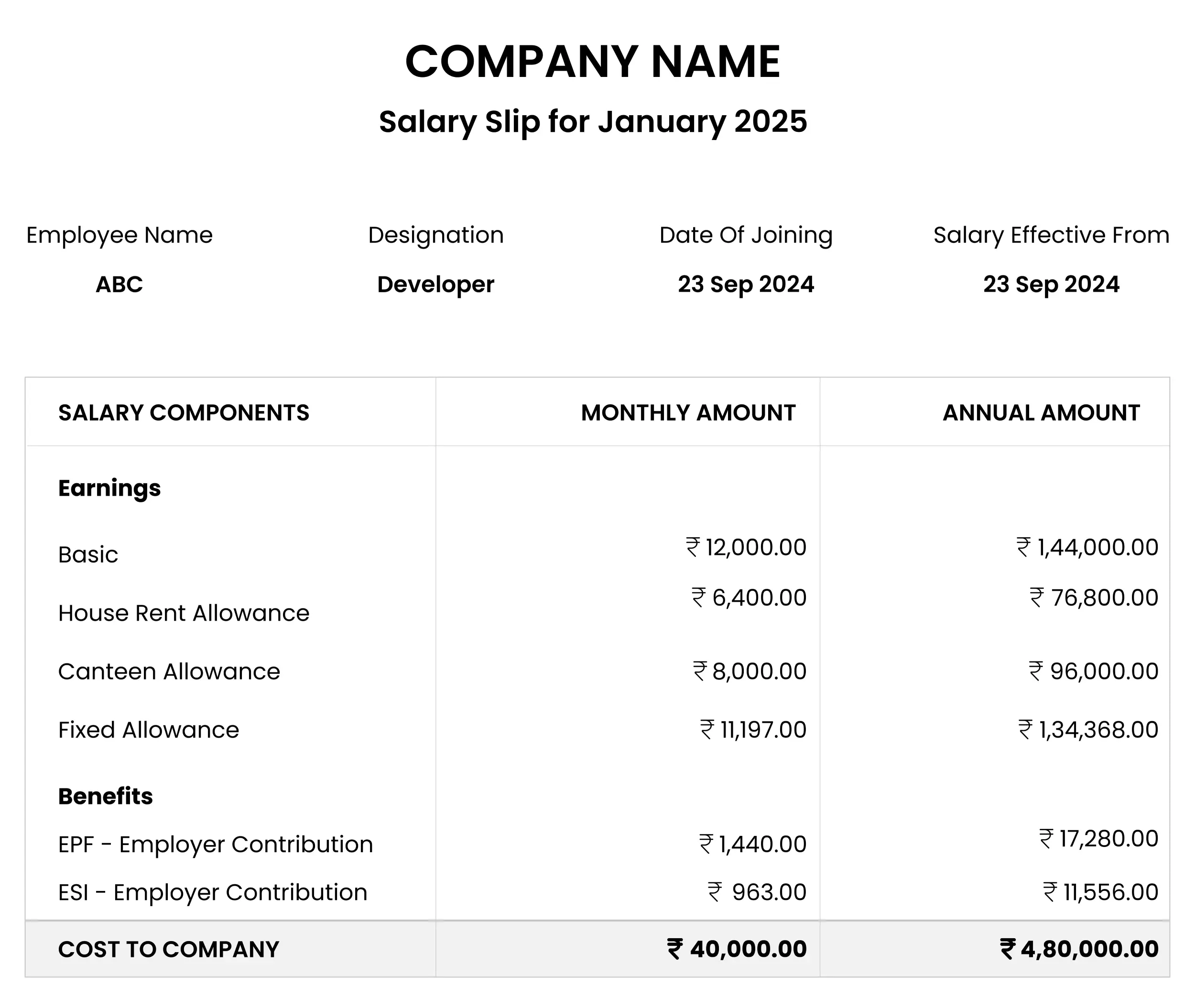

Worked example (monthly on ₹1,00,000 CTC)

| Item | Amount (₹) |

|---|

Gross salary (monthly earnings) = Basic + HRA + Conveyance + Medical + LTA + Special

= ₹93,276

What is the Difference Between Gross Salary and Net Salary?

Gross salary means your total earnings, including all deductions, whereas net salary is your total earnings in your pocket at the end of each month. Learning this distinction is valuable as it can make you better plan in terms of taxes, savings and personal spending. When you are seeking employment, employers tend to emphasise gross salary in the recruitment process, but it is actually net salary that has an actual influence on your monthly financial statement.

| Aspect | Gross Salary | Net Salary |

|---|