What is the Financial Year? | Meaning & Key Details [2025-26]

For many enterprises and taxpayers, the financial year is a very crucial time. From wages and investments to taxes and government budgets, a large part of India’s economy takes place within this 12-month cycle. For India and many other countries, the financial year is not only the form for recording income and expenses, but it also facilitates the timing for business milestones, deadlines, and compliance.

Having a clear understanding of the current financial year (FY 2025–26) and how this year is different from previous years will aid in planning and functioning properly for individuals and businesses alike. Missing key deadlines or confusion about how the financial year works can lead to penalties, missed deductions, or compliance challenges. This is why the concept is central to financial planning, management, and general operations.

What is the Financial Year (FY)?

A financial year (FY), or fiscal year, is a 12-month period used for accounting, budgeting, and tax purposes by businesses and governments. In India, for a business, the financial year starts on April 1 and ends on March 31 of the following year. For example, the financial year 2025-26 commences on April 1, 2025, and ends on March 31, 2026. Using financial years standardizes financial documents, including tax (income tax returns) filings and annual reports, which provide taxpayers, organizations, and the government with a consistent framework. For businesses, the requirements of the financial year are important for financial planning, tax calculations, investments, employee performance reviews, and statutory compliance.

India's fiscal year system is the same as many other Commonwealth nations, such as the UK. There are some countries, such as the USA, that use the calendar year (January-December); however, the standard for taxation and corporate filings in India is April-March.

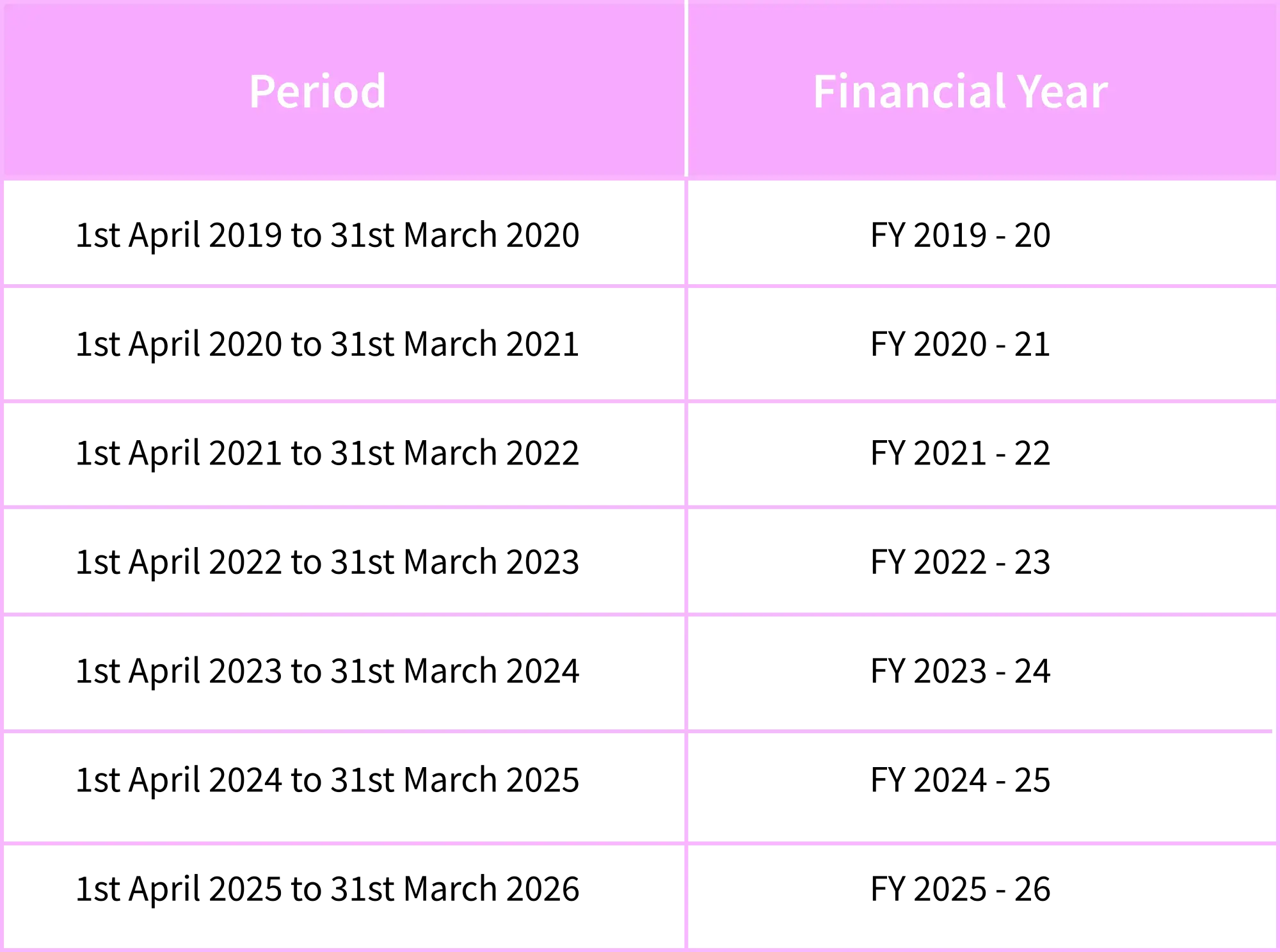

Financial Year in India for the Recent Years

Income tax calculations, the Union Budget of India, and Company Law all depend on the financial year. Employees and businesses have to plan and undertake various financial activities during the financial year (e.g., payroll, investment, tax savings, declarations) within the confines of the financial year.

Why is the Financial Year Important for Businesses?

Important areas where the financial year matters:

Tax Calculations: Taxes on income, profits, capital gains, and dividends are all dependent on the financial year. All records and income tax returns have to show the transactions made during the financial year.

Financial Reporting: The annual financial statements, the financial audits, and the statutory filing (e.g., ROC and GST returns) are all based on the financial year too, to have compliance.

Budgeting & Forecasting: Companies do budgets and forecasts based on the financial year. It can help companies to have better planning and accountability.

Decision-Making: Business performance, bonuses, and incentives typically rely on FY figures.

With respect to statutory deadlines and mistakes associated with the financial year, if you miss them, you may be subjected to penalties and legal headaches. It is better to be completely compliant in advance; otherwise, when you do complete your obligations at the last minute, that will directly affect healthy future business practices.

What is India's Current Financial Year?

India’s current financial year is FY 2025-26, lasting between April 1, 2025, and March 31, 2026; therefore, all earnings, expenses, and investments that occur between those dates will be recorded in this particular tax and business filing period.

What Are the Key Details of the Financial Year 2024 – 25?

Here are some significant details for Financial Year 2024-25 (April 1, 2024 – March 31, 2025):

It may last for 3 to 6 months but can be extended to one year depending on performance. Extensions should be made in writing.

Income Tax Slabs: For Financial Year 2024-25 (Assessment Year 2025-26), the newly revised tax regime had no taxes on income below ₹4 lakh, and the new slabs imposed tax for higher income progressively.

Standard Deduction: Increased to ₹75,000 for salaried taxpayers in Financial Year 2024-25; that was a huge jump for individuals in terms of employee savings.

Union Budget Size: The estimated total receipts (excluding borrowings) were ₹32.07 lakh crore against total expenditure of ₹48.21 lakh crore.

Fiscal Deficit: Outlined at 4.9% of GDP, indicating that the government is prioritizing maintaining reasonable economic growth.

Having the above information enables both businesses and individuals to plan investments, tax planning, and associated compliance actions at the right time.

What are the Consequences of Missing Financial Year-End Deadlines?

Not completing financial year-end tasks by March 31 for companies can lead to the following:

Penalties for Late Filing: If income tax returns are filed eventually but later than the due date, then a penalty of up to ₹5,000 will be incurred as well as an interest charge on taxes not paid.

Disqualification of Exemptions: Missing investment deadlines means disqualification from allowed tax-saving exemptions/reduction in tax liabilities for that financial year. (An example is missing ELSS or PPF, or even the date for insurance products.)

Legal Penalties: There could be notices and fines for filing company fund issues late, filing GST returns late, and other associated issues such as audits, etc. Fines could be imposed and, in some instances, could ultimately lead to legal prosecution for habitual non-compliance.

So closing all financial and tax actions by financial year-end makes for less stress and better management of the business.

How Is the Financial Year Used for Tax Filing?

Income Calculations: All income, profit, and losses are reported for the financial year, which will indicate what we report on our tax returns.

ITR Filing: Taxpayers accurately file their income tax returns after the end of the financial year and consequently after the due date (normally July 31st of an assessment year).

Proof of Investments: The proof of tax-saving investments and similar documentation, e.g., proof of HRA and claims to numerous deductions, must be completed on or before March 31 for the financial year to claim the benefits.

Example: All income earned for the period of April 1, 2024 – March 31, 2025, will be reported in the ITR for Assessment Year (AY) 2025-26.

What Is the Difference Between a Financial Year and an Assessment Year?

| Point | Financial Year (FY) | Assessment Year (AY) |

|---|

The financial year is the financial year in which you earn the income, and the assessment year will be the financial year in which you report and pay taxes on the income earned in the previous financial year.