Journal Voucher: Definition, Types, Example, Pros & Cons

A Journal Voucher is a useful report in accounting records to process entries that do not involve cash or bank payments. In general, journal vouchers are often used for adjustments, correction entries, or for entries such as unpaid salaries accrued at the end of a month.

Adjusting or correcting the accounts in this manner would qualify as a Journal Voucher entry. Typical examples of journal vouchers are adjusting entries, correcting entries, and internal transfers of expense between accounts. Journal Vouchers help businesses to keep their financial records accurate and up to date.

The primary advantage of using a journal voucher is it provides easier organization and tracking of accounting entries. Journal vouchers aid in the audit process by maintaining proper transaction records. It is also important to remember that, if mistakes are made, and even small mistakes will challenge the account and subsequently others, Journal Vouchers will help maintain well tracked financial transactions, as we are doing all in our power to enact smooth and transparent accounting practices, Journal Vouchers can be a good tool for businesses.

What is a Journal Voucher?

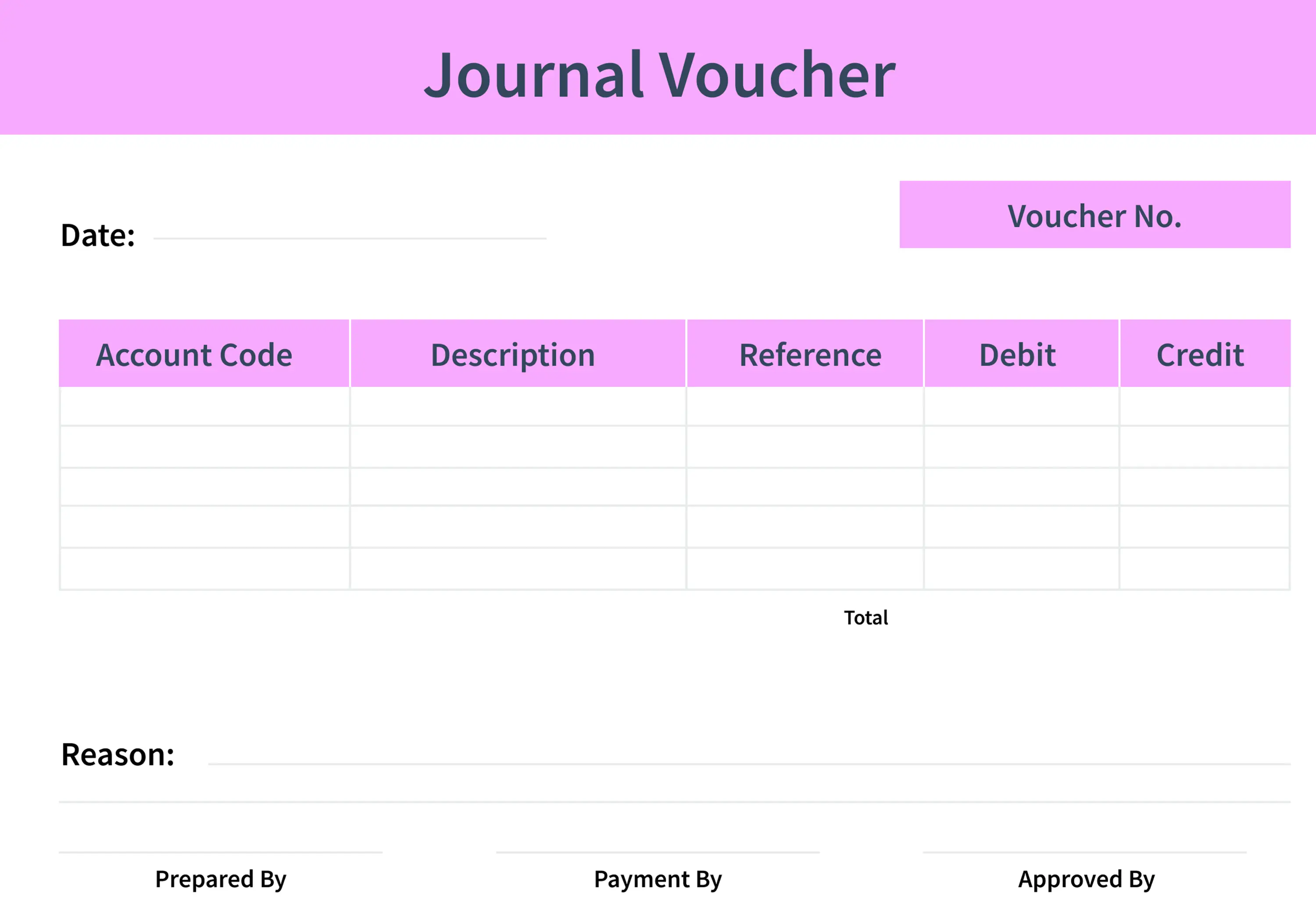

A Journal Voucher is a source document, or recording document, for accounting transactions that do not report the exchange of cash or financial liabilities. The JV captures important facts - the date, description of transaction, amount, taxes, accounts impacted, supporting documentation, authorized signatures, etc.

Journal vouchers are frequently used to process amendments or corrections, or to record internal transfers that cannot be processed through vendor or customer invoices or receipts. For example, a journal voucher may be used to reverse an erroneous salary entry from a prior month or record something at the end of the month, which needs to be properly recorded to reflect in the books. Journal vouchers are numbered with a numeric identifier (voucher number), and have a date, description of transaction, the amount being recorded, taxes amounts if applicable, any accounts being charged, often references to supporting documentation, as well as signatures from the person who recorded the transaction and, the authorizing person's signature.

In payroll and human resources, journal vouchers help act as a source of documentation for adjustments such as salary accruals, tax deductions, reimbursements, and bonuses. Journal vouchers also help to support and document many other financial activities, which should be monetized in the organization's financial accountability .

Overall, journal vouchers are an important element of and part of an organization's internal control, accounting and recordkeeping process, and facilitates the review and auditing processes.

What is the Purpose of a Journal Voucher?

1. Managing Outstanding Expenses: Keeps track of unpaid bills such as rent, utilities, or invoices from suppliers, and ensures you properly keep an eye on outstanding payments.

2. Managing Prepaid Expenses: Allocates costs that you have already paid (e.g., annual insurance premiums) over the months to which the expenses relate. The expense amount in your accounting system reflects the appropriate accounting period.

3. Identifying Accrued Income: Refers to income earned that has not been received. For example, services may have been provided in one month but not paid for until the following month. You want income to reflect the appropriate accounting period.

4. Making Transfers: Transfer amounts between accounts. For example, if payments are received by an arrangement (e.g, a payment plan by a debtor or an agreement with a creditor), you need to transfer amounts from 'Debtors' to 'Creditors,' but not by using cash.

5. Making Adjustments: Changes or reverses the wrong or incomplete entries in the books to keep your books accurate and reliable.

What are the Different Types of Journal Vouchers?

1. Depreciation Voucher: This voucher is used for accounting depreciation, or reduction in value, for assets such as vehicles and machinery.

2. Prepaid Voucher: A voucher that records prepaid expenses, such as rent or insurance, where the asset is charged against expense over time.

3. Fixed Asset (FA) Voucher: Used when a new company purchases long-term assets, like a property, equipment, or vehicles that have a useful life of a number of years.

4.Adjusting Voucher: These vouchers enable companies to provide financial records that are accurate at the end of an accounting period by making adjustments.

5. Rectification Voucher: These vouchers compensate for transactions by re-entering an incorrect entry, reversing the entry, and then replacing it with the right entry.

What is an Example of Journal Vouchers?

A journal voucher could be used to record the unpaid salary accrued for March. In this case, the journal voucher would debit the salary expense account and credit the Salary Payable account. This helps ensure the expense has been recorded in the correct period, even though the payment has not been made, which leads to wise and timely financial reporting.

What are the Benefits of a Journal Voucher?

Transaction Reliability: Journal vouchers support that all transactions entered are real and reliable because they put in place checks on all particulars, all amounts, and all supporting documents before posting.

Compliance: Comply with company processes and applicable legislative mandates, including GDP criteria, tax regulations, and accounting standards.

Do-it-yourself Record Keeping: Each entry has a date and proper identification to assist with monitoring and reviewing transactions if necessary, especially when being audited.

Correcting Errors & Non-Cash Transactions: Journal vouchers can be used to correct errors in past records or record non-cash transactions, including depreciation & written-off bills.

Year-End Work and Backup: Journal vouchers will simplify your year-end closing tasks through organized records and provide an ideal backup when adjusting entries or reversing journal entries.

What are the Features of a Journal Voucher?

All Transactional Records: The journal vouchers are used to record all transactions that do not lend themselves to the use of a regular voucher, ensuring that no transactions are lost.

Documentary Evidence: Each voucher contains supporting documentation, and for greater transparency, invoices (or bills) are often used as proof of the transaction.

Validation: Vouchers are checked for accuracy and approved by responsible officials. It guarantees that the voucher is accurate and that the transaction has been authorized before it is registered in financial records.

Fraud Prevention: Every voucher is a good record of the exchange that has happened, providing a clear record of who was responsible for the transactions, which can help mitigate cheating, theft, or misuse in the future.

Internal Controls: Before payments are processed, vouchers undergo additional review. Internal controls ensure the transaction is authentic, not fraudulent, that the right amount is being processed, and is in compliance with the organization’s policies and procedures.