What is loss of pay (LOP) in salary & how is it calculated?

Loss of Pay (LOP) or Leave Without Pay (LWP), is a salary deduction when an employee is unpaid or does not have enough paid leave available or approval for their requested time off. It is important for the intent of discipline and tracking attendance.

To calculate the LOP, the monthly salary is divided by the working days in that month and then multiplied by the number of unpaid leave days. LOP directly removes from an employee's monthly pay. For an organization tracking LOP is critical to payroll accuracy. For employees, knowing whether they are below their leave balance helps them avoid unexpected salary deductions.

What is the Loss of Pay (LOP)?

Loss of Pay (LOP), or Leave Without Pay (LWP), refers to unpaid leave taken when sick or another reason beyond the remaining paid leave balance, recognized in the company policy as entitlement or unauthorized leave. Loss of Pay affects salary and requires company approval by the employer.

Loss of Pay is a tool organizations utilize for discipline and additional financial controls over pay. Loss of Pay is applicable when sick or another leave under entitlement has been exhausted or the employee does not comply with their obligation to request time away, whether sick or unauthorized. Loss of Pay can also apply to other scenarios such as during strikes or weekend mismanagement if the employer has an entitlement policy to reduce the cost of payroll through fair and transparent procedures.

Having effective procedures for your organisation and a Loss of Pay policy is an important factor in the efficiency of your organisation, absence management reductions, and fairness within your organisation. Understanding that employees should know any Loss of Pay rules, how Loss of Pay is calculated, and how to reverse a Loss of Pay deduction are all part of managing leave responsibly.

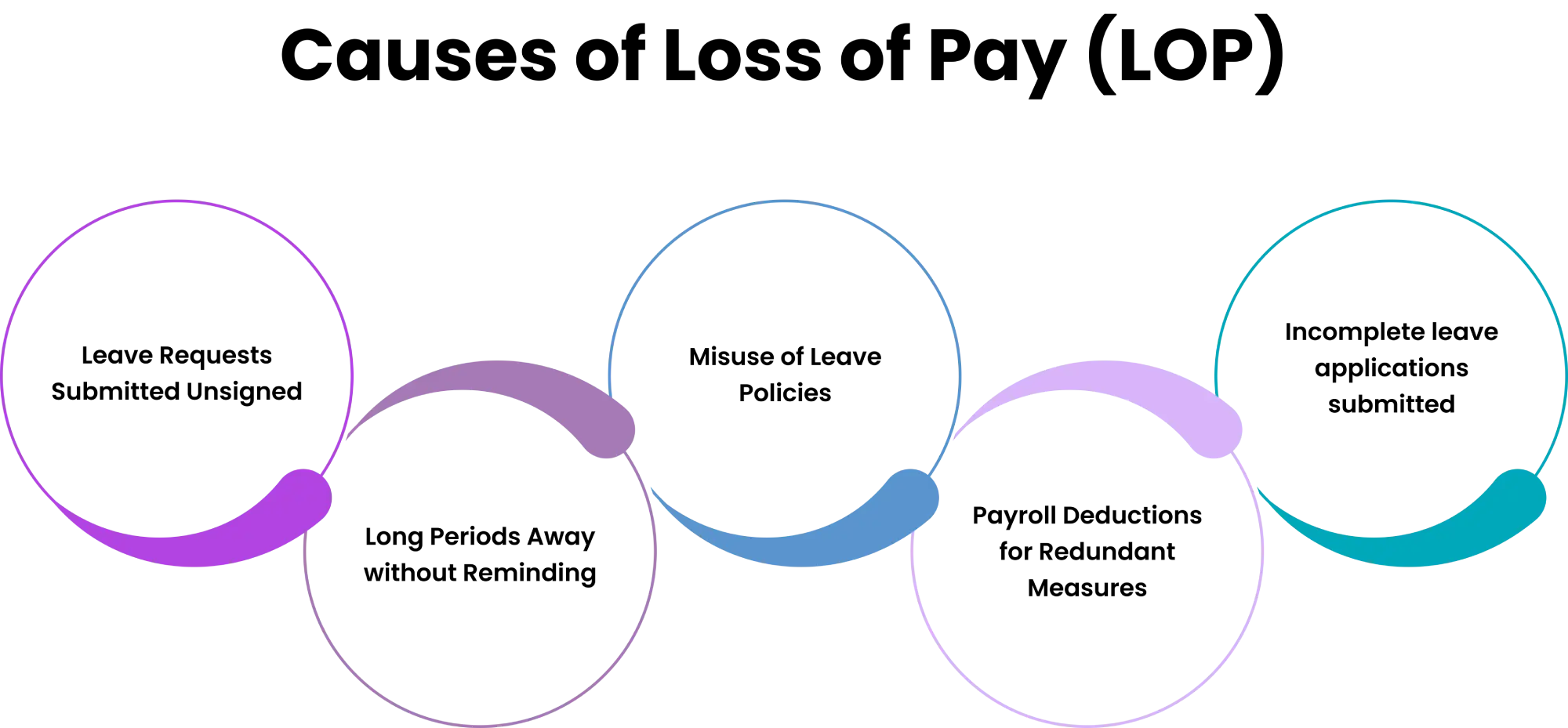

What are the Causes of Loss of Pay (LOP)?

1. Leave Requests Submitted Unsigned: Taking leave without first informing or getting permission from a manager, will likely result in deductions for Loss of Pay.

2. Long Periods Away without Reminding: Being away from work takes your fellow employees away from their work as well, which may span a variety of time without notice, leading to Loss of Pay deductions.

3. Misuse of Leave Policies: Determining that your sudden absence and the reason for your leave are not in accordance with company leave rules may compel the employer to impose the rules of Loss of Pay.

4. Payroll Deductions for Redundant Measures: Loss of Pay may be a corrective measure implemented by the employer towards a disciplinary measure, or for persistent tardiness.

5. Incomplete leave applications submitted: Any leave requests with missing or incorrect information may lead to a Loss of Pay deductions. If you submit leave requests accurately and completely, it will allow your leave request to be approved in a timely manner, avoiding errors in payroll.

What Are the Rules for Loss of Pay in India?

For Employees:

Plan Ahead: Always submit your leave requests in advance and obtain approval from your manager or HR. This will prevent your leave from being recorded as Loss of Pay.

Minimise Your Unauthorised Absences: Avoid extending your approved leave or failing to inform the employer that you are absent. Authorised leave denotes that you will be paid for your unavailability to work, while unauthorised leave can result in non-payments and detracts from your work performance record.

Keep Record: Use the company’s HR system to regularly check and update your leave history and current balance. This will help avoid payroll errors, and it will also inform you of your leave status.

Inform Your Employer: If your leave is unplanned, provide supporting documents such as a medical certificate or evidence of an emergency. This supports your leave request and assists your employer in making appropriate and fair decisions.

Follow Company Policies: You should always comply with the leave policies and leave application processes outlined in your employment contract, company handbook, or HR policies to avoid confusion.

For Employers

1. Document: Employers should clearly articulate their Loss of Pay policies in employment offer letters, HR manuals, and employee handbooks to avoid confusion from the start for the employee.

2. Legal: Make sure Loss of Pay deductions comply with the Payment of Wages Act, 1936, to prevent potential legal or financial repercussions.

3.Keep Records: Employers should keep accurate and up-to-date attendance and leave records for each employee to ensure payroll accuracy and compliance.

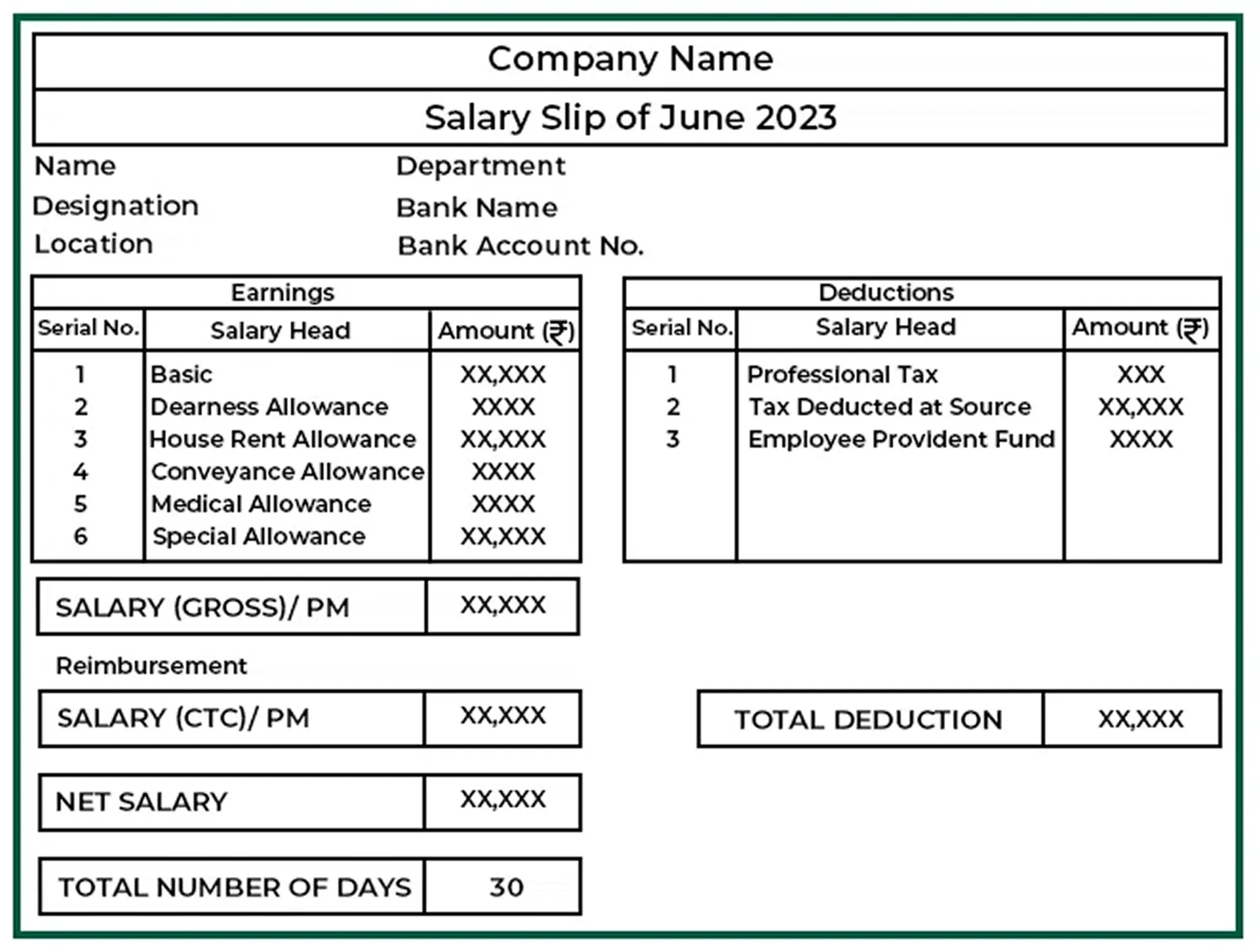

4.Transparency: Employers should issue pay-slips that itemise loss-of-pay deductions for employees to make the deductions clearer and more transparent, for employees to trust the process.

5.Allow Employees to Explain: Employers should allow employees to explain their absence before applying Loss of Pay to ensure employees are treated fairly and provide good employee relations .

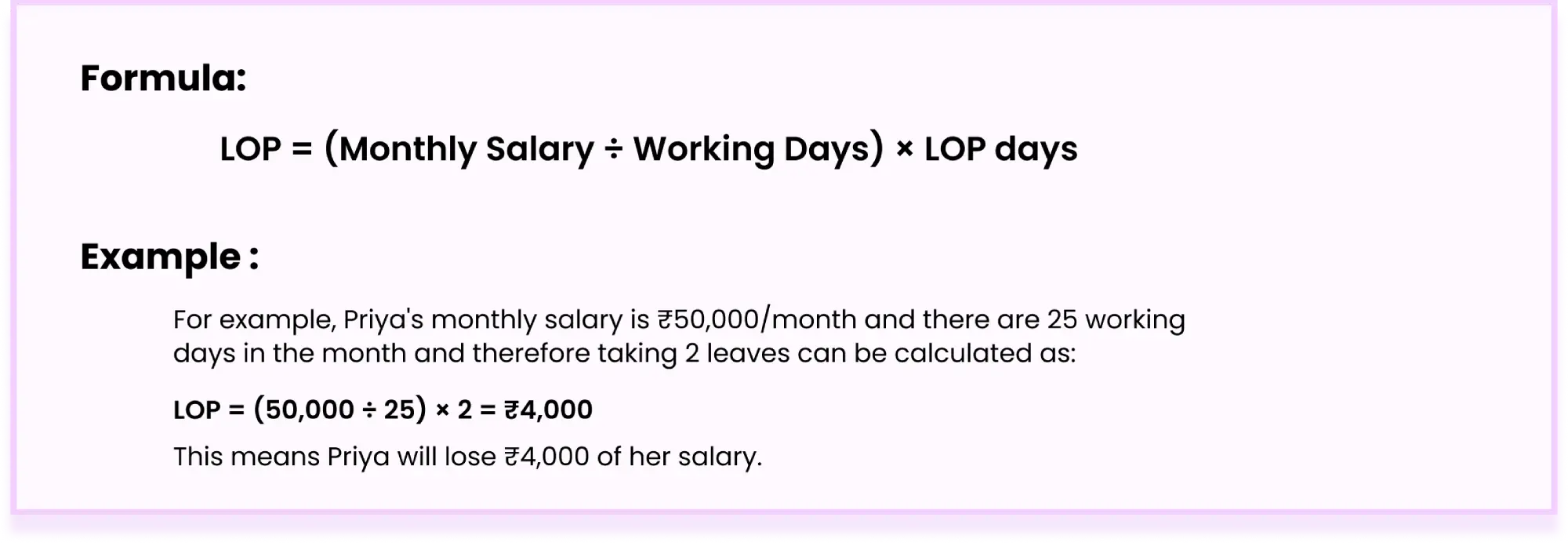

How is Loss of Pay Calculated in a Salary?

Loss of Pay (LOP) can be determined using the formula:

LOP = (Monthly Salary ÷ Working Days) × LOP days

For example, Priya's monthly salary is ₹50,000/month and there are 25 working days in the month and therefore taking 2 leaves can be calculated as:

LOP = (50,000 ÷ 25) × 2 = ₹4,000

This means Priya will lose ₹4,000 of her salary.

Every organization may consider a working day differently. Certain organizations will exclude weekends, while others may consider the calendar days. Automated payroll systems have eliminated this error and streamlined the process.

Can Loss of Pay Be Avoided or Reversed?

Certainly, Loss of Pay (LOP) can be reduced by planning leave in advance, getting approvals, and managing your leave balance.

In some cases, it can be reversed if valid documentation is provided or if company policy allows offsetting unpaid leave against accrued or compensatory leave.

How Does LOP Affect Employee Benefits?

1. Reduction in Gross Salary: Loss of Pay (LOP) days are deducted from the monthly wages, thus impacting gross salary, ultimately impacting take-home pay for that month, and will be stated on the employee's payslip.

2. Lower PF Contribution: Because Provident Fund (PF) amounts are calculated as a percentage of the Basic Salary, loss of gross salary from LOP will also impact PF contributions from both the employee and employer, and could have a minor impact on long-term savings.

3. Impact on Bonuses & Incentives: If bonuses and incentives are tied to attendance or days worked, then LOP days will also relate to the decreased amount of bonus or incentive paid, resulting in reduced performance payout.

4. Change to Allowances & Insurance- Allowances such as travel or meals could also be affected if they are based on days when the employee worked. Moreover, employer sponsored insurance amounts could possibly be adjusted based on the employer's policy.

What are Some Alternatives to Loss Of Pay?

Employers may choose not to apply Loss of Pay and instead offer alternatives. These can include adjusting the absence against earned leave, casual leave , or compensatory off if the employee has worked extra hours or on a holiday. Some companies also provide options like leave encashment or leave donation from colleagues in genuine cases.

Other alternatives may include work-from-home arrangements or flexible start and finish times to manage absences. These measures focus on employee well-being while maintaining payroll accuracy and productivity.