The taxable allowance is added to your salary package, which is over and above basic pay, but is subject to income tax under the Salaries heading. These benefits, including house rent allowance, travel allowance, or medical allowance, may be 100% taxable, partially exempt, or even not taxed at all as is the case depending on the nature of the benefits and current tax laws. These allowances are highly important to the employees since they determine the gross salary value and the final tax to pay.

In 2025, the taxable allowances have increased in significance to a greater extent with the latest tax changes. The government has increased the tax-free threshold to 12 lakh and introduced a standard deduction of 75000, so it is important to determine which allowances lower your taxable income and which increase it. Proper planning will ensure that you fully utilise exemptions and deductions whilst still being by the book and complying with tax rules.

From a calculative view, employers tend to provide allowances, and then when it comes to taxation, it is treated according to income tax. For example, bonus amounts such as Dearness Allowance are fully taxable, whereas house rent allowance can be partially tax-exempt based on rent paid and the city where you live. Awareness of how each allowance is treated will enable employees to maximise net pay and lower tax liability. This blog explains about taxable allowances, as it further classifies them and, using the salary structure, how taxable allowances are calculated.

What is Taxable Allowance?

Taxable allowance is a financial advantage that an employer offers to a worker in addition to wages, fully or partially subject to income tax according to government requirements.

There are taxable allowances that constitute an essential part of the salary structure of employees. They are given to defray costs such as accommodation, transport, or other medical requirements, although this is not always tax exempt. Depending on the nature of the allowance, it can lower your taxable income or increase your tax bill.

The taxation of taxable allowances differs under the laws on taxation. For example, House Rent Allowance (HRA) might be exempted to the extent rent is paid but Dearness Allowance (DA) is not. This makes it important that the employees know which allowances are subject to tax and how they affect take-home pay.

With new and altered tax slabs and exemptions, in 2025, the taxable allowances take up an even larger part of financial planning. By clarifying the exempt allowances, it can be established that employees can reduce tax payments and make the best of their salary package.

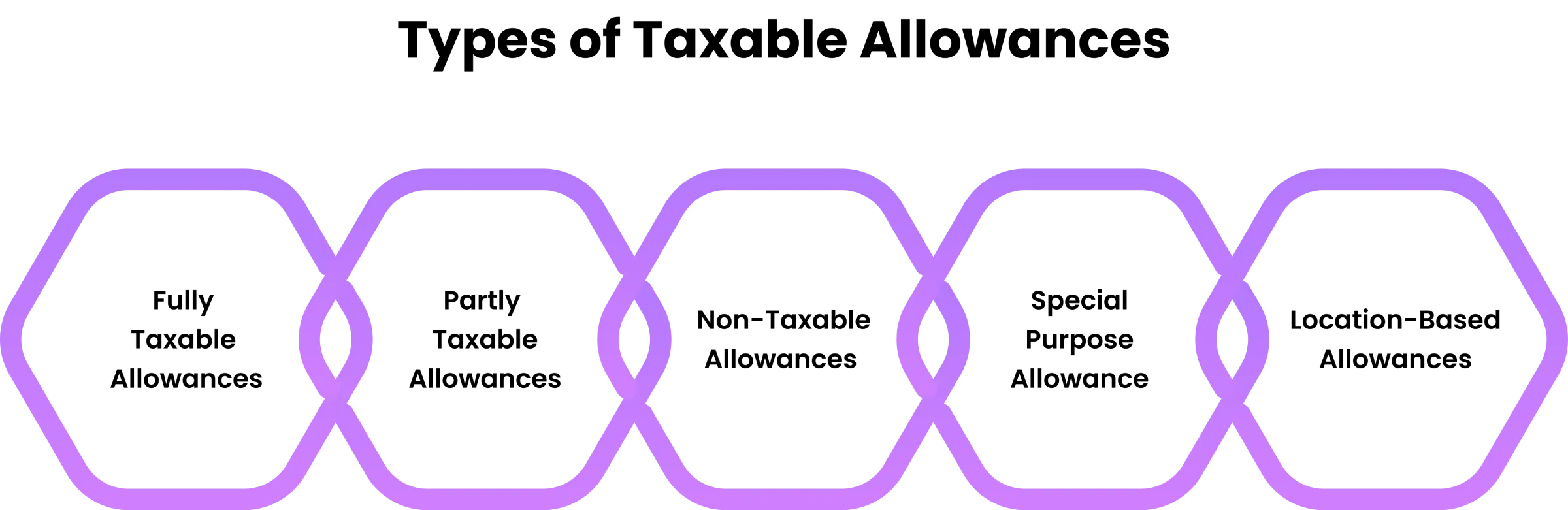

What are the Types of Taxable Allowances?

Taxable allowances are classified into different categories depending on their nature and purpose. Some are fully taxable, while others enjoy partial or complete exemption, significantly impacting an employee’s salary and tax liability.

1. Allowances Fully Taxed

These are fully taxable and directly add to your income. Taxable examples include Dearness Allowance, Entertainment Allowance, Overtime, City Compensatory Allowance, project and interim allowances, meals, cash, non-practising, warden or servant allowances.

2. Partly Taxable Allowances

Partially taxable allowances are HRA, medical, conveyance, and LTA. These are exempted subject to restricted levels, such as HRA exemption levels or fixed conveyance allowances. Any sum exceeding the stipulated exemptions is taxable, greatly affecting the net salary and overall tax burden.

3. Non-Taxable Allowances

Exemption, as per non-taxable allowances, relieves the employees fully. Examples are the allowances of government staff posted abroad, judicial compensatory or sumptuary allowances, and UNO employees’ remuneration. These allowances are not included in the taxable income or salary.

4. Special Purpose Allowance

These are given as special services or special assignments like research, academic projects, or special hardship assignments. Certain of these may be subject to exemption, but the others are to be taxed unless they are associated with reimbursements of actual costs incurred.

5. Location-Based Allowances

These exemptions apply to employees who work in areas that are either remote or difficult, e.g., hill stations, far-off areas; these allowances may be either partially or completely exempted as specified in the government notifications. Otherwise, they are accrued to taxable income and increase liability in the form of salary.

What Should Be Included in Taxable Allowances

Taxable allowances are allowances that are part of the compensation of the employees, and when added to the total taxable income, they will contribute to the total. Such allowances directly affect salary structures, net take-home pay and a lot more in terms of tax liability.

1. Bonuses

Bonuses are monetary incentives to employees to perform extraordinarily, meet objectives, or when a firm exists. They are taxable and part of the employee's gross salary computation because they are additional income.

2. Commissions

Commissions are on-demand compensation pegged to employees' sales or income. They are typical in sales positions and are added to the salary, and they will be ordinary revenue that will affect the tax stage of the employee considerably.

3. Overtime Pay

Overtime pay is an increment in the salary for time worked in excess of normal hours. Compensated at a premium rate above ordinary wages, it is taxable and adds to the aggregate gross income upon which it is taxed.

4. Expense Allowances

Expense allowances cover certain working expenses like transport, food and communication. If these are more than what the government has defined as exempt or fail to be reimbursed against actual bills, they are treated as gross salary and are liable to tax.

5. Fringe Benefits

Fringe benefits involve such perks as meals, vehicles or quarters. In other cases where they do not fall under specific exemptions, all these benefits are treated as taxable allowances, which will be included in the execution of the taxable income package of an employee.

How to Calculate Taxable Allowances?

1.Summing Fully Taxable Allowances

Any fully taxable allowances should be added to gross salary, including DA, entertainment, overtime, and city compensatory allowance. No deduction or relief is offered; hence the full personal allowance will be a deductible expense in each annual financial year.

2. Applying HRA Exemption

The criterion to determine HRA exemption is the comparison of three values: the actual HRA received, the rent paid less than 10% of basic salary, and 50% of basic and DA in metros (40% in non-metros). The lesser amount will be the tax notice; the rest will be payable from the tax.

3. Conveyance, Medical & LTA Adjustments

Some reliefs given to scholars, such as conveyance, medical reimbursement, and LTA, are partially lowered. You must deduct the fixed exemption of conveyance (1600/- per month), allowable medical reimbursement, or eligible LTA travel expenses. Any amount exceeding mandatory exemptions is considered taxable and an addition to an employee's income.

What Is the Difference Between Taxable Allowance and Non-taxable Allowances?

Taxable allowances are added to an employee’s income and taxed, like dearness or overtime allowance. Non-taxable allowances are exempt, fully or partly, as they cover specific needs such as travel or medical expenses. The main difference is that taxable allowances raise taxable income, while non-taxable ones provide relief.

| Allowance Type | Examples | Description |

|---|