Home / U / Universal Account Number

The Universal Account Number, or UAN for short, is an important way to identify all salaried employees in India who put money into the Employees' Provident Fund (EPF). The UAN was created by the Employees' Provident Fund Organisation (EPFO), and it is a 12-digit unique number that provides a permanent portable account for employees for their entire career. It also simplifies the management of Provident Fund (PF) accounts for employees when moving jobs to ensure that transferring and withdrawing PF accounts is easier and more transparent for millions of employees across India.

The UAN ensures that no matter how many times you change jobs, your PF contributions are consolidated under one account. This includes benefits from understanding what the Universal Account Number means, advantages of having a UAN, how to get a UAN account number, the UAN activation process, and benefits from using the unique UAN account effectively.

What is a UAN Number?

The UAN full form is Universal Account Number. It has a 12-digit number, which is unique, given by the Employees Provident Fund organisation (EPFO). The number is an identity for the entire life of an employee, irrespective of the number of employers.

The purpose of UAN is to eliminate multiple KYC and data-related processes for employees and provide a one-stop solution for all PF operations. The UAN links all employees’ PF accounts (Member IDs) from different organisations. The UAN system allows employees with direct access to their PF accounts to check their balance statements, download accounts, etc., and submit withdrawal or transfer requests online without depending on the employer.

Everyone only needs to take into account one basic truth to understand the significance of the Universal Account Number in the contemporary workplace: job-hopping is a typical occurrence as a result of the significant advancements in technology and globalisation. Employees find it essential to transfer PF funds from previous jobs to the current job, and this was previously a considerable pain point for employees. More importantly, the Universal Account Number has made the process of transferring PF funds easier. The Employees' Provident Fund Organisation data indicates that more than 290 million UANs have been allotted, making it central to managing the retirement savings of the formal workforce in India. The UAN promotes financial openness and transparency and gives employees more power over lifelong savings.

What Documents Are Required to Open a UAN?

To apply for UAN, certain Know Your Customer (KYC) documents are obligatory to validate the employee's identity and bank details. Therefore, it is important to take these slips, since they identify you and your account as a matter of security and verification.

1. Proof of Identity

Any state/government-issued photo ID would qualify. There could be an assortment of documents that would fulfil this requirement. For example, an Aadhaar identification card, PAN card, passport, driver's license, or voter ID card. All of the documents should bear your name and other such details that would be congruent with each other.

2. Proof of Address

There are some documents that are accepted as proof of address. This can be a recent utility bill, rent agreement, passport, or Aadhaar card. Proof of address is necessary to ensure the communication reaches the right individual from EPFO and all other concerned parties.

3. Bank Account Details

The employee's bank account number, IFSC code, and a cancelled cheque must be taken. This is to ensure that all PF withdrawals and claims are properly credited to the account provided, thereby ensuring that the funds transfer is secure.

4. PAN Card

You need to have a Permanent Account Number (PAN) in order to link it to your UAN. It is important to track personal finances, and for TDS (Tax Deducted at Source) to be calculated on PF withdrawal if the service is less than five years.

5. Aadhaar Card

The linking of the Aadhaar card with the UAN has become mandatory. Now it can smoothen e-KYC verification and help to smoothen the online submission of claims and other services for the employees. Now the employee can do all these activities efficiently and successfully.

How to Get a UAN Number?

Employees can generally get their UAN in two ways. The process is really simple & can be triggered either by the employer or the employee.

1. Via the Employer (Automatic Allotment)

Most employees will be automatically given their UAN when starting their first job with a PF-registered employer. The employer gathers KYC documents, sends them to EPFO, and EPFO generates the Universal Account Number. The employer will notify the employee of their new number, usually also placed on the employee's salary slip.

2. Generating UAN on Your Own (Online)

An employee may also choose to self-generate their UAN if the employer has not generated it. For this reason, an employee can go to the EPFO Member Portal. Select "Direct UAN Allotment" from the "Important Links" section of the main page. The individual filling in this form must enter their mobile number linked to their Aadhaar, submit the OTP received, and complete the form by providing PAN, bank details, etc.

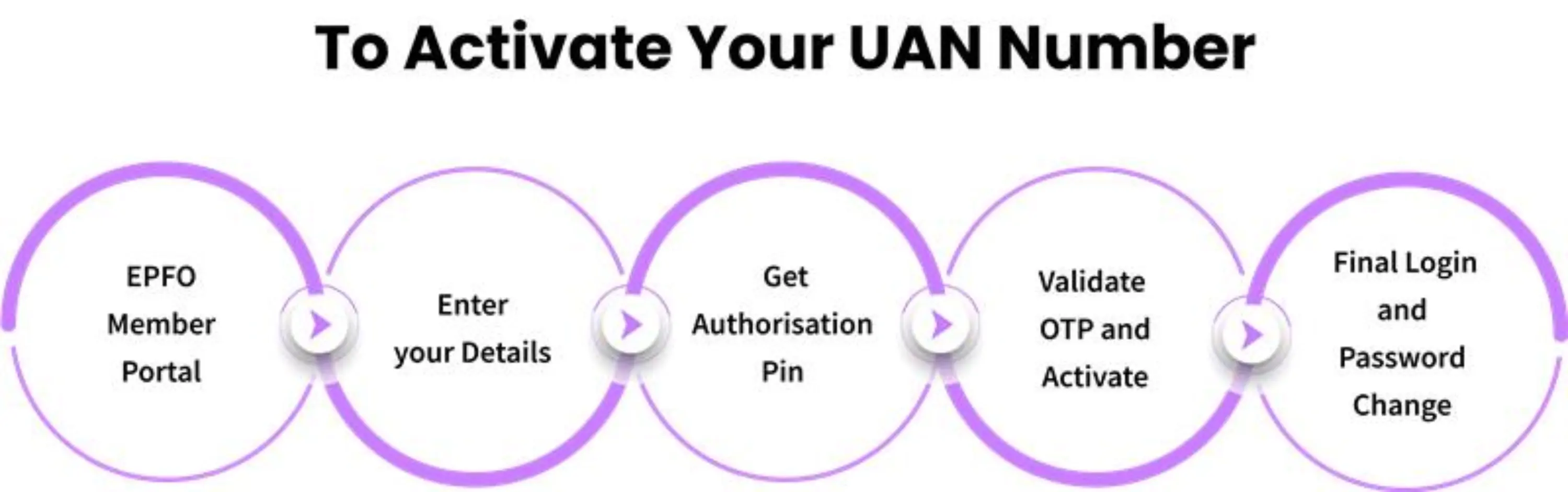

How to Activate Your UAN Number?

Once you receive your UAN, the next step would be to activate the UAN for online access to the PF services. Activating this will provide you access to ‘create a password’ for your account.

1. EPFO Member Portal

To turn on your UAN on the EPFO Member Portal, go to the official "EPFO Member e-Sewa portal" first. Once you're there, look for the "Important Links" section on the right side of the home page. To start the activation process, click on the "Activate UAN" link in this section.

2. Enter your Details

You will be directed to a new page where you will need to enter your UAN, Aadhaar number, name, date of birth, and mobile number. Make sure these details are the same as those with EPFO.

3. Get Authorisation Pin

After filling in all your details and captcha, click on "Get Authorisation Pin.” You will get a One-Time Password (OTP) on the phone number you gave us.

4. Validate OTP and Activate

To validate the OTP and activate your UAN, type the OTP you got into the box and click on Validate OTP and Activate UAN. On successful validation, it will send you a password to your mobile number for your account, and you will have an activated UAN. You can log in and change this password.

5. Final Login and Password Change

Once your UAN is active and you have your temporary password, use your UAN and the password you got to log in to the portal. For security reasons, you should change this temporary password to a strong, unique one.

How to Download Your UAN Card?

The UAN card is an official document that includes your UAN, name, and KYC status. It's a handy way to keep track of your permanent PF account number.

1. Log in to EPFO Portal

First of all, you have to log on to the EPFO Member e-Sewa website. Use your activated UAN and previously set up password for your account to access your personal dashboard and continue to download.

2. Locate "View"

Now that we have successfully logged into the dashboard webpage, you need to locate the main menu at the top of the page. Here, you should see the "View" option and click on that. From here, you will have a drop-down menu that will give you additional options related to your account details.

3. Select "UAN Card"

Once you have the drop-down menu, select the "UAN Card" option. This will take you to an entirely new page that has your own personalised UAN card. You will be able to see all your specific information and KYC status on the UAN card.

4. Download and Print

On the top right-hand side of your UAN card, it has a "Download" option. This will allow you to download the UAN card as a PDF file, which you can then print.

What are the Benefits of UAN to the Employee?

The implementation of the Universal Account Number has provided many benefits that give employees better control over their retirement savings, and it is more convenient.

1. Centralised PF Account Management

The UAN centralises all PF accounts related to an employee to a single number, which removes the burden of dealing with numerous accounts from past jobs. In this realm, an employee can see their total PF savings from all jobs, as well as their service history, all in one account.

2. Easier PF Transfers and Withdrawals

Once the UAN is activated and successfully KYC-integrated, transferring your PF if you change jobs can happen strictly online. Partial or full withdrawals are now also easier, which has greatly minimised paperwork and reliance on employers to cut checks.

3. Online Passbook Access

One of the main benefits of the UAN is that employees are now the direct holders of their EPF passbook online. The employee can view their own contributions and the employer's contributions month by month, and they can access this information at any time. The employee can also know where their money is and spend it with full transparency by looking at their own passbook.

4. Less Reliance on Employers

The UAN is now a permanent number given to people, which has made many PF-related services no longer dependent on the employer. It also allows the employee direct access to the EPFO portal, where they can update their personal information, interact with the claims, and keep track of their PF account.

5. SMS Alerts and Notifications Suggested Action

After the UAN has been activated for an employee, the member receives regular SMS alerts through their registered mobile number about monthly PF contributions made into their account. This keeps members informed, and they can raise an alert immediately if and when discrepancies arise.

Is the UAN and PF Number the Same?

No, the UAN and PF numbers are not the same. They are given for distinct purposes. A UAN is a permanent 12-digit number that an employee gets for the rest of their working life. It acts as your primary identifier that links all your different PF accounts. Think of it as a master key to your entire PF universe.

A PF number (also referred to as a Member ID) is created as an alphanumeric code assigned by the EPFO through an employer. The PF number is specific to employment with an organisation, so when you change jobs, your new employer will create a new member ID for you. Thus, during your career, you could have a number of PF numbers, but they will all be grouped back to a single UAN.