Retro pay, or retroactive pay, is extra pay given to employees after their pay has been underestimated or lagged behind schedule. It usually occurs because of increased pay, advancement or other changes that may not be included in previous paychecks. Retro pay corrects these discrepancies, and the employees are given what they deserve.

This type of remuneration is essential to payroll compliance and employee satisfaction. Retro pay is used by employers as a way to compensate for missed earnings of overtime pay, bonus, or delayed approval, hence ensuring that the compensatory practice is trusted and fair in workplace compensation. It also averts any possible conflict that might occur due to the inaccuracy of wages.

Beyond individual corrections, retro pay highlights broader payroll challenges. Most organisations can face a problem of manual errors or even delays in implementing the policy, necessitating the need to make retroactive adjustments. Payroll issues are better managed by understanding how retro pay operates and the difference between retro pay and back pay.

What is Retro Pay?

Retro or retroactive pay refers to the extra money paid to employees due to incorrect or delayed predetermined wages in past years. It guarantees equitable compensation for work done and salary increase, or promotion done or overtime changes not considered previously.

Retro pay is generally implemented when salary increases or promotions are back in time, but they were not implemented before the stipulated time. Employers offer this adjustment to pay the workers according to the updated compensation package.

The main reason retroactive pay is designed is to ensure accuracy and fairness in the compensation of the employees. It corrects pay imbalances, such as overtime pay, late bonuses or unpromotional pay raises, ensuring payroll compliance while building trust between the employer and employee.

In addition to personal remedies, retro pay assists an organisation in ensuring that it remains credible and complies with labour laws. Managing payroll errors early helps companies to minimise the amount of controversy, issues related to the law and keep their employees well motivated with clear and timely financial operations.

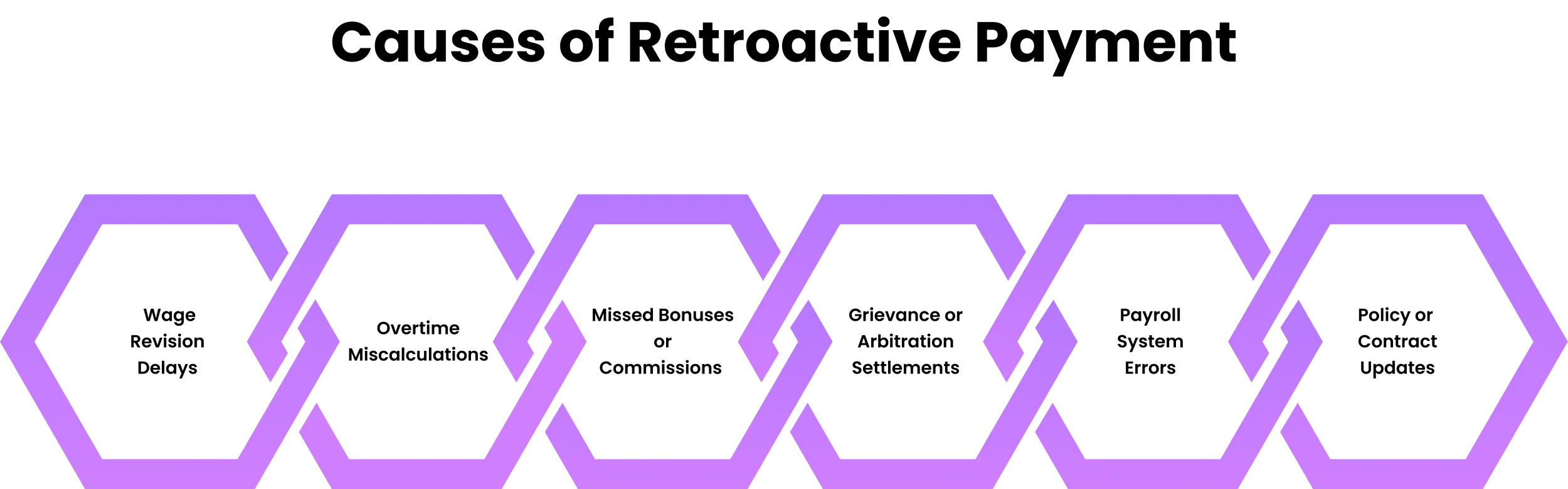

What are the Causes of Retroactive Payment?

Retroactive payment results from payroll errors, alteration of the policies or delayed approvals. Such cases require employers to revise the previous pay period to ensure employees are compensated correctly and fairly.

1. Wage Revision Delays

Retroactive payment is commonly found where a pay increase or promotion is approved and not enacted after the effective date. For example, when a raise effective in January is only effective in April, the employees will have to be paid retro pay to take care of the months not covered.

2. Overtime Miscalculations

Workers are not always compensated appropriately for overtime working hours. In case the overtime rate was under-calculated or even omitted, retro pay will guarantee that the difference in wage will be paid during the previous pay periods.

3. Missed Bonuses or Commissions

Performance bonuses or sales commissions are sometimes withheld or forgotten when the payroll is processed. Retroactive pay is used to correct such errors by giving an employee the amount owed in subsequent pay cycles to receive the amount that the employee deserved.

4. Grievance or Arbitration Settlements

Retroactive payment can also be provided due to a legal or workplace dispute resolution. In case arbitration or grievance procedures prove that an employee was underpaid in the past, the employer must pay the outstanding amount over the period.

5. Payroll System Errors

Sometimes, errors in payroll software or manual processing cause incorrect calculations of wages. Retroactive compensation is needed to clean up such system errors so that employees do not lose money due to system bugs or operator errors.

6. Policy or Contract Updates

Employees may be due adjustments when new policies, collective bargaining agreements, or government regulations are implemented retroactively. Retro pay means that these historical remuneration adjustments to salary structures or allowances are represented fairly in remuneration.

What are the Examples of Retroactive Pay?

Examples of retroactive pay can be used to demonstrate how salary corrections can be applied in practice. They demonstrate how the employees are paid once they receive their compensations at the end of previous payroll periods when they miss their raises, overtime , or bonuses.

Example 1: Promotion-Linked Salary Adjustment

For example, when an employee received a promotion in March and the increment took effect in January. The employer would then compute the difference between the old and new pay in January and February and make the difference in another paycheck later as retro pay.

Example 2: Overtime Correction

In the case of an employee who had to work overtime in April but was paid at the employee's normal hourly rate instead of the overtime pay, the employer has to pay back retro. This adjustment compensates for the underpayment and gives the employee the due overtime compensation.

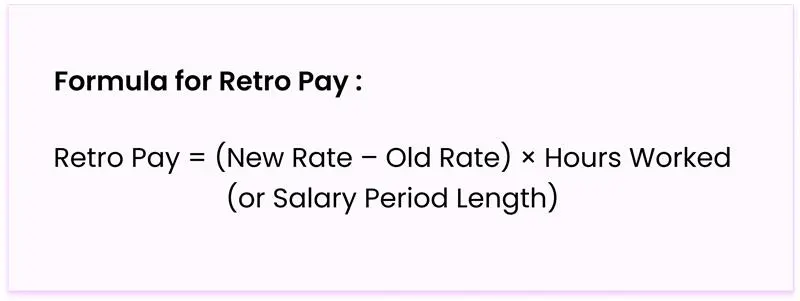

How to Calculate Retro Pay?

Retro pay calculation determines that workers are compensated the proper wages for the prior periods. It would involve comparison of old and new pay scales, identifying gaps and rectifying salaries to match fair pay in the applicable pay cycles.

Formula for Retro Pay

Retro Pay = (New Rate – Old Rate) × Hours Worked (or Salary Period Length)

For Hourly Employees-Stepwise Procedure (with detailed example)

Scenario used in these steps:

- Effective date: June 1 (raise should start).

- Payroll's pay raise was applied on July 1 (so June is the retro window).

- Old hourly rate = $20.00/hr

- New hourly rate = $23.00/hr

- Hours worked in June: 148 ordinary hours and 12 overtime hours (multiplier=1.5)

Step 1: Confirm Effective Date and Retro Window

- Action: Mark the date the new rate should have been used and find the exact pay period(s) that used the old rate.

- Example: The new rate is effective June 1, but the payroll ran at $20/hr for the entire June Pay Period --> retro window = June 1 - June 3

Step 2: Gather and Separate Hours Worked

- Action: Pull validated timesheets or punch records for the retro window and separate normal hours from overtime hours

- Example: June has a total of 148 regular hours and 12 overtime hours. Make sure you have these numbers on hand for the formula.

Step 3: Compute the Hourly Rate Difference

- Action: Difference between the old rate and the new rate. Rate difference = New Rate - Old Rate.

- Example calculation step-by-step: New Rate − Old Rate = $23.00 − $20.00 = $3.00 (rate difference)

Step 4: Apply the Formula to Regular and Overtime Hours

- Action: Compute the formula for regular hours and for overtime separately (recalculate overtime pay at the higher base).

Regular-hours retro: (New- Old) × Regular hours

- Calculation: $3.00 × 148

- Break down: $3 × 100 = 300; $3 × 40 = 120; $3 × 8 = 24 → 300 + 120 + 24 = $444.00

Overtime retro: (New − Old) × Overtime multiplier × Overtime hours

- First compute difference × overtime multiplier: $3.00 × 1.5 = $4.50

- Then multiply by overtime hours: $4.50 × 12 = ($4.50 × 10) + ($4.50 × 2) = 45 + 9 = $54.00

- Total retro gross = Regular retro + Overtime retro = $444.00 + $54.00 = $498.00

Step 5: Withhold Taxes, Record the Adjustment, and Pay

- Action: Treat the $498.00 as gross retro wages in the payroll run when you issue it. Withhold applicable taxes and benefit contributions per normal payroll rules, record the adjustment in payroll ledgers, and notify the employee of the breakout (regular retro, overtime retro, taxes withheld).

- Example Note: If payroll withholdings apply, the employee will receive net after those withholdings; keep both gross and net documented.

For Salaried Employees: Stepwise Procedure (With Detailed Example)

Scenario Used in These Steps:

- Effective date: May 1 (raise should start).

- Payroll applied the raise on July 1 (so May and June are retro windows).

- Old annual salary = $60,000

- New annual salary = $63,000

- Pay frequency = monthly (12 cycles per year)

Step 1: Confirm Pay Cycle and Retro Window

- Action: Determine payroll frequency (monthly/semimonthly/biweekly) and identify each pay cycle where the old salary was used.

- Example: Monthly cycles for May and June were paid at the old rate → affected cycles = May, June (2 full cycles).

Step 2: Compute Gross Pay Per Pay Cycle (Old Vs New)

- Action: Divide annual salary by number of pay cycles to get gross per cycle.

Example Calculations:

- Old monthly gross = $60,000 ÷ 12 = (60,000 ÷ 12) = $5,000.00

- New monthly gross = $63,000 ÷ 12 = (60,000 ÷ 12) + (3,000 ÷ 12) = 5,000 + 250 = $5,250.00

Step 3: Calculate Per-cycle Difference

- Action: Subtract old cycle gross from new cycle gross.

- Example: $5,250.00 − $5,000.00 = $250.00 per month

Step 4: Multiply By the Number of Affected Cycles (Or Prorate Partial Cycles)

- Action: Multiply per-cycle difference by fully affected cycles. If the effective date is in the middle of the cycle, prorate by the number of days.

- Example (Full Cycles): Per cycle variance x 2 months = $250.00 x 2 = $500.00 total retro gross

Example (Partial Cycle/Prorate): If the raise effective date was May 15 and payroll cycles are monthly, prorate for May:

- Days in May = 31. Days at new pay in May = 31 - 14 = 17 days (if include May 15)

- Prorated difference for May = Per-cycle difference × (17 ÷ 31) = $250 × 0.548387 ≈ $137.10 (round per payroll policy). Then add full months if any.

Step 5: Withhold Taxes, Record the Adjustment, and Pay

- Action: Include the amount of retro gross in the employee's next pay run; use normal tax withholding and benefit deductions; update payroll data and communicate with the employee regarding the breakdown.

Is Retro Pay Taxable?

Yes, retro pay is taxable to the fullest since it amounts to an employee as part of employee’s regular income. It is included with the cumulative income during the year it is paid and taxed like other aspects of salaries at the applicable income tax slabs.

What Does the Retroactive Pay Law Cover in India?

In India, retroactive pay laws provide for the fair payment of employees' wages when pay increases, government regulations, or collective bargaining agreements are instituted after a paycheck has been issued. This applies to matters such as wage increases which have been notified through government announcements, changes under revised minimum wages and arrears arising from updated recommendations of the pay commission.

It also applies to organisations that have introduced backdated salary increases under new employment contracts and settlement negotiations. Employers are required by law to pay this difference between old and new pay rates for the period in question, and the amount is required to be shown in payroll records with proper tax deductions. For example, an employee who has been paid an amount, but the adjustment is delayed in meaning but starts on a date earlier than when it would otherwise have been paid.

How is Retro Pay Different from Back Pay?

Retro pay and back pay are often confused, but they are related to different compensation issues. It is important to understand their differences in order to manage their payroll correctly.

| Aspect | Retro Pay | Back Pay |

|---|