Home / H / Human Resource Accounting

What is Human Resource Accounting (HRA)? Benefits & Methods

HRA or Human Resource Accounting is another crucial HR and financial concept through which the human capital of an organization is given a monetary value. It determines the value and cost of people as organizational assets, and this enables one to make informed decisions regarding the strategy to follow in hiring, training, and retaining people.

This concept came up in the 1960s and has increased immensely in importance. In the growing knowledge-based industries, the capability to evaluate and govern the value of human talent is a competitive asset. Organizations can also utilize the accounting principles by treating their human assets as assets and tracing their investment in these assets.

What is Human Resource Accounting (HRA)?

Human Resource Accounting consists of the identification, measurement, and reporting of the value of human resources as assets of organizations, so that management is able to make optimum decisions concerning the workforce that maximize the performance of the business and returns on the investment in human capital.

The initial step of the development of human resource accounting is the realization that human beings are the assets that help in the success of any organization. It resulted in the standard methods to measure their value.

HRA enables businesses to evaluate an employee in economic terms in terms of cost and value. This assists in planning the budget for training, workforce planning, and the analysis of HR programs. It also encourages openness with HR related investments.

The major objective is to include the valuation of human capital in the accounts of the organization in order to allow the decision-makers to coordinate the workforce policies with business objectives. It is that which fills the gap between HR and finance and enables talent to be managed as any other resource.

What Are the Key Objectives of Human Resource Accounting?

1. Valuation of Human Assets: Assigning a financial value to employees’ skills, knowledge, and experience ensures accurate financial reporting and resource allocation. This helps organizations recognize human capital as a key driver of long-term profitability and competitiveness.

2. HR Policies Decision Support: By evaluating the cost-effectiveness of HR initiatives such as training programs, employee benefits, and recruitment strategies, management can make informed policy decisions. This ensures resources are invested in programs that yield measurable business impact.

3. Increase Investor Confidence: Providing transparent and reliable data on the value of human capital demonstrates the organization’s commitment to growth. It helps investors see the strength of intangible assets, making the company more attractive for funding and partnerships.

4. Advance Resource Distribution: Detailed insights from HR accounting enable precise allocation of resources for talent acquisition, career development, and workforce expansion. This strategic approach ensures that investments align with future business needs and market demands.

5. Monitor HR Investments Overtime: Tracking training, development, and retention programs allows organizations to measure returns on HR investments. Continuous monitoring also highlights improvement areas, ensuring workforce performance remains aligned with evolving company goals

What Are the Features of Human Resource Accounting?

1. Appreciation of Employees as an Asset: Human resource accounting considers employees as an asset and not a cost. Companies have the potential to show the full extent of their value and long-term potential by appreciating their skills, their experience, and their contributions as organizational assets.

2. Valuation of Human Capital: HRA entails the use of systematic principles of human resource accounting to attach monetary value to the employees. It is an endeavor that assists the management in assessing returns on training, recruitment, and development, rendering workforce-related decisions more data-driven.

3. Connection to Financial Reporting: The process of HR accounting ensures that financial statements are aligned with the value of human assets. This will cause transparency among stakeholders to prove that the organization invests in its workforce and receives value out of it.

4. Ongoing and Live Process: HRA is not a single activity. This valuation will change with time in case of experience, upskilling, or a change of appointment by the employee. Consistency of updating makes the information current on the value and contribution of the workforce.

What Are Two Important Models of HR Accounting?

Cost-Based Model: This model focuses on quantifying all the expenses an organization incurs to acquire and maintain its human resources. It includes costs related to recruitment, onboarding, training programs, skill development, and other employee-related investments during their tenure. By measuring these expenses, businesses can assess the financial resources required to sustain their workforce and make informed decisions on budgeting and HR strategies.

Value-Based Model: This model measures the economic value employees bring to the organization by analyzing their contribution through productivity, creativity, innovation, and overall job performance. It evaluates how effectively human capital drives revenue, improves operational efficiency , and supports organizational growth. By doing so, it highlights the return on investment that employees generate and helps in recognizing high-value performers within the company.

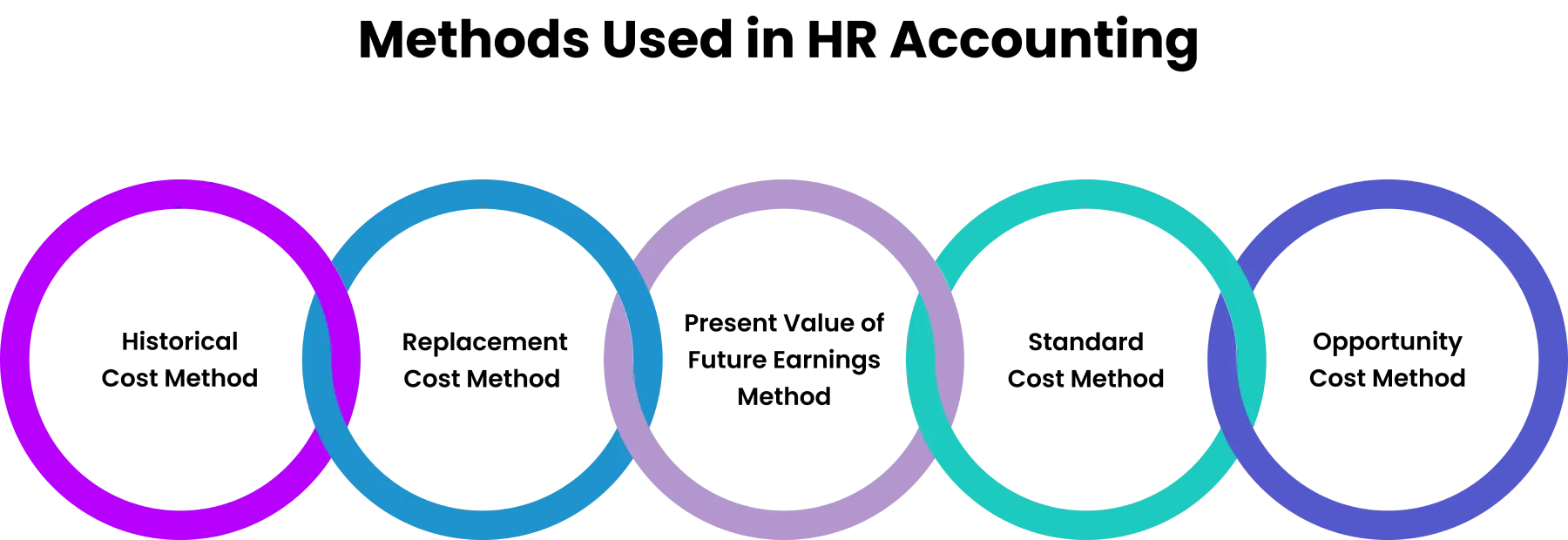

What Are the Different Methods Used in HR Accounting?

1. Historical Cost Method: Records the actual expenses incurred for hiring, training, and developing employees. It provides an accurate historical record of investment in human resources.

2. Replacement Cost Method: Calculates the estimated cost required to replace an existing employee with another of similar qualifications and experience. This helps in understanding the current market value of talent.

3. Present Value of Future Earnings Method: Determines the present worth of the future earnings an employee is expected to generate during their employment. This approach values employees based on their long-term contribution.

4. Standard Cost Method: Sets predetermined costs for different employee roles to simplify budgeting and cost control. This ensures uniformity in evaluating human resource expenses.

5. Opportunity Cost Method: Estimates the value of employees based on the potential loss if they were not employed in the organization. It reflects the economic opportunity missed without their services.

What Are the Steps Involved in the HR Accounting Process?

1. Identification of Human Assets: This step involves recognizing the employees or groups that significantly contribute to organizational goals. It requires assessing their skills, expertise, and roles to determine their strategic value.

2. Selection of Valuation Method: Once the key human assets are identified, organizations must choose the most suitable HR accounting method. The choice depends on available data, the purpose of the valuation, and the nature of the workforce.

3. Data Collection: Accurate valuation requires comprehensive data collection on various employee-related factors. This includes salaries, benefits, recruitment expenses, performance metrics , productivity levels, and training costs.

4. Valuation and Recording: In this stage, the chosen HR accounting method is applied to calculate the monetary worth of employees. The results are systematically recorded in the organization’s reports, ensuring transparency and consistency.

5. Reporting and Review: The final step involves integrating the HR asset valuations into both financial and HR reports for internal and external use. Organizations should also periodically review and update these valuations to reflect changes in employee roles, skills, or market conditions.

What Are the Benefits of Human Resource Accounting?

- Improves Decision Making: Enhances managers’ ability to make data-driven decisions by integrating HR metrics with financial data. This ensures choices are backed by concrete evidence rather than assumptions.

- Boosts Transparency: Clearly communicates the value and investment in human capital to stakeholders. This openness helps build trust and ensures everyone understands the contribution of employees to business success.

- Enhances Talent Management: Provides detailed insights into high-performing employees, making it easier to design retention strategies. This ensures organizations can nurture and retain their best talent.

- Strengthens Strategic Workforce Planning: Aligns HR investments with the company’s long-term objectives. This allows businesses to plan for future skill needs and workforce changes effectively.

- Increases Accountability: Promotes responsible management of human resources by setting measurable performance benchmarks. This ensures HR practices are aligned with organizational goals.

- Supports Cost-Benefit Analysis: Helps in evaluating whether the returns from HR initiatives justify the investment. This aids in prioritizing strategies that deliver the highest impact.

What Are the Limitations Involved in Human Resources -Accounting?

- Valuation Challenges: Talents, skills, and employee potential are often intangible, making them difficult to measure in financial terms. The lack of clear metrics leads to inconsistent valuations across organizations.

- No Standardization: There is no universally accepted or standardized procedure for valuing human resources in HR accounting. This inconsistency makes it challenging to compare data across companies or industries.

- Subjectivity: The estimation process often depends on the judgment of the evaluator, leading to variations in results. Different assessors may apply different criteria, which can impact accuracy.

- Non-Monetary Value: Human Resource Accounting may overlook qualitative aspects like employee morale, workplace culture, and job satisfaction. These elements, though intangible, can significantly influence productivity and retention.

- Cost of Implementation Setting up a human resource accounting system can be expensive, as it involves extensive data collection, verification, and analysis. For many organizations, these processes can be both time-consuming and resource intensive.