A salary advance means receiving a portion of your salary ahead of your regular payday. Salary advances are typically offered by employers as a way to help an employee cover unexpected costs such as a medical expense, travel expense, or family emergency. A salary advance is different from a personal loan because it is typically easy to get, generally interest-free, and deducted from the employee's next month's salary. Salary advances are useful if you need to cover short-term costs quickly and without stress.

Companies, typically due to the desire to ensure fairness, will set up a salary advance policy. The salary advance policy usually articulates who can apply, the amount of the advance, the terms of repayment, and the authorisation needed. This safeguards any employees using a pay advance, limits abuse by employees and sets out clear guidelines for the employer to follow. More importantly, it builds trust and confusion between employees and management is minimised.

For tax purposes, a salary advance is not separately taxable since it is part of the salary. However, salaried individuals may be required to file for advance tax because they have extra income that is not part of their job. Even a salary advance offers many benefits, such as better access to money, it comes with some costs (for instance, your next month's salary will be reduced). Salary advances may be smaller in amount than a personal loan. Salary advances are always much faster than personal loans. Generally, salary advances have no interest, compared to a personal loan, where you will be charged interest and the repayment will take longer.

What is a Salary Advance?

A salary advance is an employer-issued payment taken out of an employee’s future salary before they are officially paid. It is typically used to fulfil an urgent financial need, such as unexpected medical costs, travel needs, or sudden individual purchases.

The point of a salary advance is to help employees with quick financial needs when employees find themselves in certain situations where the delay of the next payday could create hardship for them. Taking a salary advance means the money comes out of the employee's next payment, which keeps employees from relying on banks, financiers, or other lenders for cash.

Salary advances are valuable since they typically have no interest, involve relatively little paperwork, and require easy approval from your employer. From an employee perspective, it helps relieve financial burden, while from an employer perspective, it generates trust and loyalty within the workforce.

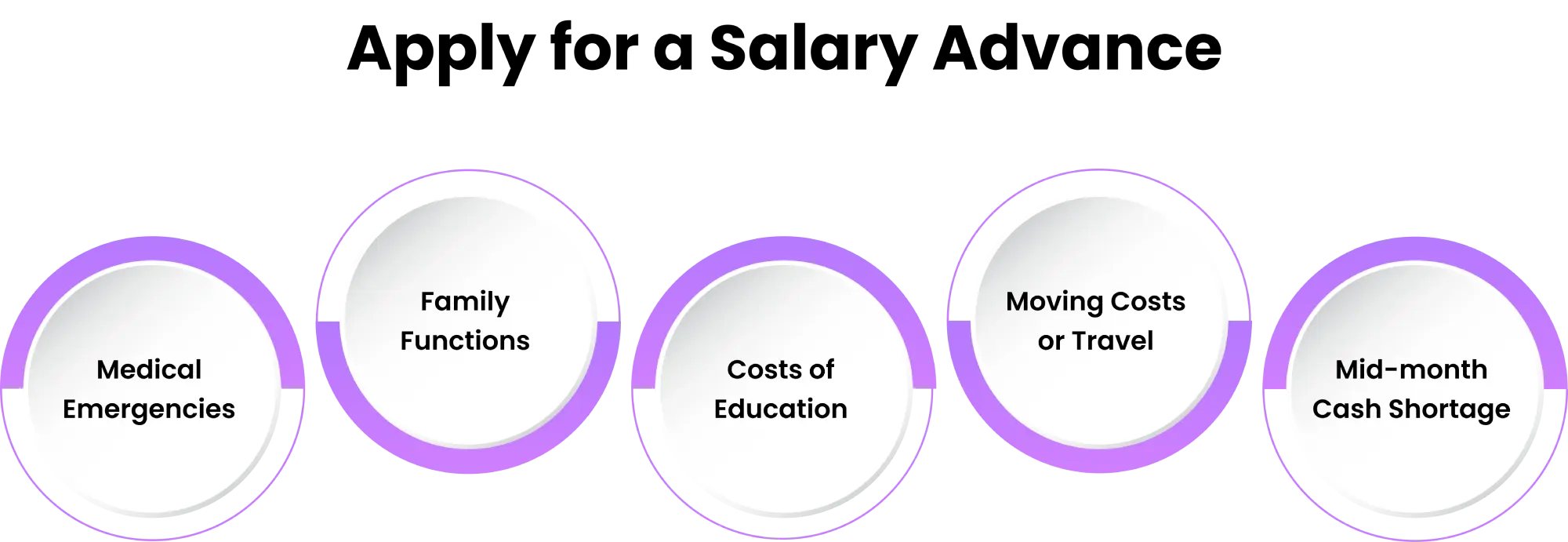

When to Apply for a Salary Advance?

Applying for a salary advance should be done only in genuine situations, like good and bad scenarios, where you need urgent financial help. It's important to use this option to limit undue financial pressure that may arise down the road.

1. Medical Emergencies

Salary advances are most beneficial when an employee encounters sudden medical needs such as hospitalisation, medication, or treatment expenses involving out-of-pocket costs. A salary advance gives employees the opportunity to address their immediate health costs rather than having to wait for payday.

2. Family Functions

Occasional situations occur when employees make a request for an advance to manage expenses related to weddings, festivals, birthdays, or other family gatherings and events. A salary advance allows employees to meet large expenses for each particular event without creating debt by taking out personal loans.

3. Costs of Education

Employees can ask for a salary advance when they have education costs such as school or college fees, educational materials costs, and admission-related costs. A salary advance is designed to help employees get an education-related payment on time and not worry about how they pay for costs related to their education.

4. Moving Costs or Travel

If employees have emergency travel or moving costs that come up unexpectedly, a salary advance can assist employees with getting cash and not having to borrow if needed. It will relieve stress for the employee, so they can feasibly move or travel with some cash from their pay.

5. Mid-month Cash Shortage

In the case of having a cash shortage caused by expense overruns exceeding income, employees may want to apply for a salary advance so they can make it to the next date for salary. This is a great support for employees who do not want to borrow money or incur civic late fees through borrowing.

Do Salaried Employees Need to Pay Advance Tax?

Most salaried employees do not need to worry about paying advance tax separately because their employer already deducts TDS (Tax Deducted at Source) from the monthly salary they pay to that employee. The deduction of TDS from their monthly salary covers the employee's income tax liability, which means they will not have to pay their income tax in advance.

If the employee has some other income apart from their salary, such as rent, business profits, interest, or capital gains, and their total tax liability in the entire financial year (after taking TDS into account) is over ₹10,000. The employee needs to make an advance tax payment.

Then that employee will be required to pay advance tax according to the guidelines. This advance payment is generally made as per the guidelines of the Income Tax Department.

What are the Pros and Cons of a Salary Advance?

Salary advances can be a great financial option during times of urgency, but similar to any option, there are pros and cons to consider. Knowing the pros and cons will help employees make an informed decision before applying.

Here’s a simple comparison:

| Pros of Salary Advance | Cons of Salary Advance |

|---|

What Should Be Included in the Salary Advance Policy?

A salary advance policy is a good way to create specific rules and rights and also provide clarity around the responsibilities and rights of employees and employers. It helps eliminate misunderstandings and ensures that salary advance requests are treated equally and consistently each time.

Here are some of the important elements of a salary advance policy:

1. Eligibility Criteria

The policy should specify who is entitled to apply (for example, permanent employees, employees who have passed their probation period, or employees with no records of performance-related or workplace/disciplinary-related progressive discipline). This will ensure only reliable employees, who can be trusted to pay back the advances, will have access to advances.

2. Purpose of Advance

The policy should specify that advances are for legitimate needs (medical needs, education, emergencies, etc.) and not used to supplement normal monthly expenditures. This will eliminate employees being dishonest with administrators regarding the need for advances and will ensure the advance window is open for employees with true needs.

3. Repayment Method

The policy should indicate how the advance will be repaid. The employer will normally indicate some automatic deduction from future earnings or repayment in instalments as previously agreed. This will clarify any issues and disputes in the future on how the advance is to be repaid between the employee and employer.

4. Maximum Limit

The salary advance policy should include a maximum amount the employee can borrow, which is normally equal to their base salary for one month, or it could be a fixed amount determined by the company. If no maximum is applicable, employees may borrow too much, and this would not be fair or be responsible for the company's financial well-being.

5. Approval Process

The salary advance policy should outline how the employee seeks approval by establishing who the employee requests approval from, such as HR-related matters go to HR, financial matters go to finance, and workplace matters go to the reporting manager, or it may be determined by the nature of the request. The salary advance policy should include this approval process so that it is fair to all employees and is done transparently, eliminating confusion and ensuring accountability for the actions taken.

How is a Salary Advance Different from A Personal Loan?

A salary advance is a form of short-term financial assistance provided by the employer, whereby the employee can receive a portion of their upcoming salary in advance. A personal loan is a loan taken out from a bank or financial institution with interest charges, EMIs, and is repayable over an extended period of time.

There are no eligibility checks, documentation, or credit score checks for an advance salary, unlike a personal loan. Though both a salary advance, and a personal loan provide financial support, they are very different in purpose, process, and repayment. Here’s a simple comparison:

| Aspect | Salary Advance | Personal Loan |

|---|