What is a Muster Roll? Definition, Importance, Types & Benefits

Muster roll assists employers in keeping track of labor and assists with wage distribution, especially in labor-intensive industries. Also, it serves as a record of attendance, hours worked, together with information related to the wages paid.

If you are working in industries where an accurate muster roll used for payment of labor is a legal requirement (i.e., construction, government contract, factories, economic development, and infrastructure), it is absolutely critical that you know the muster roll format, contents, and how muster roll differs from an attendance register.

Becoming familiar with the muster roll enables you to not only support legal compliance, moving you forward to more efficient operational delivery; let’s explore its definition, types, significance, advantages, and more.

What is a Muster Roll?

A muster roll is an official document used to record the daily attendance of employees, especially laborers, including their working hours and wages. It helps in ensuring accurate payments and is a key requirement for compliance under the Lop(Loss of Pay) system.

The primary purpose of a muster roll is to provide a transparent and verified log of all employees working on a project or in an organization. It is typically used in public works departments, construction firms, and government-funded labor schemes.

The muster roll draft record of attendance does not merely capture presence and absences; it indicates length of time working, leave status, and wages paid. A muster roll serves as proof of existence for temporary or contract workers and can help employers with accountability for wage payments.

In a number of jurisdictions, labor laws may require a muster roll form to be used in an audit/inspection setting. Inaccurate information in a muster roll form can carry possible penalties in labor law or disputes regarding payment of wages.

Why is the Muster Roll Important?

The muster roll is essential for the following reasons:

- Ensures timely and fair payment of wages, particularly to laborers who are paid on a daily or hourly basis.

- Helps in labor law compliance by maintaining accurate records, which are subject to audits and inspections.

- Supports transparency in payroll management, especially in government or public-sector funded projects.

- Acts as legal evidence in case of any wage disputes or employment verification.

- Plays a critical role in calculating Loss of Pay (LOP) or leave deductions based on actual workdays.

Who Typically Uses Muster Rolls?

Muster rolls are typically used by industries that manage large, labor-intensive, or frequently changing workforces. This includes sectors like construction, manufacturing, agriculture, and maritime operations, where it’s essential to maintain accurate records of employee attendance , work hours, and wage calculations. These records help ensure accountability, simplify payroll processing, and support legal compliance. The military also uses a version of the muster roll to document the presence and details of its personnel, although the structure and terminology may differ based on the branch and country.

What are the Different Types of Muster Rolls?

1. Daily Muster Roll: A daily muster roll is used to document and record the daily presence and working hours of workers who are working under a daily wage staff or a temporary position. Daily muster rolls are updated every day and are intended to keep a daily record that will be accurate and indicate the current presence of each worker as of that day. The idea is to ensure that all workers receive timely and correct payment, specifically a daily wage for attendance.

2. Weekly Muster Roll: A weekly muster roll records attendance, records, and calculations for up to one week. In most cases, a weekly muster roll is used when the workforce is in or has completed only short-term periods or rotating workers. A weekly muster roll simplifies the payroll process by compiling attendance information over a week and ensuring that both attendance and compensation allocations have been captured in an organized fashion.

3. Project-Based Muster Roll: A project-based muster roll is maintained for the length of time a project is ongoing and will account for the attendance of workers. A project-based or one-project muster roll is typically applied to larger projects, depending on the nature of the work. For example, a construction project , roadwork, or large-scale social infrastructure project, a project-based muster roll lends itself to monitoring how many workers are available at any given point, how costs can be managed, and liability to account for the workers' attendance.

4. Electronic Muster Roll: An electronic muster roll is the electronic alternative to manual muster rolls and is often managed through HR or workforce management software. The electronic mustering roll can result in the accurate, real-time tracking of employee attendance with less manual data entry, leading to fewer mistakes. Also, electronic muster rolls can be easily integrated with payroll, allowing for automated salary calculations and improving administration.

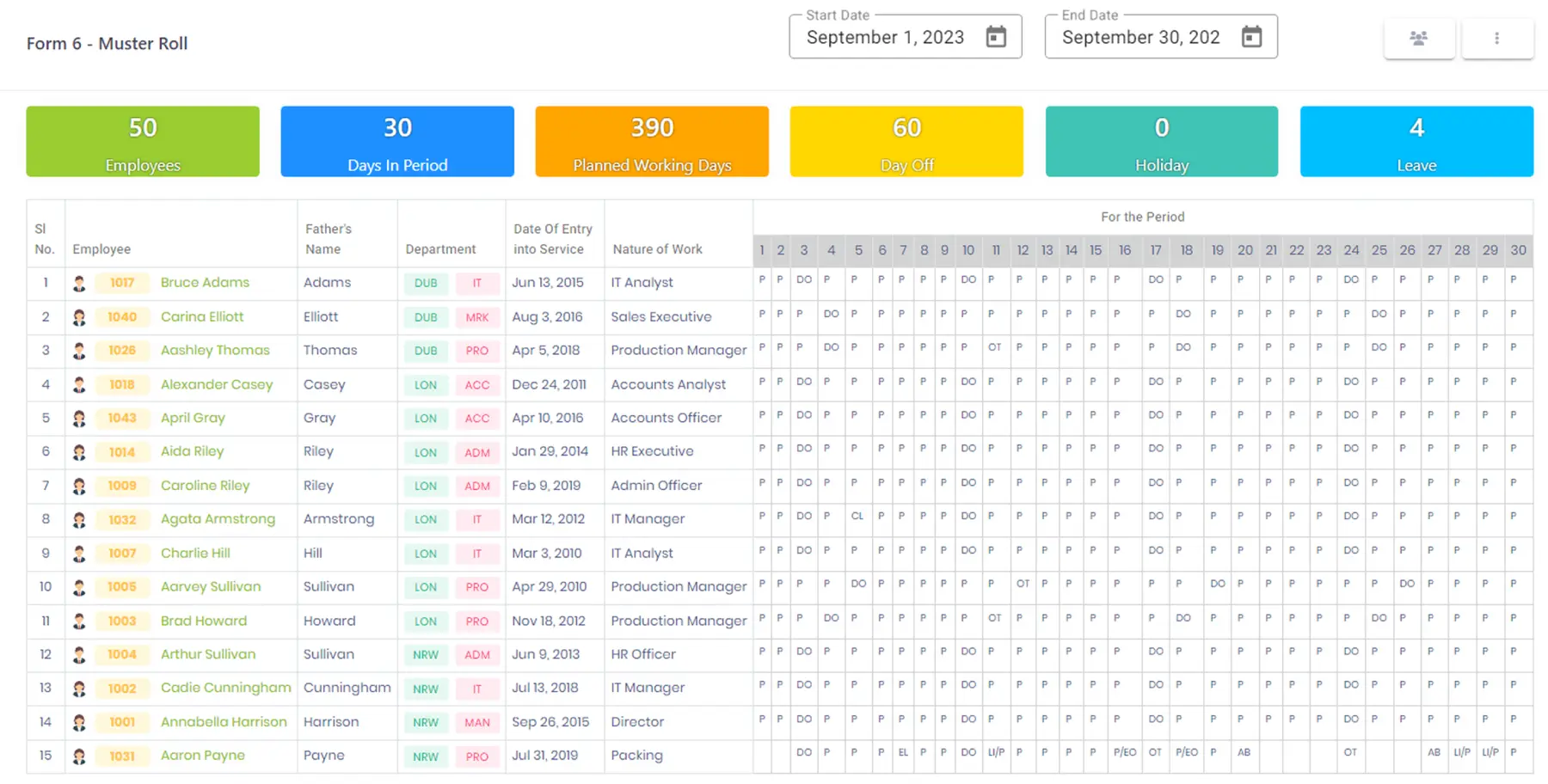

What are the Key Contents of a Muster Roll?

1. Employee Details: This section contains important identification and employment particulars for every employee, including their full name, unique employee ID, job title, department in which the employee is employed, and the official date the employee was engaged in employment. These particulars are used to maintain the proper records and ensure that employees' time and payroll information is associated with the appropriate employee.

2. Date and Work Duration: This section of the muster roll contains the particular dates on which the employee worked and how many hours or shifts were worked each day. Accurate knowledge of dates and duration of work is very important for determining wages, productivity, as well as proper management of shift work.

3. Wage Rate: The rate of pay section communicates contracted pay details for an employee that will be on an hourly, daily, or per-shift basis. With this information, an employee's total compensation can be calculated by the actual attendance report and wage history for the period for each employee in the muster roll.

4. LOP (Loss of Pay) Status: The loss of pay (LOP) status indicates whether an employee was absent or on leave without pay on a given day. If it is marked, it changes the pay calculation by not paying the employee for those days or hours lost, and offers a clear, pre-defined way of making deductions on salary or attendance-related decisions.

5. Signature/Verification: At the end of the muster roll, there will be a signature of a supervisor, a manager, or other authorized person who verifies the entries. This signature acts as an authorizing signature for verification on the attendance and payroll data collected. It is responsible and transparent when dealing with payroll processes and potential disputes, discrepancies or financial responsibility.

How to Maintain Employee Muster Roll Effectively

1. Use a Standardized Format

Using a standard muster roll format to collect attendance data that is recognized by all applicable government representatives will allow for consistency in the accurate recording of time at the workplace. Inaccurate attendance records can have repercussions and consequences during audits, inspections, and reviews of the official attendance records, and penalties for mistakes or discrepancies can still occur. Not only does a standard format assist with being consistent, but it will also assist with reading and understanding the muster roll by having it in the same manner for the different departments or groups.

2. Ensure Daily Updates

To ensure accurate and reliable attendance records, the information on the muster roll needs to be updated every workday, and this is best accomplished at the end of the shift, so everything can become current, and it is less likely that an entry will be missed. Additionally, it will be beneficial for verifying workforce productivity for that particular day's work and for determining labor resources.

3. Cross-Check with Attendance System

Finally, a cross check/verification of the muster roll with attendance recorded either in an attendance system (like biometric systems ) or a manual attendance sheet is a good idea to not only verify the muster roll as accurate, but to verify the records that exist in an attendance system. This will help in identifying inconsistencies, preventing fraudulent entries, and bolstering overall reliability of the attendance records. Follow-up on this process will also provide greater transparency and trust of workers with management.

4. Digital Attendance Records

Maintaining a digital copy of the muster roll, in addition to physical records, provides significant advantages in terms of storage, accessibility, and data security. Digital records are easier to back up, search, and share when needed, ensuring that important information is not lost or damaged over time.

5. Ensure Compliance

Always follow relevant local labor laws and official guidelines when maintaining muster rolls, especially if they are used for processing labor payments. Compliance ensures legal protection for the organization, avoids potential penalties, and guarantees that workers are compensated fairly and in accordance with the law.

Legal Requirements:

For example, under the Contract Labour (Regulation and Abolition) Act, 1970, the muster roll is a legally mandated document in India. This includes retaining the muster roll for a specific number of years and allowing access during labor inspections.

What are the Benefits of a Muster Roll?

1. Accurate Wage Calculation

Muster rolls provide an accurate account of each worker’s daily work patterns (hours or days actually worked) and allow wages to be calculated based on the actual work performed. This ensures workers are paid the correct amounts and prevents overpayment or underpayment of wages. It also creates an environment of fairness and accountability for determining how wages are paid.

2. Legal Compliance

Muster rolls help organizations comply with the requirements of labor laws or government regulations. By keeping proper muster roll records, it will be easier for organizations to provide evidence of compliance to inspectors, instead of having to deal with fines, penalties, or legal action later for lack of compliance. In the event of a work-related employment claim, muster rolls can also provide a legal defense.

3. Transparency in Payments

When accounts of attendance and work undertaken are well organized in a muster roll, a clearer and more transparent payment process is created. This decreases misunderstandings and wage-related disputes between employers and workers, thereby fostering a healthier employer-employee relationship .

4. Fewer Manual Errors

When a standard format for muster rolling is used, there is less chance for errors to happen in attendance or payroll data recording. By having robust data entry standards (and consistent data entry), muster rolls make it much easier to send accurate payments out to workers in much less time (and maybe with less cost).

5. Easier Project Audits

For projects, and specifically construction projects or projects funded by government agencies, verified muster roll records are useful documentation of the actual deployment of labor. In terms of audits, it makes it easier to conduct audits because repayment serves as clear proof that the work was completed, wages were paid, and all required compliance checks were fulfilled.

6. Builds Trust with Workers

Accurate and reliable recordkeeping conveys to workers that an employer values fairness and transparency and would build trust between workers and contractors. If workers see and know their attendance, wages, etc., are being documented honestly, it gives the worker greater motivation to be loyal.

7. Validates Government Schemes

For many public welfare schemes, such as MNREGA or other rural employment schemes, muster rolls provide useful documentation to authenticate beneficiaries and validate the actual labor provided against the muster rolls. They also help with verifying payments are made to eligible workers and protect against fraudulent payments and help to ensure schemes are achieving their intended outcomes.

How Muster Roll Differs from Attendance Register

While both are used to record attendance, the muster roll is more detailed and is often used for wage calculations, legal compliance, and government reporting. Here's how they differ:

| Feature | Muster Roll | Attendance Register |

|---|