Home / L / Labour Welfare Fund

Labour Welfare Fund: Meaning, Contribution & Payment [2025]

Labour Welfare Fund (LWF) is a statutory fund set up by each state government in India to promote the well-being and improve the standards of living of a worker. LWF provides for social security and welfare cases, such as medical facilities, housing, education, nutritious food, recreational facilities, and financial assistance to the workers, like scholarships, pensions, etc.

Contributions to the LWF are obligatory for both employers and employees, and the rate of contributions is determined initially by the state Labour Welfare Board. Contributions are also required to be paid on a monthly, half-yearly or annual basis, and interest is given by the concerned LWF Board. In some states, the government also contributes to the fund. The scheme particularly applies to the workers of establishments such as factories, mines, plantations and others involved in any commercial activity, in order to improve their welfare and working conditions.

Although it is beneficial for a company and also possibly helpful to the employees, there is still a lack of knowledge among many employers and employees with regard to the provision and benefits offered by this fund. Hence, it is vital that employers fully understand the LWF regulations and compliance with labour laws to maintain job satisfaction and employee satisfaction. By contributing to the labour welfare fund, organisations play a key role on behalf of workers, improving workers' welfare, strengthening workforce morale and ensuring robust social security is in place and thus imperative to India's labour ecosystem.

What is the Labour Welfare Fund (LWF)?

In India, the Labour Welfare Fund (LWF) is a statutory fund established by the government to promote the welfare and well-being of workers. The Labour Welfare Fund was created under the Industrial Disputes Act, 1947. It provides for the welfare of employees through monetary assistance and essential facilities such as healthcare, education, housing, entertainment, and retirement support.

The Labour and Welfare Fund Act apply to the welfare of industrial and unorganised workers by securing their health care, education, housing, recreation, and retirement benefits. Its scope is intended to improve the standard of living of workers, improve social security, and improve relations with employers and employees.

The Labour Welfare fund aims to enhance standards of living, provide social security and promote better living conditions for workers. The employer and employee contributions to the Labour Welfare Fund (LWF) are required for all states. The contribution amounts are decided by the respective State Labour Welfare Boards, and payment timelines can vary by state, such as monthly and half-yearly or yearly. In addition to these contributions, some state governments also contribute to the Labour Welfare Fund. The Labour Welfare fund is also funded by some state governments.

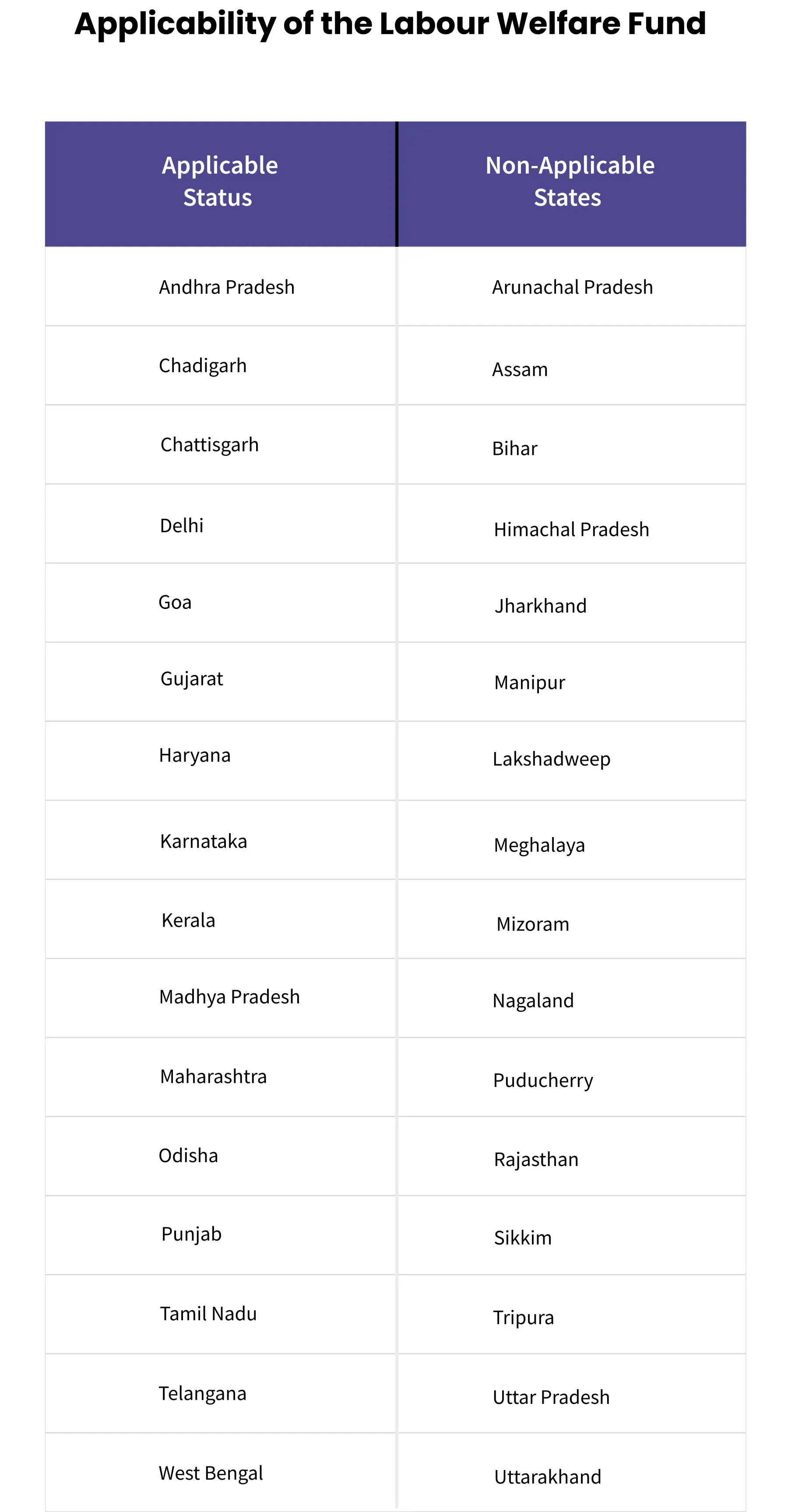

Under the Labour Welfare Fund Act, employees in factories, mines, plantations, and other commercial establishments have the right to welfare benefits, which should be made available to all eligible workers in an efficient manner. The Labour Welfare Fund (LWF) is a federal minimum program with state-level administration, but it is not administered by all states. LWF regulations exist in only about 16 states, and whether the LWF applies to a worker depends on the type of industry: factories, shops, plantations, and transport, the number of employees employed by the employer, and the classification of the workers. Generally speaking, non-managerial or supervisory employees are usually covered, while managerial or higher-paid employees are usually not included.

What is the Applicability of the Labour Welfare Fund?

The Labour Welfare Fund Act does not cover every employee in an establishment. Its applicability depends on factors such as the wages earned and the role or designation of the employee. In addition, organisations need to consider the total number of employees before applying this act, as the required count varies from state to state.

Since each state has its own Labour Welfare Fund rules, the applicability may differ across regions. Some states have made it mandatory, while others have not adopted it at all.

Below is the table showing the states where the act is applicable and where it is not.

What an Employer Must Do to Comply With LWF?

- Employers have to first register their company or establishment as an entity under the LWF Act (where applicable for their state), to become legally recognized under the scheme.

- Employers have to regularly pay their share of the contribution to the fund, in keeping with the rules of the state.

- Employers are responsible for deducting the employee's share directly from an employee's salary or wages and are to keep proper records of this.

- The overall contributions (both employer and employee) need to be paid to the Labour Welfare Board by the relevant deadline, in accordance with the arrangements which the state establishes (monthly, half-yearly, or annual).

- Employers must file the required returns in the prescribed forms, which are designed to demonstrate compliance. Employers must file their returns carefully to avoid possible penalties.

How Does the LWF Scheme Work in Different States?

| State / UT | Applicability | Employee ₹ | Employer ₹ | Frequency | Due Date(s) | Compliance Form / Notes |

|---|

How to Register for the LWF Scheme?

Step 1: Determine Applicability: Employers must first verify that the Labour Welfare Fund Act is applicable to their state, as rules and contribution rates in India differ from state to state.

Step 2: Gather Documents: Gather documents, including certificates of establishment registration, employee particulars, and proof that the business is actually operational.

Step 3: Apply for Registration: Employers should apply for registration with their respective State Labour Welfare Board. Applications may be submitted online via the state's official portal or offline in person at a designated office. Employers are also required to provide the prescribed documents and information set out by the state rule with their application.

Step 4: Receive Registration Details: UOnce approved, an employer will receive registration details and must utilise this for return form filing and contributions under LWF.

How to Make LWF Payments Online?

Employers can submit Labour Welfare Fund (LWF) contributions online through the portal of the State Labour Welfare Board. After logging in using registration details, they will fill out the employee and contribution details before completing the payment via net banking, debit card, or available online modes before the due date.

What Are the Penalties for LWF Non-Compliance?

1. Monetary Fine: Employers failing to make contributions to the Labour Welfare Fund (LWF) or failing to make mandatory contributions in a timely manner is subject to a monetary fine. The fine amount will differ from state to state but is generally limited to ₹5,000.

2. Imprisonment: Further, an employer may be subject to a term of imprisonment if the employer wilfully defaults on the LWF contributions or has knowingly avoided making LWF contributions. Imprisonment can extend up to three (3) months depending on the seriousness of the default.

3. Very High Interest: Any delay in depositing their contributions makes employers liable for interest. Interest payable by the employer for late contributions can be extremely high in certain states (at a maximum of 25% annual interest).

4. Tax Disallowances: If the LWF provisions are not complied with, disallowances of certain allowances and deductions will occur when computing taxable income, resulting in an increased tax burden on the employer's taxable income.

5. Prosecution Proceedings: If a particular employer exhibits a repeated default or a serious default, prosecution will occur. In such circumstances, strict proceedings such as sealing of the premises, suspending business operations, etc., can be imposed.

How to Calculate LWF Contributions?

Step 1: Check State Rules

The Labour Welfare Fund (LWF) contribution rates differ by state. Employers must first refer to their respective state’s Labour Welfare Board guidelines to know the exact employee and employer share.

Step 2: Apply the Formula

The basic formula for calculation is:

LWF Contribution = Employee’s Share + Employer’s Share (+ Government’s Share, if applicable)

Step 3: Deduct from Salary

The employee’s share is deducted directly from wages or salary, while the employer adds their contribution.

Step 4: Example Calculation

For instance, if in a state the employee contributes ₹10 and the employer contributes ₹20, then for 100 employees:

Total LWF Contribution = (₹10 + ₹20) × 100 = ₹3,000

What Are the Benefits of the Labour Welfare Fund?

LWF Benefits for Employees:

1. Educational Assistance: Scholarships, free educational supplies and uniforms are granted for children of workers, to promote educational achievement.

2. Medical Assistance: Medical care, including dental care, is provided to workers. Financial support is also offered for the death of a worker in service, funeral expenses, and mobility assistance, such as three-wheeled cycles for handicapped workers.

3. Nutrition: Nutritious food (under the Labour Welfare Fund) is provided in order to improve the health of workers and their families. It is meant to improve their nutrient intake, to strengthen the overall nutritional status of workers and their children, and to ensure that they are in good health, which means they remain active and productive at work.

4. Transport Facilities: Employees are eligible for subsidies to buy a cycle and improve their daily journeys, particularly in rural and semi-urban locations. For mine workers, there is free and complimentary bus service to pick workers up from home to work, and vice versa.

5. Recreation: Employees and their family members have opportunities to participate in recreation, including sports, painting, music and dance, contributing to dealing with relaxation and stress.

6. Other Benefits: Education, access to vocational training, reading rooms and libraries for skilling and development, and concessional housing loans for workers' financial solidity.

LWF Benefits for Employers

1. Higher Productivity: The principle behind the Labour Welfare Fund is to facilitate the health, education, and standards of living of workers. In doing so, it creates a healthier and more productive workforce, ultimately leading to higher overall productivity.

2. Better Retention: When welfare schemes are put in place, trust is created within the employee-employer relationship, which results in lower attrition rates . Employees are more likely to stay with the organisation that promotes their welfare.

3. Better Morale: Wages, training, and access to recreation and welfare activities improve self-confidence and self-esteem, resulting in a motivated workforce that is more likely to have a positive attitude.

4. Better Employer-Employee Relations: The more that employers invest in welfare measures for their employees, the more goodwill is created between the employer-employee relationship. This is important in terms of industrial relations to reduce disputes and assist in the cohesiveness expected of employers in the workplace.

5. Positive Company Image: Investing in employee welfare can assist in developing the company’s image in the domestic and international market as a socially responsible employer, improving corporate image and workplace culture.

How Does the LWF Scheme Work in Different States?

| Aspect | Labour Welfare Fund | Provident Fund |

|---|