Home / E / Expense Reimbursement

Expense Reimbursement: Meaning, Importance, Types & Process

Controlling business costs is a critical aspect of doing business. The employees tend to absorb the work expenses out of pocket, thinking that they will be refunded later by the company. This repayment is referred to as expense reimbursement. These reimbursements cover travel costs and client dinners, among others; therefore, employees do not have to incur expenses associated with their business activities.

Properly done, employee reimbursement will boost the trust factor, retain employee contentment, and financial transparency. Alternatively, reimbursements, managed incorrectly, may become a source of delays, conflicts, and even compliance hazards. In 2025, when the processes will be easier to conduct due to digital systems, the meaning, types of expenses reimbursement, as well as the process itself and the challenges, should be understood by organisations.

What Is Expense Reimbursement?

Expense reimbursement refers to the process by which a company reimburses employees for tax-deductible expenses incurred in the line of duty. These expenses can be in the form of travel, food, accommodation, or supplies and are reimbursed with any form of proper documentation and approval.

Expense reimbursement is significant as it ensures fairness. Workers should not be left to shoulder the economic burden of undertakings that have a direct positive impact on the company. For instance, when you use your own money for travel to a client meeting, the company should cover your travel and accommodation costs.

It also aids compliance. Governments and tax authorities need proper records of reimbursements to differentiate them from employee income. Adequate control of these expenses eliminates the risk of legal issues and keeps the company aboveboard when subjected to an audit.

Lastly, it improves morale. Being fast and efficient in the reimbursement process will give assurance to the employees. Employees will be ready to go on client visits or attend training programs without reluctance when they are confident that they will receive their money back on time.

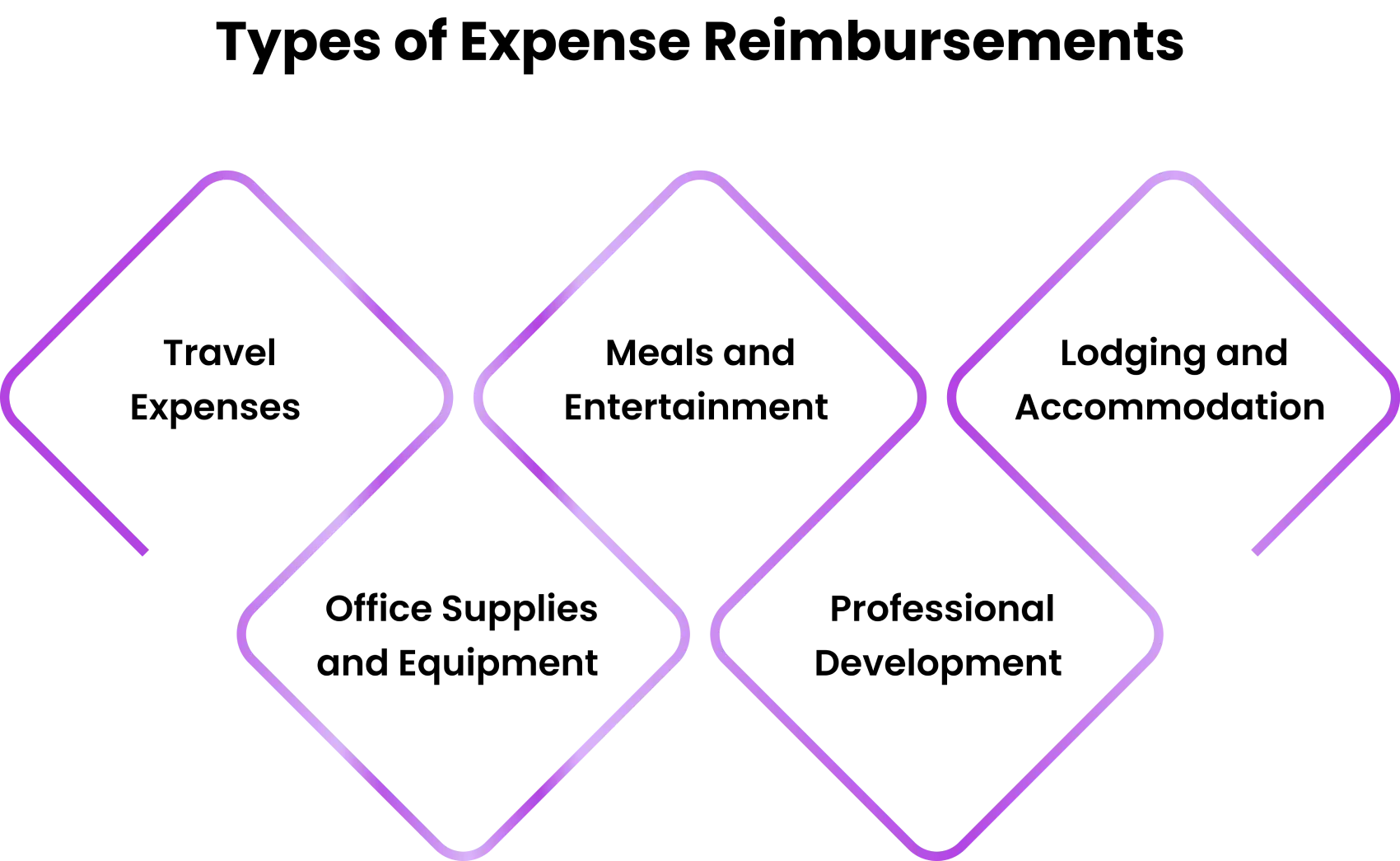

What Are the Types of Expense Reimbursements?

Expense reimbursements are classified into various categories, each of which depends on the nature of costs incurred.

Travel Expenses

Workers can visit clients, attend conferences, or attend training. Expenses such as flight fare, train, taxi bills, and parking are reimbursable. Clearly stipulated policies mean that employee travel is only covered insofar as it relates to work, and this helps prevent misuse of the travel program and keeps the budgets in control.

Meals and Entertainment

The types of meals that one can reimburse include meals with clients, team dinners, and other entertainment activities related to the business. Organisations tend to impose expenditure caps or demand receipts as a means of checking the expenditure. These aid in the equilibrium of hospitality and financial accountability.

Lodging and Accommodation

In the event of travelling on official duties, accommodation is reimbursed when employees have to stay over. Hotels, guesthouses, or apartments rented accomplish this. Companies will also establish relationships with their preferred hotels to normalise prices and billing.

Office Supplies and Equipment

Stationery, printer cartridges, or work software may be refunded when employees purchase them to use in offices. In work-from-home arrangements , the companies can also cover the cost of internet or ergonomic furniture.

Professional Development

Fees paid to attend workshops, training programs, and certification courses will be reimbursable if they directly improve the employee's skills. Organisations also promote such reimbursements in order to foster long-term workforce development.

How Does the Expense Reimbursement Process Work?

The reimbursement process ensures that only legitimate expenses are reimbursed. It normally encompasses various processes.

Expense Submission

Employees present receipts, invoices, or online payment receipts. Most of the time, the submissions are done using HR software , expense applications, or paper forms. Precision of the receipts is important in verification.

Manager Approval

The supervisors can look at the expenses claimed to ensure they fit the reasonableness of work expenses and are within the company policy. It makes sure that accountability and fraudulent claims are prevented and not allowed to be inserted into the system.

Finance Team Review

The accounts staff or finance team would review to ensure that the taxes are being paid and also to ensure that the organisation's guidelines are being followed. They also make sure that expenses are documented before passing them to be reimbursed.

Payment Processing

Once vouched, the money is credited to the employee's bank account, typically through payroll systems. Good payment strengthens confidence in the process.

Recordkeeping

Expense claims are recorded so as to be used in future audits and in tax filing. Proper records assist an organisation in proving compliance and monitoring the trend of expenditure.

How Long Does It Take to Receive an Expense Reimbursement?

It varies with the company policy and efficiency of the process. The majority of organisations reimburse their employees within 7 to 30 days of receiving approval for their submission. Automated workflows and digital systems have decreased the time of delay; however, manual processes can take longer to complete due to verification and paperwork.

What are the Common Challenges of Reimbursable Expenses?

Although reimbursement of expenses is straightforward, companies tend to encounter issues that lead to time and disagreements

1. Missing or Partial Receipts: Occasionally, employees fail to retain receipts; hence, it may be hard to verify them. The finance teams can deny claims without sufficient evidence.

2. Policy Violations: Spending in excess of the agreed-upon amounts or claiming personal expenses as business expenses are some of the areas that bring tension in the business. There must be clear policies and communication to avoid confusion.

3. Delayed Approvals: Reimbursements are frequently bogged down by managerial bottlenecks. A long delay in approvals makes the employees lack confidence in the system.

4. Currency and International Expenses: Cross-border travel introduces complications such as fluctuating exchange rates and varying tax regulations. Organisations should implement tools like a reliable currency convertor to calculate accurate reimbursement amounts and ensure fair, compliant payouts for international expenses.

5. Fraudulent Claims: In other instances, employees can provide counterfeit receipts. When it comes to detecting and preventing fraud, strong approval workflows and digital audit trails are necessary.

What Are the Best Practices for Managing Expense Reimbursement?

Organisations can enhance efficiency through the use of structured practices.

1. Make Clear Policies: Clearly establish which expenses are to be reimbursed, limits, and document requirements. You deserve to be aware of what counts towards your reimbursement.

2. Automate Process: Use digital tools or software to automate expense reimbursement to improve the submission, approval, and payment processes. Automation minimises errors and delays.

3. Managers and Train Employees: Carry out training sessions to create awareness of reimbursement guidelines and taxation. Awareness lowers policy violations and enhances compliance.

4. Due Dates of Submission: Employees should be required to submit their claims within a specific timeframe, such as 30 days. This maintains proper recordkeeping.

5. Regular Audits: Fraud can be detected, and the trends in expenditure can be identified by conducting periodic reviews of the expense claims. Audits also guarantee adherence to taxation acts and budgets of companies.

Are Expense Reimbursements Taxable?

Expense reimbursements are not taxable in most cases since this is a repayment of the actual business expense and not the additional income. However, if employees make untrue claims or employers make lump-sum allowances without records, the tax authorities can tax it as salary. Documentation done correctly is a safeguard for both the employer and the worker.