Leave Encashment: Meaning, Tax Exemption, Calculation & Rules - 2025

Clever management of your leave encashment can not only save you a lot of money, but it can also save you a significant amount of tax. With the changing face of workplaces in India, HR teams are working to clarify and simplify their policies for employees who are unclear about their entitlements in cases where leaves are not taken. With a clearer understanding of the income tax laws in 2025, as a salaried employee, you must be conversant with your rights, computation modalities, and your exemptions.

This guide explains the meaning and rules of leave encashment, how taxation works, and how to determine your final payout. You shall learn by the end exactly how to use a leave balance calculator or formula to calculate your earnings.

What is Leave Encashment?

Leave encashment refers to the money you receive instead of your unused paid leave. Also known as leave surrender, it is either paid out during service, on resignation, or at retirement as defined by company policy and the government regulations.

Leave encashment ensures that you retain the financial value of unused leaves. An example of this is where you may accrue 30 days' leave in a single year, but only take 20 days, at which point the other 10 days may be monetised. This promotes improved work-life balance and yet provides financial security.

It is also a second income, especially in old age. Rather than wasting leaves, you get compensation, which finds its way as a part of your savings or pension benefits.

Notably, leave encashment policies vary with organisations. Higher exemptions are granted to government employees, whereas non-government employees are restricted to a limited number of exemptions in several cases. It is important to understand the difference to successfully plan taxes.

Who Qualifies for a Leave Encashment Exemption?

Not all employees qualify to be treated as full exemption leave encashment. The qualification is determined by the type of employment, retirement, and the policy of the organisation. Let us put this into major categories.

1. Government Employees: Freedom of government employees is complete when they go on retirement with leave encashment. This makes their lump sum payment on the unused leave a hundred per cent tax-free, and it is a good financial help in their retirement years.

2. Non-Government Employees: In the case of non-government employees, the exemption is incomplete in the case of leave encashment, explained under Section 10(10AA) of the Income Tax Act . The exempt amount in the lifetime is 3,00,000; so the excess is chargeable to income tax.

3. Private Sector Employees: The workers in the private sector belong to the non-government segment and can gain only partial exemptions. Employers tend to deduct TDS on the amount of leave encashment, yet the employees may claim refunds after the due submission of income tax returns.

4. Retiring Employees vs Resigning Employees: The regulations are different in case of retirement or resignation. The exemptions are wider in the case of retirement as compared to resignation, where leave encashment is usually taxed as salary. Therefore, the time that you leave an organisation is of great importance to your tax advantage.

5. Contractual and Temporary Employees: Unless otherwise specified in the company's HR policy , most contractual or temporary employees do not qualify. Such protection ensures that the benefit of leave encashment is more closely related to long-term or permanent employees who have accumulated leave balances.

What Types of Leave are Eligible for Encashment?

In India, only some kinds of leaves can be encashed. These tend to be stated in your HR policy or employment contract.

1. Earned Leave (EL): This is the most common type of leave eligible for encashment. It is accumulated over time and can be converted into monetary value either during service, at resignation, or at retirement.

2. Privilege Leave (PL): Often similar to earned leave, privilege leave is provided for long-term absence. Many organisations allow PL encashment, especially when employees exit the company, ensuring they don’t lose accumulated leave days.

3. Annual Leave: Annual leave, which accrues yearly, is often eligible for encashment at the end of a service year or during separation. This ensures that unused leave days translate into financial benefits for employees.

4. Casual Leave (CL): Casual leave is generally provided for short-term absences and is usually not encashable. Its purpose is to meet urgent personal needs, not to accumulate for financial conversion.

5. Sick Leave (SL): Sick leave is typically excluded from encashment because it is intended solely for medical emergencies. However, some employers may offer partial encashment depending on internal policies.

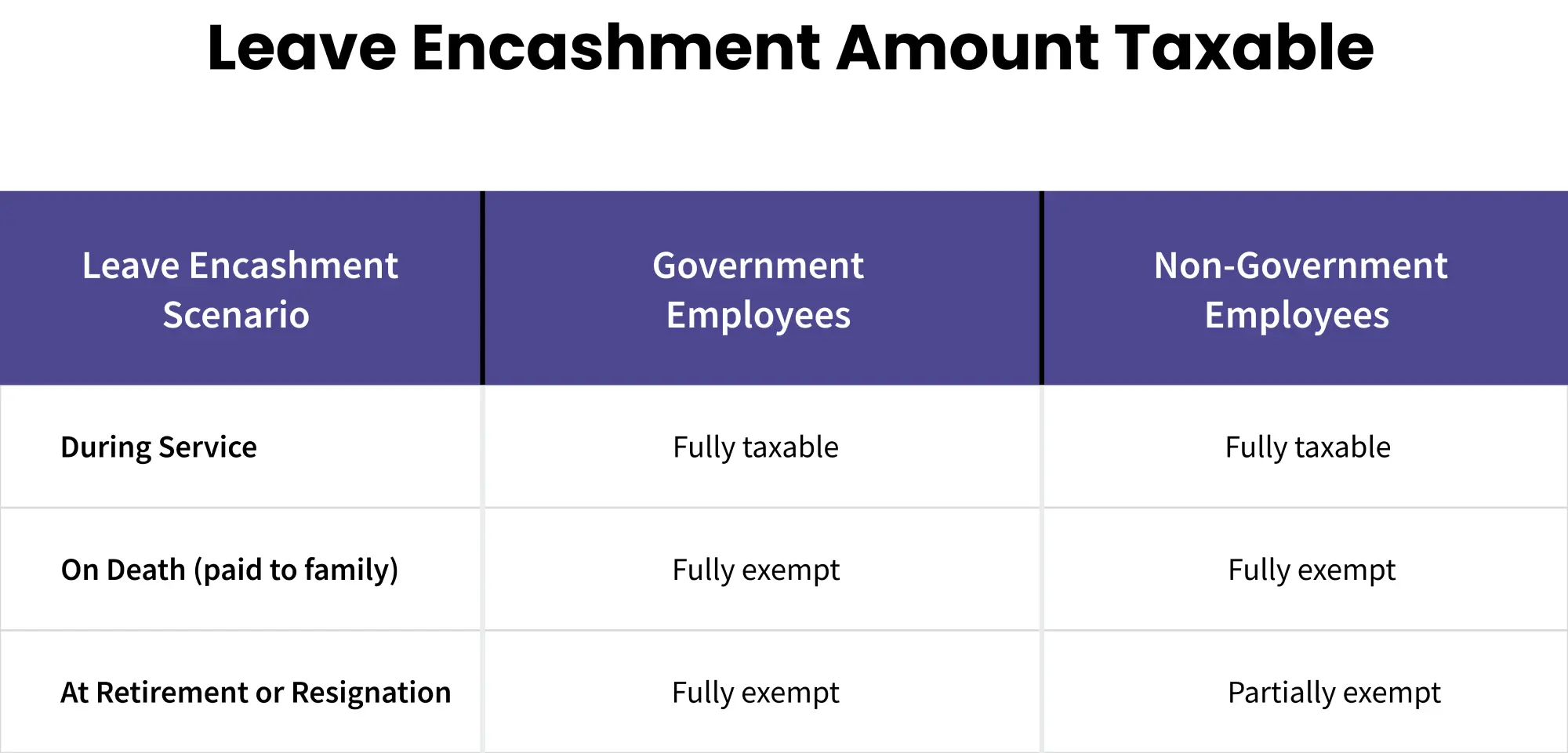

What Are the Tax Implications of Leave Encashment?

The treatment of leave encashment will depend on the type of employee receiving the leave encashment.

1. Encashment During Service: If you encash leave while still employed, the full amount is subject to tax as salary income. There is no exemption here, and the employer normally will deduct TDS.

2. Encashment at Retirement – Government Employees: In case of central and state government employees, tax exemptions pertain to the leave encashment at retirement, which is not subject to any tax deduction . This leaves the public servants in a position where they are paid their full entitlement.

3. Encashment at Retirement – Non-Government Employees: Non-Government employees have an exemption under Section 10(10AA). The exemption is to be computed as the lowest of four values: actual encashment received, 10 months' average salary, cash equivalent of unutilized leave, or three lakhs (whichever is less).

4. Encashment at Resignation: Individuals who leave employment prior to retirement are not usually eligible for exemption benefits. The encashment of leaves is considered a salary income, and the entire tax liability is expected, which decreases the total payout.

5. Encashment to Heirs: In case of encashment of leave (on the death of an employee) to your family members, there is full tax exemption. The exemption provides relief and financial support avenues for dependents

Is the Leave Encashment Amount Taxable?

Most encashments of leave are taxable, with exceptions in relation to the nature of employment and relevant circumstances.

Government Employees: In the case of government employees, encashment of leaves at the time of retirement is altogether exempt from income tax. This will imply that they will not have to pay tax, regardless of the amount of money they receive.

Non-Government Employees: Leave encashment is partly exempt from non-government employees. The exemption is restricted to the smallest of the four: actual encashment received, 10 months' average salary, unutilized leave encashed, or three lakhs (lifetime limitation).

Resignation Cases: In the case of resignation, full encashment is tax payable as salary. Exclusions are usually not provided, and this drastically decreases the amount of net benefit that employees earn at home.

What is the Exemption Limit for Leave Encashment?

- Government employees: Full exemption at retirement.

- Non-government employees: The Limit of exemption is capped at three lakhs (lifetime). Anything in excess of this is taxed.

- Heirs of deceased employees: Full exemption, irrespective of amount.

TDS Deduction: TDS is deducted by employers on leave encashment that is subject to tax. Later, non-government employees will have to adjust their income tax statements.

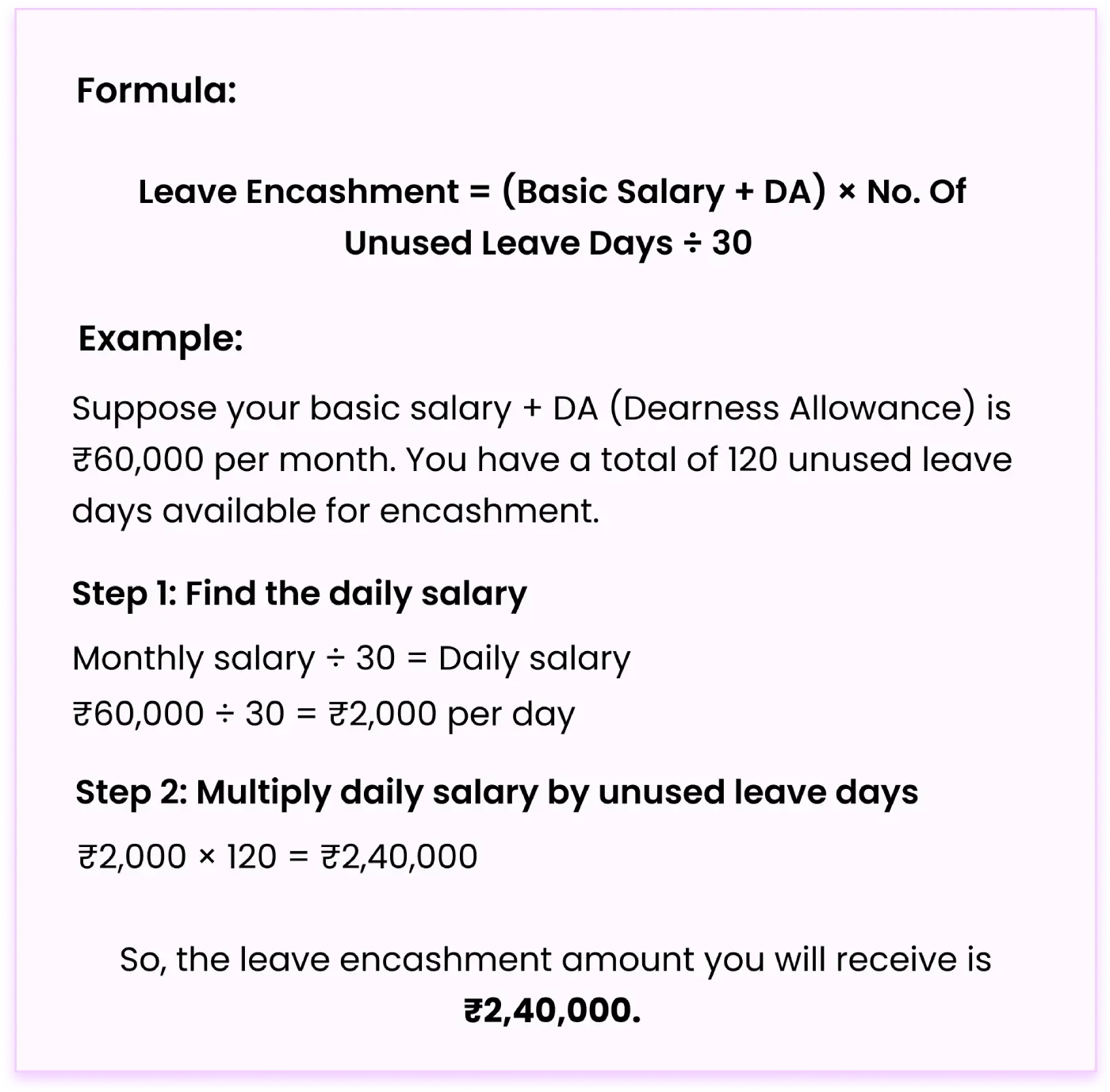

How Is Leave Encashment Calculated?

The formula for leave encashment is based on your basic salary and unutilized leave balance.

Basic Formula: Leave Encashment = (Basic Salary + DA) × No. Of Unused Leave Days ÷ 30

Example Calculation: Suppose your basic salary + DA (Dearness Allowance) is ₹60,000 per month. You have a total of 120 unused leave days available for encashment.

Step 1: Find the daily salary

Monthly salary ÷ 30 = Daily salary ₹60,000 ÷ 30 = ₹2,000 per day

Step 2: Multiply daily salary by unused leave days

₹2,000 × 120 = ₹2,40,000

So, the leave encashment amount you will receive is ₹2,40,000.

How Can HR Create an Effective Leave Encashment Policy?

A powerful leave encashment policy provides a balance between personnel advantages and organisational adherence.

1. Define Eligible Leave Categories: The HR department must clearly state which leaves are eligible for encashment. Earned or privilege leave is normally included, whereas casual and sick leave is excluded. This prevents confusion on the part of employees.

2. Set Encashment Limits: Choose when employees are allowed to encash their leaves, annually, upon resignation, or upon retirement. Imposing caps will give the organisation financial predictability.

3. Educate Employees on Tax Rules: HR should provide guidance on the taxation of leave encashment. In explicating the tax exception rules regarding leave encashment, employees become knowledgeable as to their net benefits and can employ tax planning accordingly.

4. Use HRMS Tools for Transparency: HRMS automation of leave tracking will result in proper leave balance calculation. Employees have visibility of the real- time encashment eligibility, which builds trust and helps to prevent the occurrence of disputes.

5. Review Policies Regularly: Regularly updating policies is essential to ensure consistency with shifts in tax laws, labour codes, and company practices. Periodic reviews guarantee compliance with the law and employee satisfaction.