Ad Hoc Payment: Meaning, Types, Examples & How It Works

Ad hoc payments are singular or one-time financial transactions made on an occasion that is outside of the established regular payroll cycle. Companies typically use ad hoc payments in order to process transactions for special situations such as bonuses, reimbursements, and emergency payouts. Ad hoc payments are typically completed on demand, not on a regular payroll cycle.

For companies, ad hoc payments are for providing timely payment to employees or contractors without disrupting the normal payroll process. Ad hoc payments in a variety of industries can also assist with employee satisfaction, provide urgent payments for employee needs, or maintain trust in the employer-employee relationship.

Ad hoc payments play an important role in ensuring quick and flexible financial transactions, making them a valuable tool for businesses to address unique or urgent payment needs. This guide will explain the meaning of ad hoc payments, types of ad hoc payments, examples of ad hoc payments, and best practices in managing ad hoc payments

What is an Ad Hoc Payment?

An Ad hoc payment is a singular, non-repeating compensation made to an employee, contractor, or vendor by an organisation outside of the organisation's normal payroll schedule. Ad hoc payments may include bonuses, reimbursements, or emergency payments, and are not included in a person's normal pay or salary.

Ad hoc payments are also important in maintaining flexibility in dealing with the new, unplanned payment activity. Organisations can handle occasional, unexpected situations that require an immediate payment response, for example, payments to employees for additional work performed outside their normal duties, reimbursement of employee expenses, or compensation for extraordinary performance in a given situation.

Employees like and appreciate ad hoc payments because the employer can support them without having to wait for the next scheduled payroll. Ad hoc payments allow the employer to respond to a unique situation without delaying payment for another week or two, and may help maintain employee morale and fulfil urgent financial obligations toward employees.

Organisations commonly make ad hoc payments during project completions, bonuses during holiday seasons, relocation payments, or payments for emergency relief. Organisations that make these types of payments allow them to provide immediate assistance when a payroll solution isn't possible, and at the same time support maintenance of payroll compliance by executing outside of the normal payroll processing cycle.

What are the Types of Ad Hoc Payments?

1. Performance-Based Payments: These are rewards such as spot bonuses, incentives, or commissions given to employees for achieving specific targets, delivering outstanding results, or surpassing key performance indicators (KPIs). They act as motivators, recognizing high performance and encouraging employees to maintain or improve their productivity.

2. Reimbursements: It covers costs that employees personally incur while carrying out business-related activities. These types of expenses cover travel and accommodation, client entertainment, training costs, or purchasing equipment and materials needed to do the work. The key is to ensure employees are not out of pocket for company-related expenses.

3. Overtime Payments: If employees work past scheduled hours, they may receive some form of overtime payment. Overtime pay is usually calculated at a different rate than standard wages. The calculations are generally different from regular pay and may be processed separately from standard payroll in urgent cases where the employee has already worked beyond normal hours.

4. Special Allowances: These are offered to employees for clearly articulated purposes, but usually apply to one-time payments, for example, relocation allowance, holiday bonuses, or in the case of high-value projects where the employee is being given an allowance for a special role. Special allowances apply to exceptional situations and are typically used for motivation or assistance.

5. Emergency Payments Emergency payments are direct and immediate support offered to employees in unforeseen situations such as emergencies (e.g., medical situations), natural disasters, or family crises. Emergency payments provide immediate support or funding in times of urgent need and are ideally suited to ensure an employee can deal with an urgent situation without additional financial stress.

What are Some Examples of Ad Hoc Payments?

Ad hoc payments are one-time financial transactions made outside the company’s regular payroll cycle. They are usually provided to address urgent, unexpected, or special needs. These payments ensure flexibility, quick financial support, and proper recognition for employees when required. Here are some common ad hoc payment examples:

- Performance bonus: A payment is provided on certain occasions after completing significant tasks or projects. It acts as an acknowledgement of effort and can inspire employees to keep delivering quality results.

- Travel reimbursement: Covers costs when an employee has to travel unexpectedly for work, such as visiting a client on short notice. This ensures employees are not personally burdened with business-related expenses.

- Overtime payment: It is the extra money employees receive when they work beyond their regular working hours. It usually happens during urgent situations, like fixing a system outage or completing a critical project and is often paid at a higher rate than normal wages.

- Relocation allowance: Relocation allowance is financial support given to employees who are transferred to a different city or location. It helps them cover costs such as moving their belongings, temporary housing, and other expenses related to settling into the new place.

- Emergency cash advance: An emergency cash advance is immediate financial help provided to employees in urgent situations, such as medical emergencies or personal crises. It ensures that employees can manage unexpected expenses quickly without facing unnecessary stress or delays.

Methods to Process an Ad Hoc Payment:

1. Manual Bank Transfer: The finance team directly transfers the payment to the employee’s bank account. This method is useful for urgent situations where funds are needed immediately and cannot wait for the payroll cycle.

2. Payroll Adjustment: The payment is added as a one-time entry in the next payroll cycle, ensuring proper tax deductions, accurate records, and a smooth process while keeping everything compliant and error-free.

3. Expense Management System: The payment is processed through an expense claim submitted by the employee. Once approved, the amount is reimbursed along with other business-related expenses.

4. Corporate Card Payment: For urgent purchases or travel, employees use a company credit card. This avoids delays, reduces personal spending, and allows the finance team to monitor and control expenses quickly and effectively.

5. Cash Payment Through Petty Cash: For very small, urgent payments, the finance team may issue cash from the company’s petty cash fund. This is typically recorded and reconciled immediately to maintain transparency.

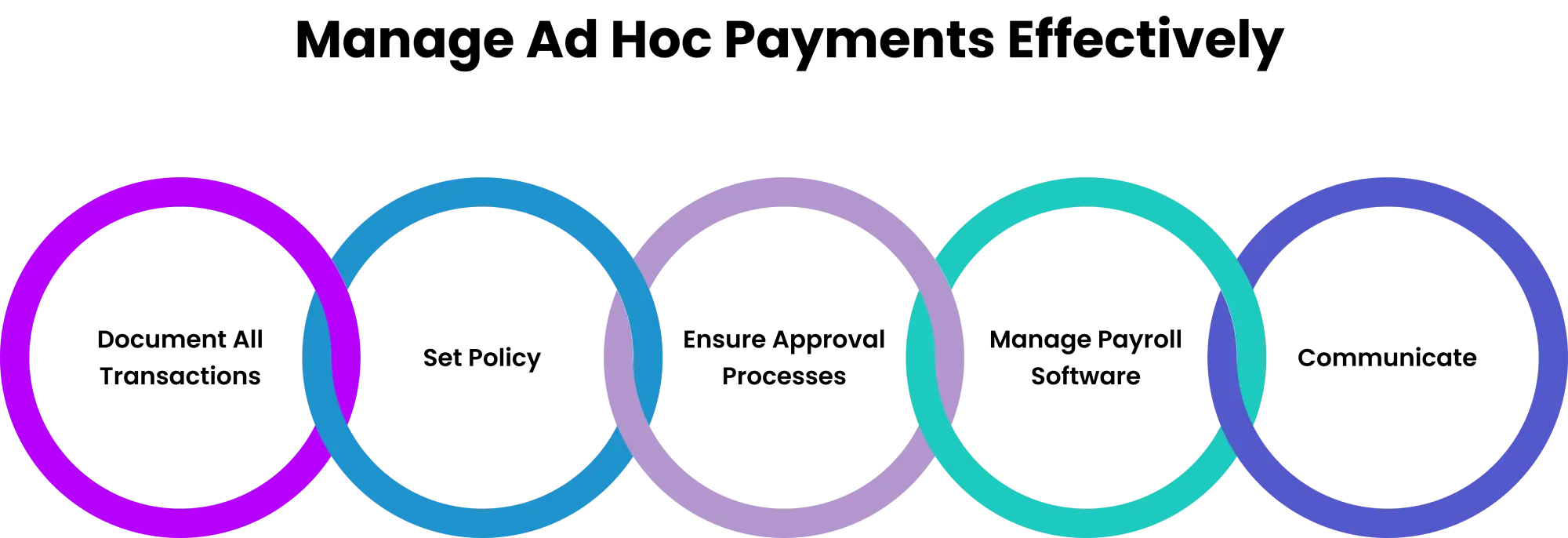

How to Manage Ad Hoc Payments Effectively?

1. Document All Transactions: Keep complete and accurate documentation for every ad hoc payment so you can maintain transparency, support audits , and comply with regulations. Having quality documentation will also assist you in the event of a future dispute or if someone asks you about their payment history.

2. Set Policy: Have a clear policy with specifics around the types of situations that you can identify that qualify for an ad hoc payment, and also the criteria for who qualifies. Many times, having something in writing alerts people that you have a fair process and not someone just giving money away.

3. Ensure Approval Processes: Create an approval workflow allowing HR and finance to look over a payment request to ensure there are no mistakes, duplication, or unauthorized payments being made.

4. Manage Payroll Software: Utilize any available payroll management systems to plug in ad hoc payment amounts to automate tax calculations and apply any applicable benefits or report generation for ad hoc payments. Depending on the number of employees, automating the calculation of all variables reduces the chance of errors involved with manual processes and provides back-office efficiencies.

5. Communicate: Provide employees with prior notification about the why, what, and when they could expect their ad hoc payment. Giving employees as much information as possible builds trust with our employees and avoids confusion or potential misunderstandings regarding the ad hoc payment made to them.

What are the Benefits of Ad Hoc Payments?

- Increases Payment Flexibility: Ad hoc payments give companies the flexibility to make urgent or special payments without waiting for the next scheduled payroll. This makes it easier to quickly cover expenses like emergencies, employee bonuses , or fast reimbursements, ensuring that important needs are met on time.

- Boosts Employee Motivation: When employees receive immediate payment for outstanding performance, it creates a strong sense of recognition. This timely reward boosts their morale, motivates them to maintain high performance, and reassures them that their efforts are truly valued by the company.

- Improves Cash Flow Management: Ad hoc payments allow businesses to release money only, when necessary, instead of altering the regular payroll cycle. This approach helps companies manage their cash flow more effectively while still taking care of short-term financial needs without disruption.

- Stronger Employee Relations: Quick financial support during urgent situations builds trust between employers and employees. When workers see that the company responds promptly to their needs, it strengthens loyalty and shows that the organization genuinely cares for its people.

- Operational Efficiency: By handling certain payments outside the regular payroll process, companies can avoid unnecessary delays and speed up approvals. This ensures that both business operations and employees’ financial needs continue without interruption, improving overall efficiency .

What are the Challenges of Ad Hoc Payments?

1. Administrative Complexity: Handling multiple one-time payments can add layers of complexity to payroll management. Without a proper system in place, tracking, recording, and reconciling these payments can become time-consuming and prone to confusion, especially during audits or financial reporting.

2. Risk of Errors: Processing ad hoc payments manually increases the chances of miscalculations, which could result in overpayments or underpayments. Such errors can lead to employee dissatisfaction, mistrust, and the need for corrective actions that consume additional time and resources.

3. Compliance Issues: Failing to apply the correct tax rules or statutory deductions to one-time payments can lead to non-compliance with labour and tax laws. This not only brings financial penalties but can also damage the organisation’s reputation and credibility.

4. Approval Delays: If the approval process for ad hoc payments is slow or overly bureaucratic, the payment may lose its purpose of being immediate. Delayed disbursements can undermine the effectiveness of emergency support or urgent financial incentives , reducing their intended impact.

How does an Ad Hoc Payment Differ from a Recurring Payment?

| Criteria | Ad hoc Payment | Recurring Paymen |

|---|