Do you spend too much time preparing pay stubs for your employees every month? Or worry about missing details like deductions and overtime pay?

If yes, you don’t need to worry! In this blog, you will find free pay stub templates that simplify your payroll process, save time, and avoid costly mistakes. Don’t skip any part of the blog. You get free downloadable links to the different types of pay stub templates in Excel, Word, and PDF.

Download free paycheck pay stub templates in your preferred format and gain instant access to edit and customise them as per your requirements. Let’s get started!

What Are the 8 Types of Pay Stub Templates?

Pay stub templates are available in different formats. Each is designed to meet specific payroll needs. Among those, you can select the template based on your company’s structure and employee requirements. Whether you’re managing simple salary payouts or handling more complex calculations involving PTO, overtime, or automated computations, choosing the right template ensures accurate records and smooth payroll processing.

Here, I have listed the 8 most commonly used free pay stub templates that help you streamline calculations and maintain clear financial documentation. You can download them instantly in your preferred format.

1. Basic pay stub template

2. Basic pay stub template with a calculator

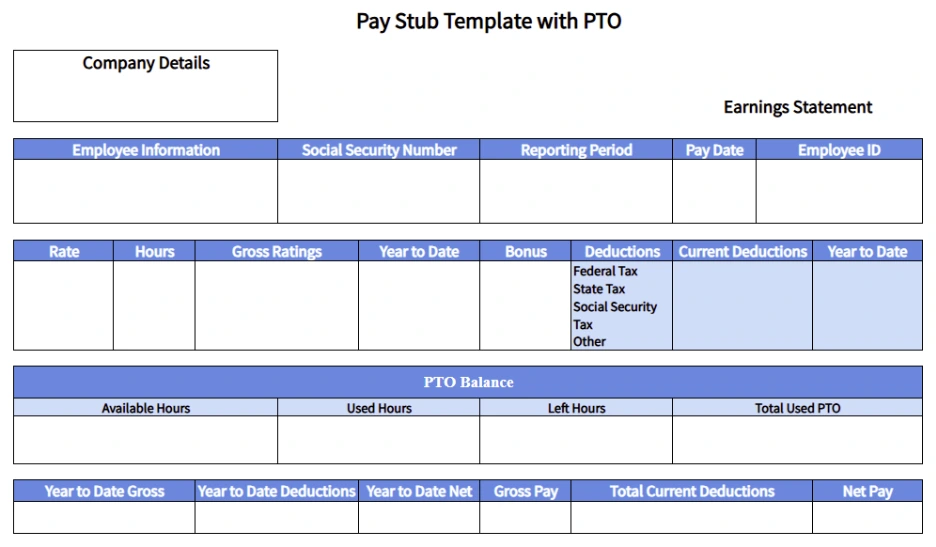

3. Pay stub template with PTO

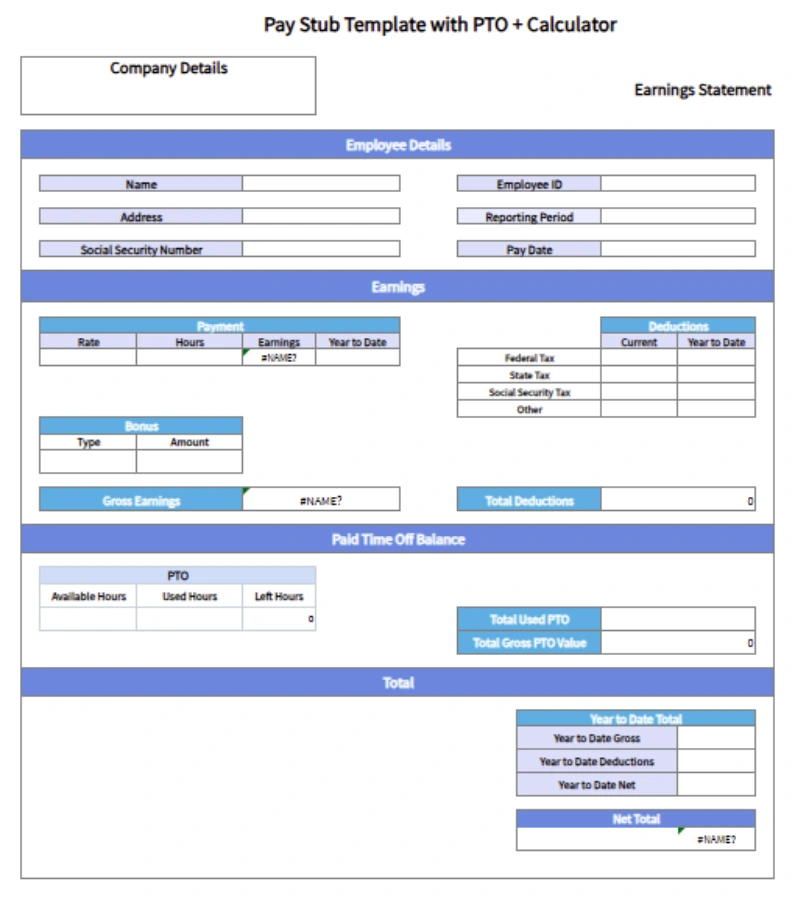

4. Pay stub template with PTO + calculator

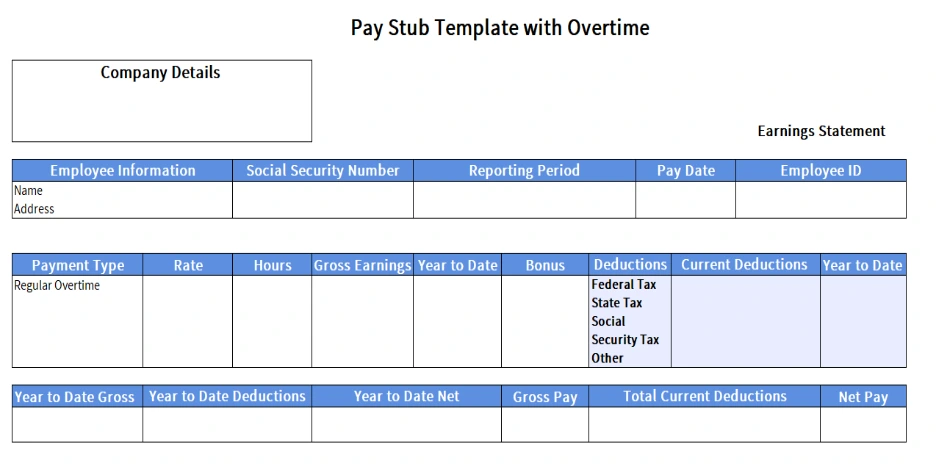

5. Pay stub template with overtime

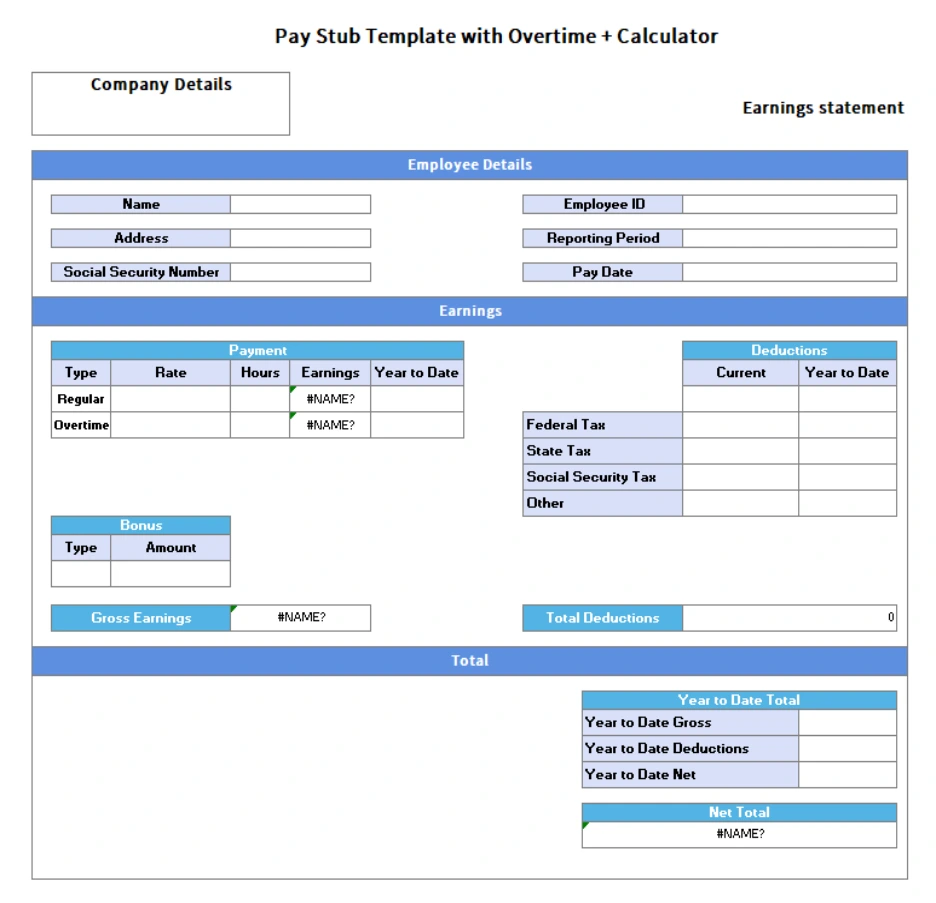

6. Pay stub template with overtime + calculator

7. Pay stub template with PTO and overtime

8. Pay stub template with PTO and overtime + calculator

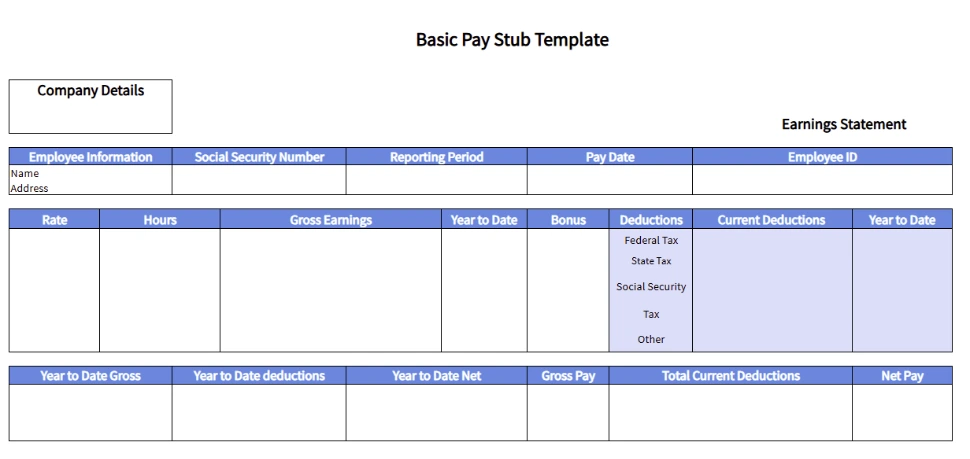

1. Basic Pay Stub Template

A basic pay stub template is the simplest format you can use to break down an employee’s gross pay, deductions, and final net pay. It gives you all the essential payroll details without any extra features, making it perfect if your payment structure is straightforward.

You’ll find this template especially useful when your employees work fixed hours or have consistent salaries with very few changes. Its clean and easy-to-read layout helps you and your team clearly understand every pay cycle without any confusion.

Key Features:

- Essential Payroll Fields: Includes fields for gross pay, deductions, and net pay.

- Simple Layout: Easy to fill out with minimal distraction.

- Ideal for Fixed Schedules: Works best when employee hours don’t change often.

- Quick Data Entry: Reduces time spent preparing pay stubs.

Best For:

Businesses with simple payroll needs, including teams where employees earn fixed salaries or work consistent hours and require a clear, easy-to-read breakdown of earnings and deductions.

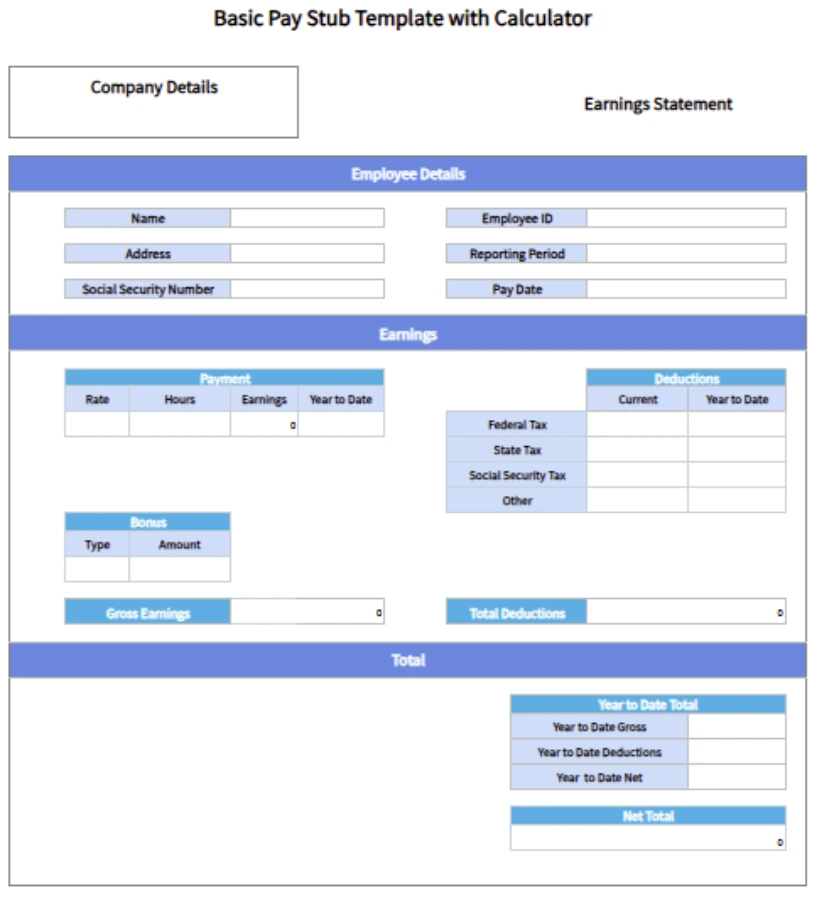

2. Basic Pay Stub Template with a Calculator

A basic pay stub template with a calculator gives you built-in automated calculations that make your payroll easier by updating totals instantly. All you have to do is enter the earnings and deduction amounts, and the template automatically recalculates gross pay, taxes, and net pay.

This template reduces the risk of manual mistakes and keeps your payroll process smooth and accurate. If you manage multiple employees or deal with variable pay amounts, this template is very useful for you to make your workflow better and reliable.

Key Features:

- Automatic Calculations: Computes totals instantly as you enter data.

- Accurate Totals: Updates gross, deductions, and net pay without manual math.

- Error Reduction: Assigns specific responsibilities to team members for accountability.

- Great for Variable Pay: Simplifies payroll when numbers change frequently.

Best For:

Businesses that want a simple pay stub format but also prefer automatic calculations to reduce errors and speed up payroll processing.

3. Pay Stub Template with PTO

A pay stub template with PTO helps you track paid time off, whether it’s casual leave, sick leave, or personal leave, all in one place. It lets you keep accurate records of PTO earned, used, and remaining in each pay cycle.

Your employees can also see how their time off impacts their paycheck and how many leaves they still have available. If your business offers structured leave policies or flexible time-off options, this template streamlines the entire process, making time-off management effortless.

Key Features:

- PTO Tracking: Shows PTO earned, used, and remaining.

- Multiple Leave Categories: Lets you track different types of time off.

- Clear Impact on Pay: Displays how PTO affects final pay.

- Useful for Leave-Based Workplaces: Works well for teams with regular PTO usage.

Best For:

Companies that provide paid time off need a clear way to show employees how their PTO is earned, used, and remaining within each pay cycle.

4. Pay Stub Template with PTO + Calculator

A pay stub template with PTO + calculator helps you manage payroll by tracking time off and running calculations automatically. It updates PTO balances and calculates gross pay, deductions, and net pay as soon as you enter the numbers.

You can rely on it to reduce manual work and prevent errors in leave or salary calculations. If your team takes time off often, this template keeps everything clear and accurate for each pay cycle.

Key Features:

- Automated Calculations: Calculates pay totals without manual math.

- Real-Time PTO Updates: Adjusts leave balances as you record time off.

- Tracks All PTO Types: Supports vacation, sick leave, and more.

- Consistent Payroll Accuracy: Helps prevent mistakes in PTO and salary calculations.

Best For:

Organisations that track PTO and need automated calculations to simplify payroll, improve accuracy, and make leave balances easy for employees to understand.

5. Pay Stub Template with Overtime

A pay stub template with overtime helps you track extra hours worked and calculate the additional pay owed. It lets you enter regular hours and overtime hours separately, so the breakdown is clear for you and your employees.

This template helps you avoid confusion around OT rates and ensures everyone gets paid correctly for extra work. It’s especially useful if your team regularly works beyond standard hours.

Key Features:

- Separate Hour Tracking: Records regular and overtime hours individually.

- Overtime Rate Clarity: Shows the applied overtime rate and final overtime pay.

- Accurate Payouts: Helps ensure employees receive correct overtime compensation.

- Ideal for OT-Heavy Teams: Great for workplaces with frequent extra hours.

Best For:

Employers whose teams regularly work beyond standard hours need a clear breakdown of overtime earnings to ensure transparent and accurate payroll.

6. Pay Stub Template with Overtime + Calculator

With this template, you can manage overtime and let the built-in calculator handle the math for you. Once you enter the hours and rates, it automatically updates gross pay, deductions, overtime pay, and net pay.

This reduces errors and speeds up payroll when overtime varies from week to week. If accuracy and efficiency matter to you, this template makes overtime tracking much easier.

Key Features:

- Automated OT Calculations: Instantly applies overtime rates and updates totals.

- Instant Pay Breakdown: Updates gross, deductions, OT pay, and net pay.

- Error Prevention: Reduces mistakes caused by manual calculations.

- Great for Changing OT Hours: Designed for teams with fluctuating overtime.

Best For:

Businesses that manage overtime regularly want automated calculations to ensure accurate totals for both standard and overtime pay.

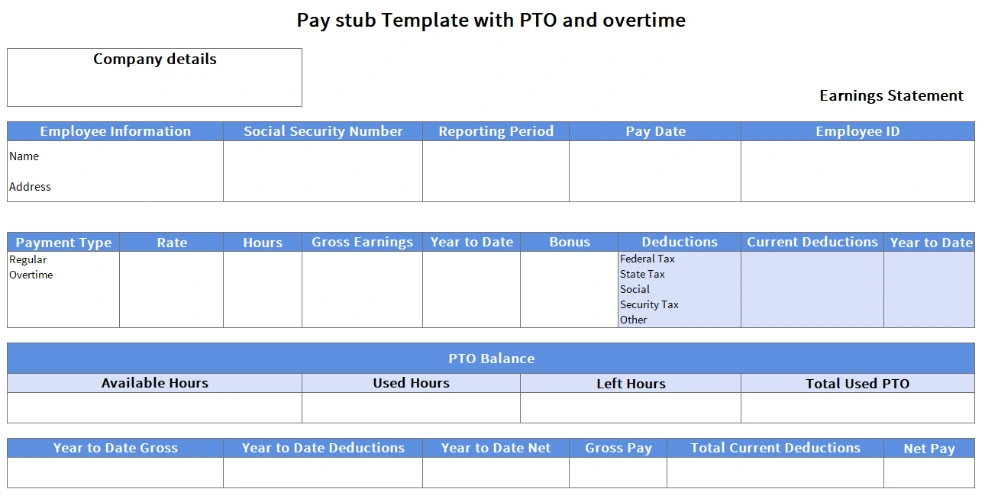

7. Pay Stub Template with PTO and Overtime

This template allows you to track both paid time off and overtime in one place. You can record PTO used, remaining balances, and extra hours worked without switching between different documents.

Employees get a complete picture of how their time off and overtime affect their pay. It’s ideal if your team has flexible schedules and often uses a mix of PTO and extra hours.

Key Features:

- Combined Tracking: Manages both PTO and overtime in one place.

- Clear Hour Breakdown: Displays PTO, regular hours, and OT hours.

- Better Transparency: Helps employees understand how time worked affects total pay.

- Efficient for Dynamic Teams: Great for businesses with varied schedules.

Best For:

Companies that offer paid time off and also track overtime hours, providing employees with a clear picture of leave balances and additional earnings in each pay cycle.

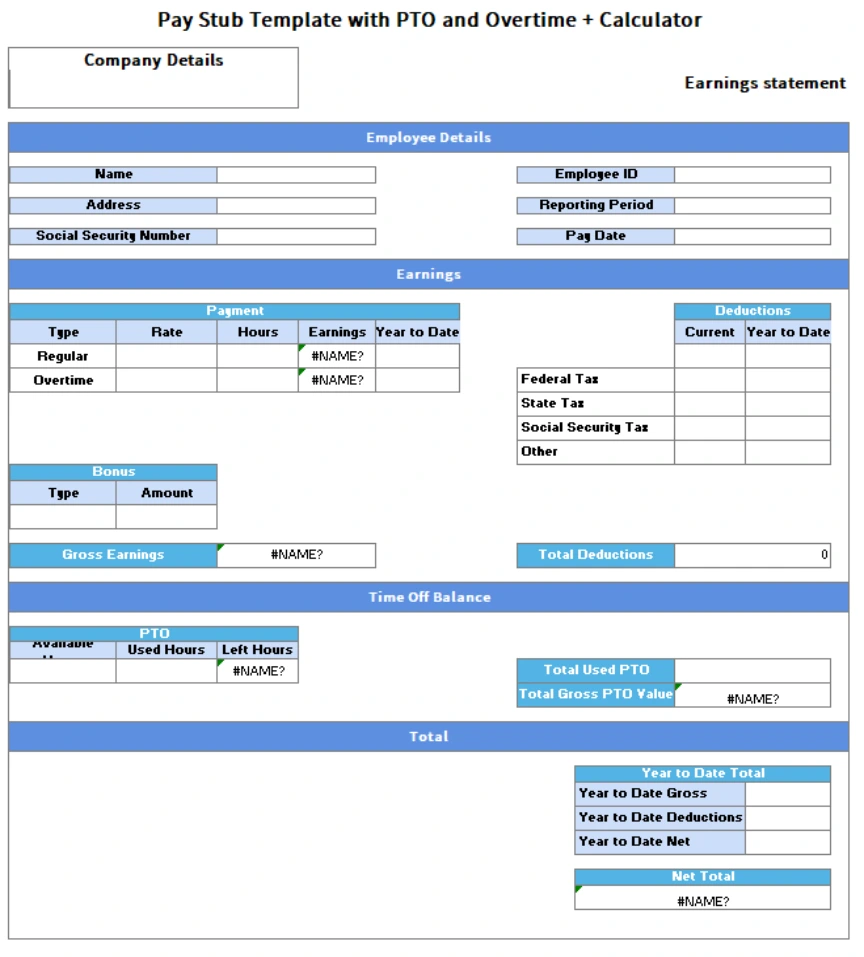

8. Pay Stub Template with PTO and Overtime + Calculator

This version combines PTO tracking, overtime tracking, and automatic calculations for a full payroll solution. It updates PTO balances, overtime pay, and total earnings instantly as you enter the numbers.

You save time and reduce errors by letting the template handle the calculations for you. For teams with frequent time-off requests and varying hours, this template keeps payroll clear, accurate, and consistent.

Key Features:

- Comprehensive Automation: Calculates PTO, overtime, earnings, and deductions instantly.

- Real-Time Updates: Adjusts PTO balances and OT earnings automatically.

- All-In-One Layout: Combines multiple payroll functions into a single template.

- Perfect for Complex Payroll: Ideal for teams with variable hours and frequent PTO usage.

Best For:

Organisations that handle both PTO and overtime and rely on automated calculations to maintain accuracy, streamline payroll, and give employees an easy-to-understand breakdown of all earnings and leave updates.

What Are the Pros and Cons of Pay Stub Templates?

Pay stub templates help you create professional and organised pay slips quickly. They make the process easier and save time for both employers and employees. Here’s a simple look at the key pros and cons of using pay stub templates.

| Pros of Pay Stub Templates | Cons of Pay Stub Templates |

|---|---|

| Easy to use and requires no special skills. | Some templates may not meet all business needs. |

| Saves time compared to creating pay stubs manually. | Limited customisation options in some templates. |

| Helps maintain a professional and uniform look. | Errors can occur if incorrect data is entered. |

| Many templates are available for free. | Some may not comply with local tax laws or formats. |

| Makes record-keeping easier and more organised. | May not integrate well with certain payroll systems. |

How Does Time Champ Streamline Pay Stubs

When you are responsible for preparing pay stubs, you know how important accuracy is. A small mistake can create confusion, delay payments, and add unnecessary pressure to your day. But don’t worry! Time Champ gives you clear, reliable data you can trust, so preparing each pay stub feels simple and stress-free.

You no longer need to chase teams for attendance details or cross-check hours at the last minute. Time Champ records working hours, overtime, breaks, and leaves in real time. You get complete, well-organised data that is ready for payroll whenever you need it. This gives you peace of mind because you always know your calculations are backed by accurate information.

When you sit down to prepare pay stubs, you already have everything in front of you. You simply export the attendance data from Time Champ and use it directly in your payroll process. This saves you valuable time and removes the stress of correcting errors or verifying scattered records.

Time Champ also helps you create a more transparent workplace. Employees can clearly see their hours and attendance, which reduces misunderstandings and builds trust. You handle your responsibilities smoothly, and your employees feel confident that their pay reflects the work they contributed.

With Time Champ supporting your workflow, pay stub preparation becomes a simple, reliable, and worry-free task. You work faster, you stay accurate, and you deliver a payroll experience your team can trust.

Wrapping Up

Creating accurate pay stubs doesn’t have to be complicated or time-consuming. With these free pay stub templates that I have provided in Excel, PDF, and Word formats, you can simplify the entire process and ensure every employee receives a clear, professional, and accurate breakdown of their earnings. Download and customise them as needed, and streamline your payroll process easily.

And when you pair these templates with accurate attendance and work-hour data from tools like Time Champ, preparing pay stubs becomes even smoother and more efficient.

Frequently Asked Questions

A pay stub is a document given to employees that shows their earnings, deductions, taxes, benefits, and net pay for a specific pay period. It helps both employers and employees track accurate payment details.

Templates save time, reduce manual errors, and ensure consistency across payroll cycles. They make it easy to organise earnings, deductions, PTO, and overtime in a clear, professional format.

Yes, you can easily adjust sections such as company details, employee information, PTO fields, overtime hours, or deduction types to match your specific payroll structure.

Yes, whether your team earns fixed salaries or variable hourly wages, the templates can be adapted to accurately reflect their earnings and deductions.

Time Champ provides precise attendance, work-hour tracking, overtime logs, and leave details. This accurate data feeds directly into your pay stubs, ensuring error-free and transparent payroll processing.

Yes, they are especially helpful for small teams and startups that want a simple, cost-effective way to generate professional and accurate pay stubs without needing complex payroll software.